Tax Trends in Small Business: What Drives Them to Seek Professional Help

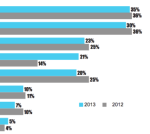

New data obtained by CPA Trendlines shows that 84 percent of small-business owners are now paying an independent tax practitioner or accountant to handle their taxes.

In addition, an increasing number of small business taxpayers appear to be taking advantage of Sec.179 expensing and bonus depreciation.

The new report available from CPA Trendlines includes information on:

- the number of small business owners who use an outside tax or accounting service

- how many hours per week a small business spends on payroll tax administration

- average cost for using a payroll agency

- hours spent on federal tax

- various tax burdens

- how to download complete report (PDF, 13 pages)