But Some Challenges May Still Be Ahead

via CCH

Accounting firms are doing well weathering the effects of the current economic slump, but unfortunately there may still be challenges ahead, even as the economy picks up, according to the findings of an independent nationwide survey of 100 U.S. accounting firms. The survey was conducted by Opinion Research Corporation, and commissioned by CCH, a Wolters Kluwer business (CCHGroup.com).

According to the survey, despite the downturn, firms have been successful overall in maintaining rates, client services and staff productivity as they carefully manage the bottom line.

But even during the recession, firms reported difficulty in finding good staff. And, with the Baby Boomers about to retire in record numbers, a talent crunch looms on the horizon as the opportunity for business growth returns with the economic recovery.

“The accounting profession has performed well in a poor economy, but it should be a wake-up call for many that staffing challenges have persisted through the recession,” said CCH President Mike Sabbatis. “Firms should be considering right now what they need to do to win that talent war as the economy heats up again.”

The Talent Crunch

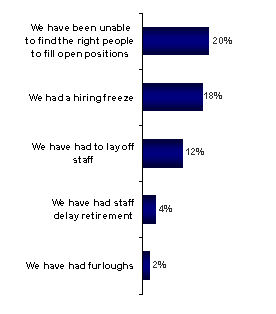

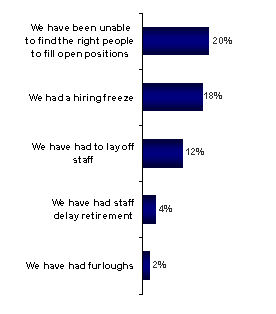

The good news is that the level of job reductions in accounting firms has been relatively low. Twelve percent of firms surveyed had layoffs, while 18 percent instituted hiring freezes. However, firms highlighted difficulty in finding good staff even in the recession, with 20 percent reporting that they are unable to find people to fill open positions despite record-high unemployment rates.

READ MORE →

The eminent sage, August J. Aquila (right), has an eminently practical to-do list to help firm managers get ready for tax season.

The eminent sage, August J. Aquila (right), has an eminently practical to-do list to help firm managers get ready for tax season.  he offices of CPAs tops a list of 20 other industries, with an average pretax margin of 17.1%. Wired communication carriers (transmission-line operators and the like), with a 10.1% margin, rank 20th.

he offices of CPAs tops a list of 20 other industries, with an average pretax margin of 17.1%. Wired communication carriers (transmission-line operators and the like), with a 10.1% margin, rank 20th.