Seven Steps to Building a Great Partnership

What makes an accounting firm great? by August Aquila Aquila Global Advisors Too many firms don’t give a lot of thought to the question.Their main concern is surviving. But the sooner a firm can start focusing on what makes a great partnership, the better off it will be. Think about this, if you don’t address this question, how will you know if you are admitting the right types of partners? What technical and personal skills would you want? What personal values (character) would you look for? Here are seven characteristics that form the foundation of a great partnership. If you are missing any of them or if you merely need to improve in some areas, now is the time to start strengthening your firm’s foundation. READ MORE →

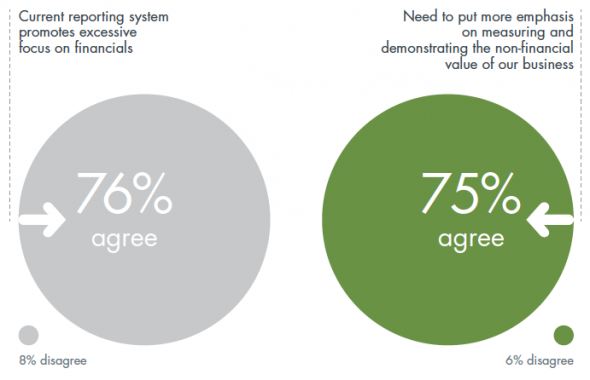

Survey unveiled at launch of new credential.

Survey unveiled at launch of new credential.