AICPA CEO Barry Melancon on Today’s Transformational Age for the CPA Profession

[CLICK TO PLAY] CPA Trendlines talks to Barry Melancon, American Institute of CPAs chief executive.

[CLICK TO PLAY] CPA Trendlines talks to Barry Melancon, American Institute of CPAs chief executive.

[CLICK TO PLAY]

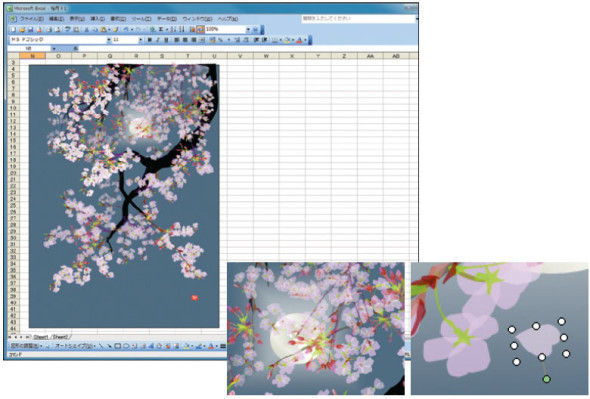

Can you do this..?

Or this…?

“I never used Excel at work but I saw other people making pretty graphs and thought, ‘I could probably draw with that,’” says 73-year-old Tatsuo Horiuchi. About 13 years ago, shortly before retiring, Horiuchi decided he needed a new challenge in his life. So, according to the Japanese art and design journal spoon-tamago, he bought a computer and began experimenting with Excel.

“Graphics software is expensive but Excel comes pre-installed in most computers,” explained Horiuchi. “And it has more functions and is easier to use than Microsoft Paint.” Horiuchi also tried working with Microsoft Word but it didn’t offer the flexibility that Excel did.

Horiuchi first gained attention when, in 2006, he entered an Excel Autoshape Art Contest. His work, which was far superior to the other entries, blew the judges away. Horiuchi took first place and went on to create work that has been acquired by his local Gunma Museum of Art.

Don’t believe these were made in Excel?

You can even download the excel file and play around with it yourself: READ MORE →

By Gary Adamson, CPA

Adamson Advisory

CPA firms are wrestling their way through partner retirements and the accompanying succession issues in numbers that the profession has never seen before. It’s the Baby Boomer Bubble, up close and personal.

Our succession planning should focus on replacing that retiring partner’s contribution on several fronts. Depending on the role of the retiring partner in the firm we will experience varying levels of pain surrounding things like replacing significant knowledge or technical expertise, back-filling a block of hours to get the work done and shoring up voids left in firm leadership. These are all significant issues and deserve a plan of their own.

But the biggie is the transition of client relationships. READ MORE →

And four other hurdles today’s accounting firms must overcome.

By Patrick J. McKenna

Professional Services Firm Consultant and Author

Many firms are in denial, and the few that aren’t move very slowly.

If your firm gets caught behind the curve, it wasn’t because critical trends weren’t visible; it was because they were ignored. The huge challenge remains that for too many firms, unless there is acute “pain,” there is little incentive to change. History proves that laggards only grab for the new once they are totally convinced the old doesn’t work anymore.

Adapted from the introduction to “How to Engage Partners in the Firm’s Future: The Secrets Every Leader Needs to Know,”

by August J. Aquila and Robert J. Lees

And the old doesn’t work anymore!

When does a firm’s strategy change? Usually only in response to a crisis or because of the initiative of a new managing partner. In many firms we have a generation of stewards rather than entrepreneurs.

By Sandi Smith, CPA

Accountant’s Accelerator

Every business needs to do some level of bookkeeping for a couple of reasons:

1) Various government agencies require reporting and payments based on the company’s results.

2) The owner needs a certain amount of information to manage their business and keep it profitable.

Many business owners hire us grudgingly for compliance work because they have to. And they consider what they pay us as an overhead expense that is a required cost.

But what if we could turn that perception around?

More at CPA Trendlines for soloists and small firms: Six Money-Making Strategies to Take You Beyond QuickBooks | Proactive Ways to Get More Referrals | The Three Biggest Money Leaks in Your Practice | New Client Opportunities with Mobile Apps | Six Questions to Launch Your Summer Strategy Sessions | What Most Accountants Miss in the Five Simple Steps to Get More Clients | 10 Ways to Add a “Money Maker” Hour to Your Day | 11 Sources of Wealth We Can Celebrate | Nine Value-Adds to Command a Higher Fee | How to Design Your Business Around Your Strengths

Here are five areas to consider offering beyond bookkeeping that will help your clients see you as a good investment rather than as an expense. READ MORE →

Ed Mendlowitz, CPA, ABV, PFS

Ed Mendlowitz, CPA, ABV, PFS

Author of “Implementing Fee Increases”

QUESTION: As a young staff accountant, how can I bring in new business and clients?

RESPONSE: You shouldn’t be as concerned about bringing in business as you should be about planting seeds to be able to bring in business in the future.

Eleven points worth considering: READ MORE →

The right way and many wrong ways that firms handle non-equity partner strategies.

A new analysis of data in the current Rosenberg MAP Survey shows that the number of firms adopting non-equity partners is surging. Some 78% of firms over $20 million now have non-equity partners, as well as 61% of firms from $10 million to $20 million.

|

|

Percentage of firms with non-equity partners

|

|||

|

|

> $20M |

$10–20M |

$2–10M |

All Firms |

|

2012-2013 Report

|

78% |

61% |

39% |

46% |

|

2008-2009 Report

|

47% |

33% |

37% |

|

In this report by Marc Rosenberg: