Tax Refund Numbers Down, Amounts Up

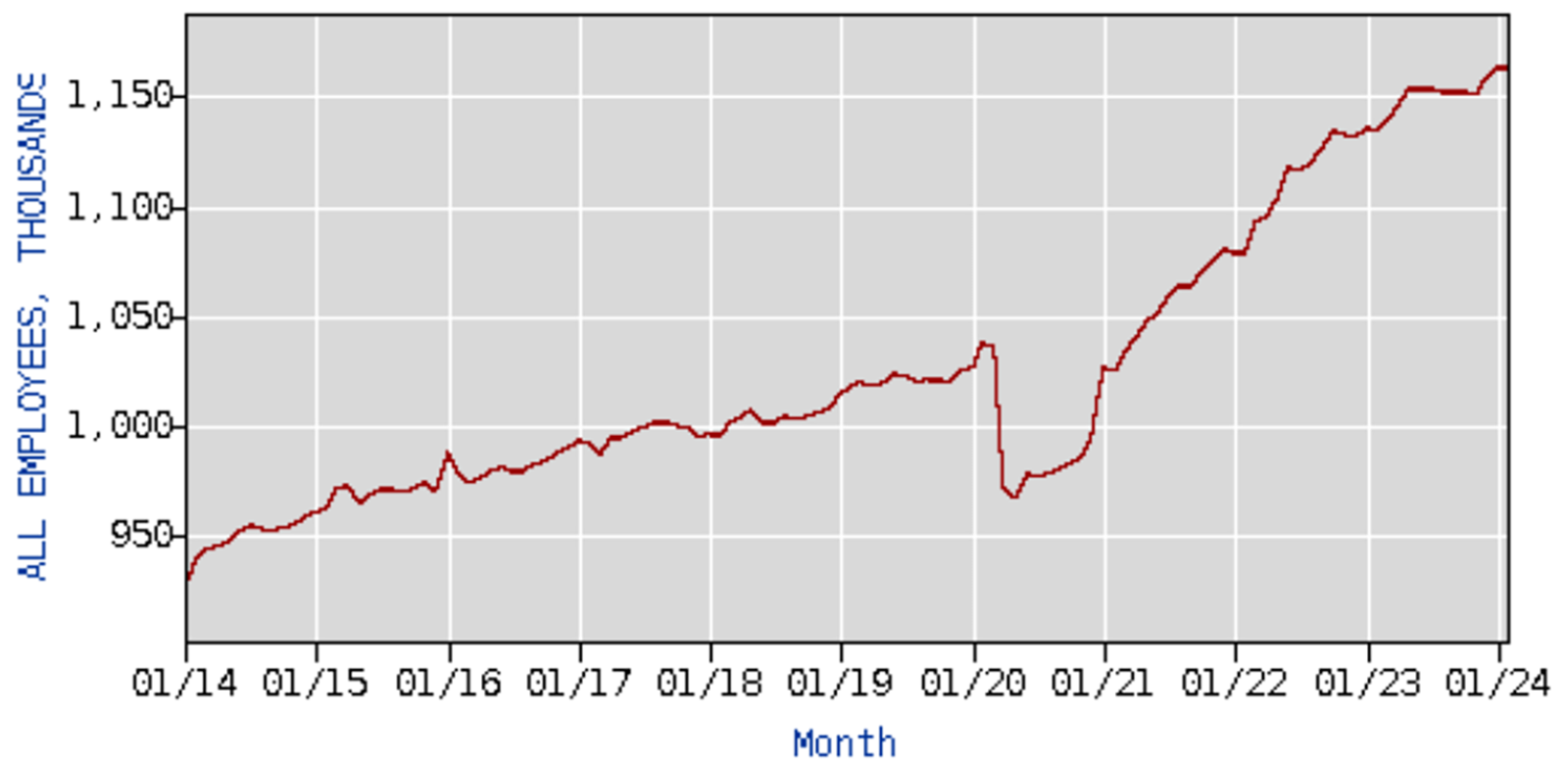

Tax pros handled 54% of e-filings.

By Beth Bellor

CPA Trendlines Research

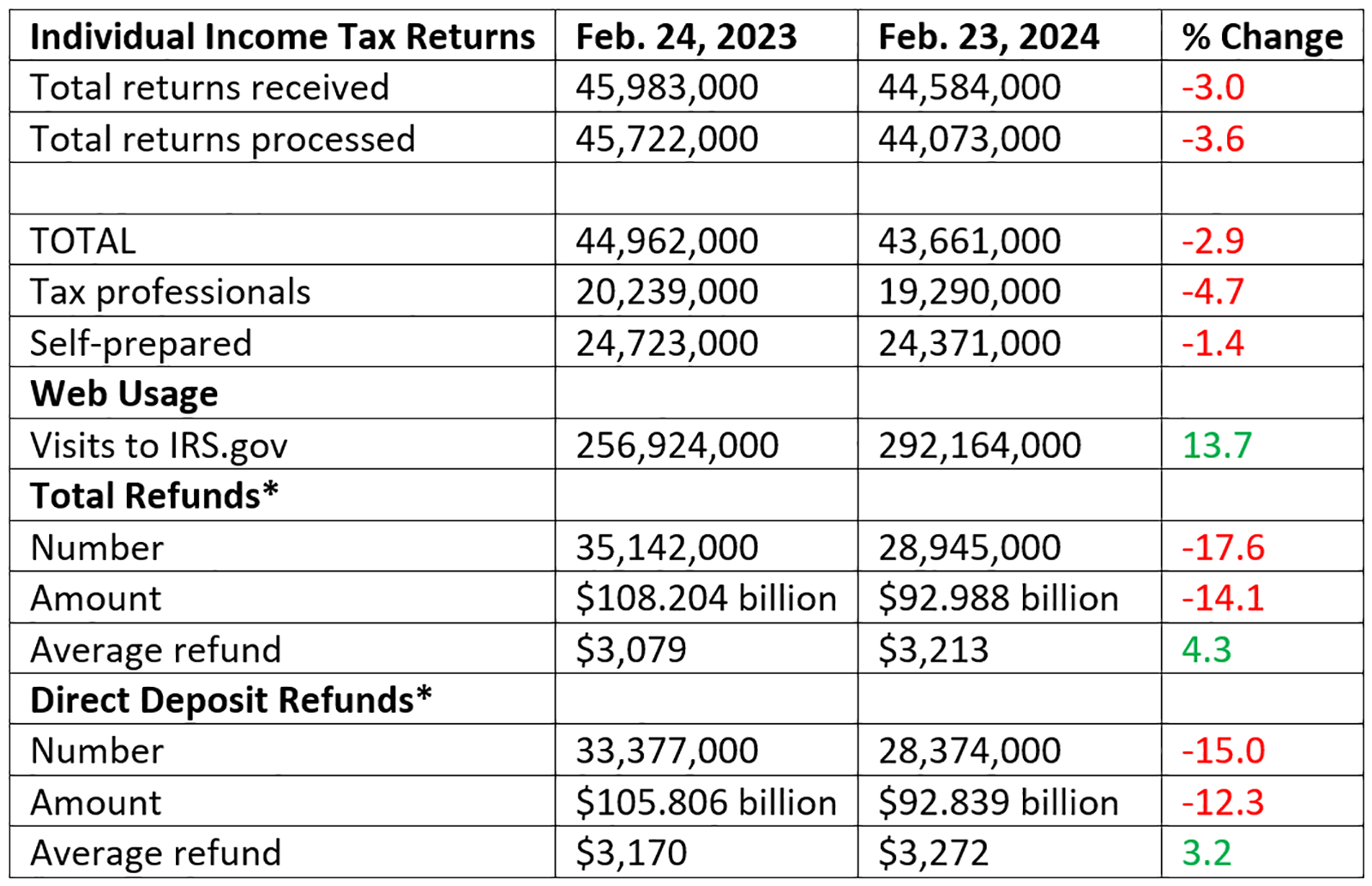

More than 100,000 individual income tax returns have flowed in and out of the Internal Revenue Service, and for the most part, we’re slightly ahead of the 2023 season.

MORE: Tax Pros Own 53% of E-filings | Tax Stats Still Playing Catchup | Tax Pros Take the Edge in E-Filings | Tax Pros Gain Ground, and DIYers Maintain Lead | Tax Pros Handle 46.4% of E-filing | Tax Refunds, Tax Pro Market Share Trending Up | Refunds Up as Tax Pros Tackle 41.5% of E-filings | Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

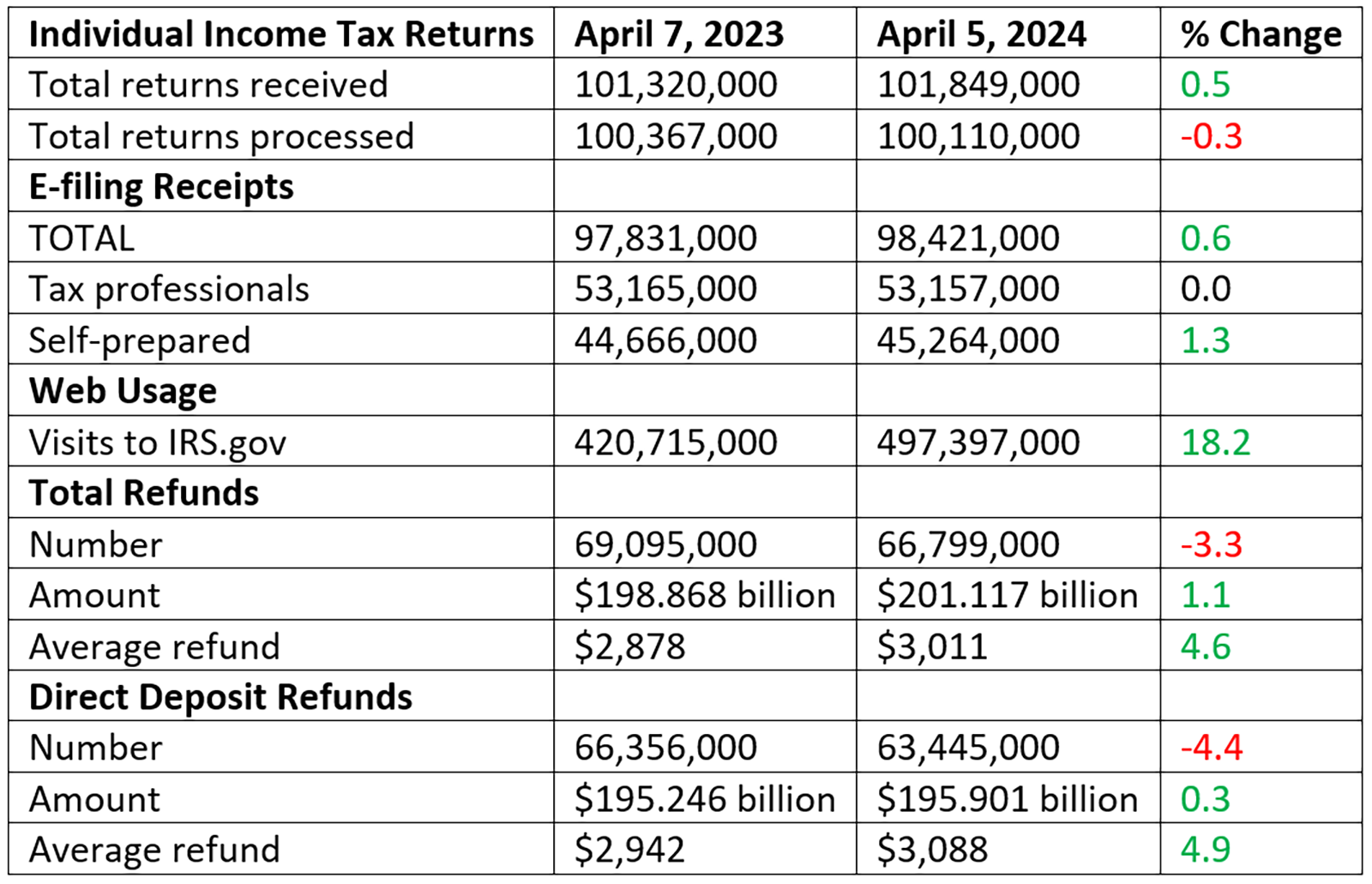

With 10 days before deadline – as of April 5, the latest data available – the IRS received 101.9 million returns, up 0.5 percent from the same period the previous tax season. It processed 100.1 million returns, down 0.3 percent.

READ MORE →

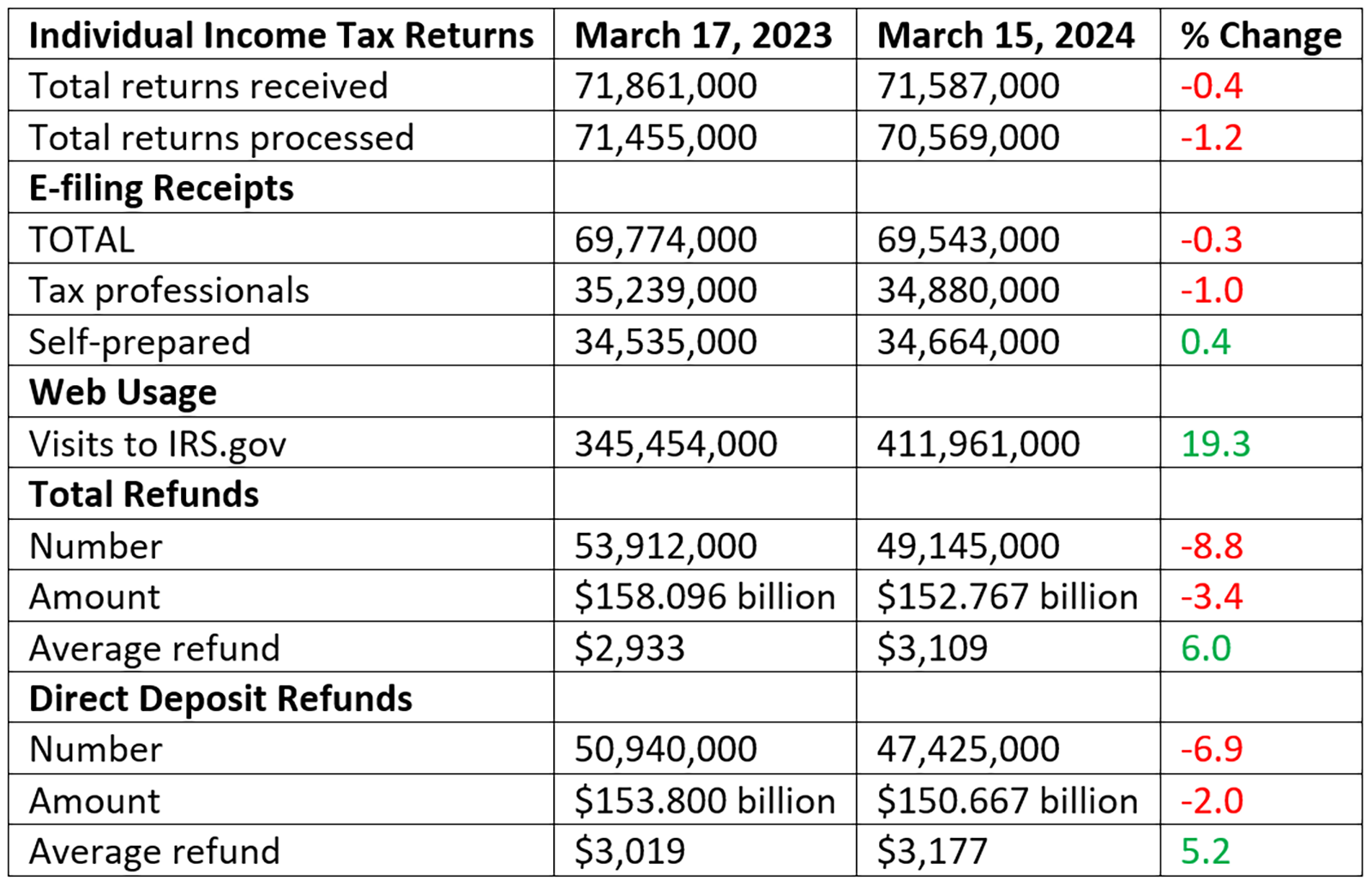

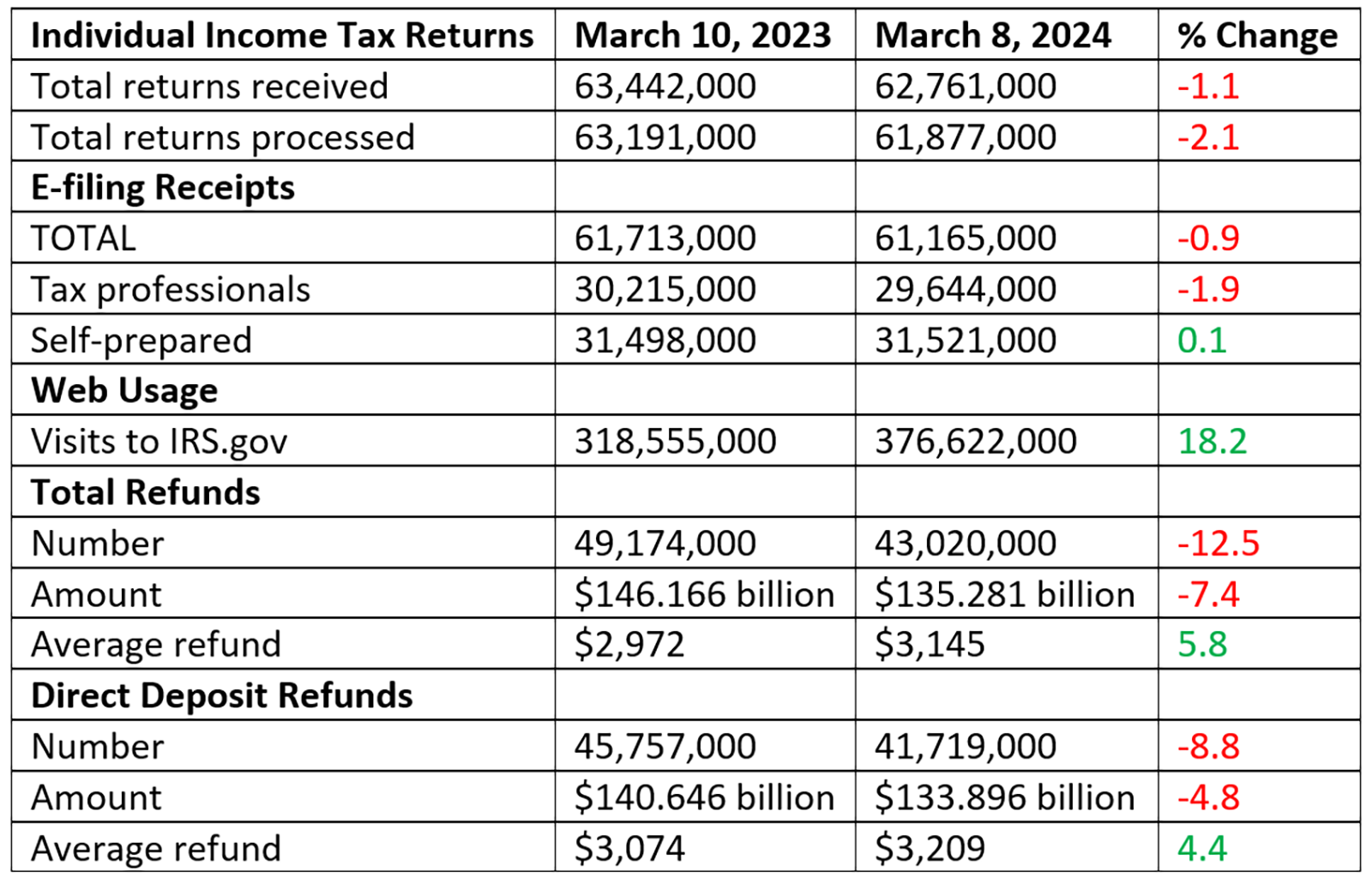

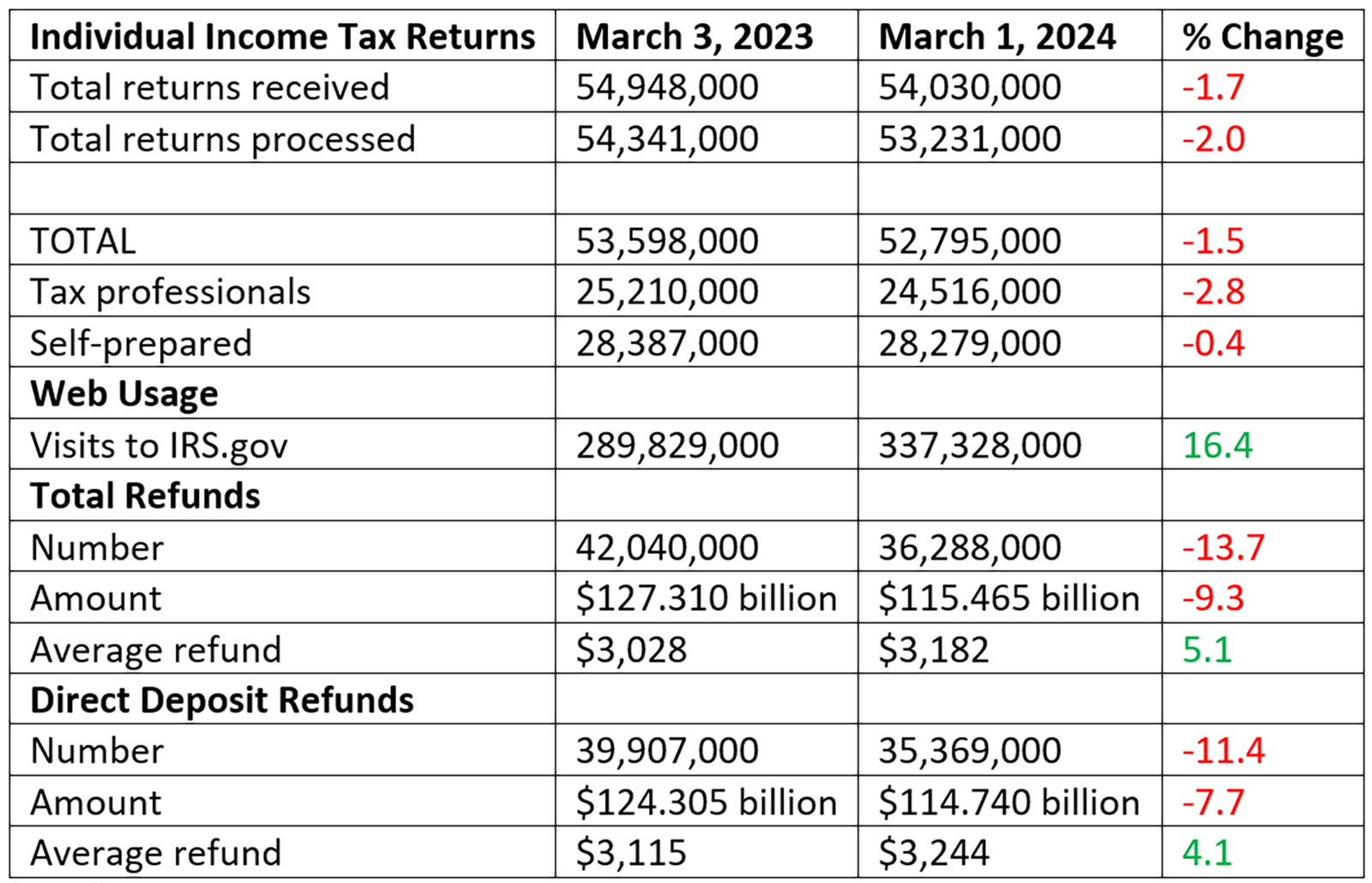

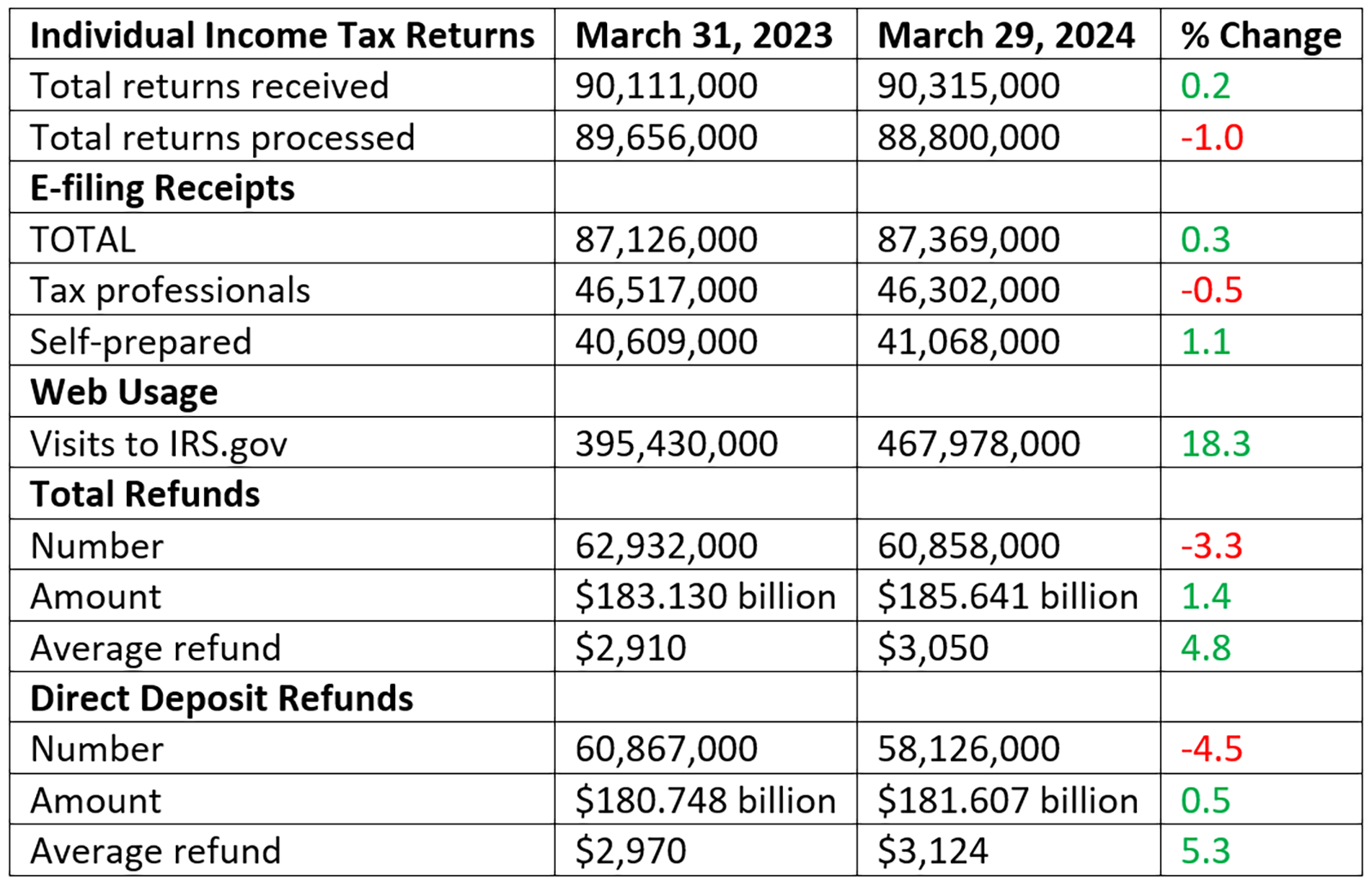

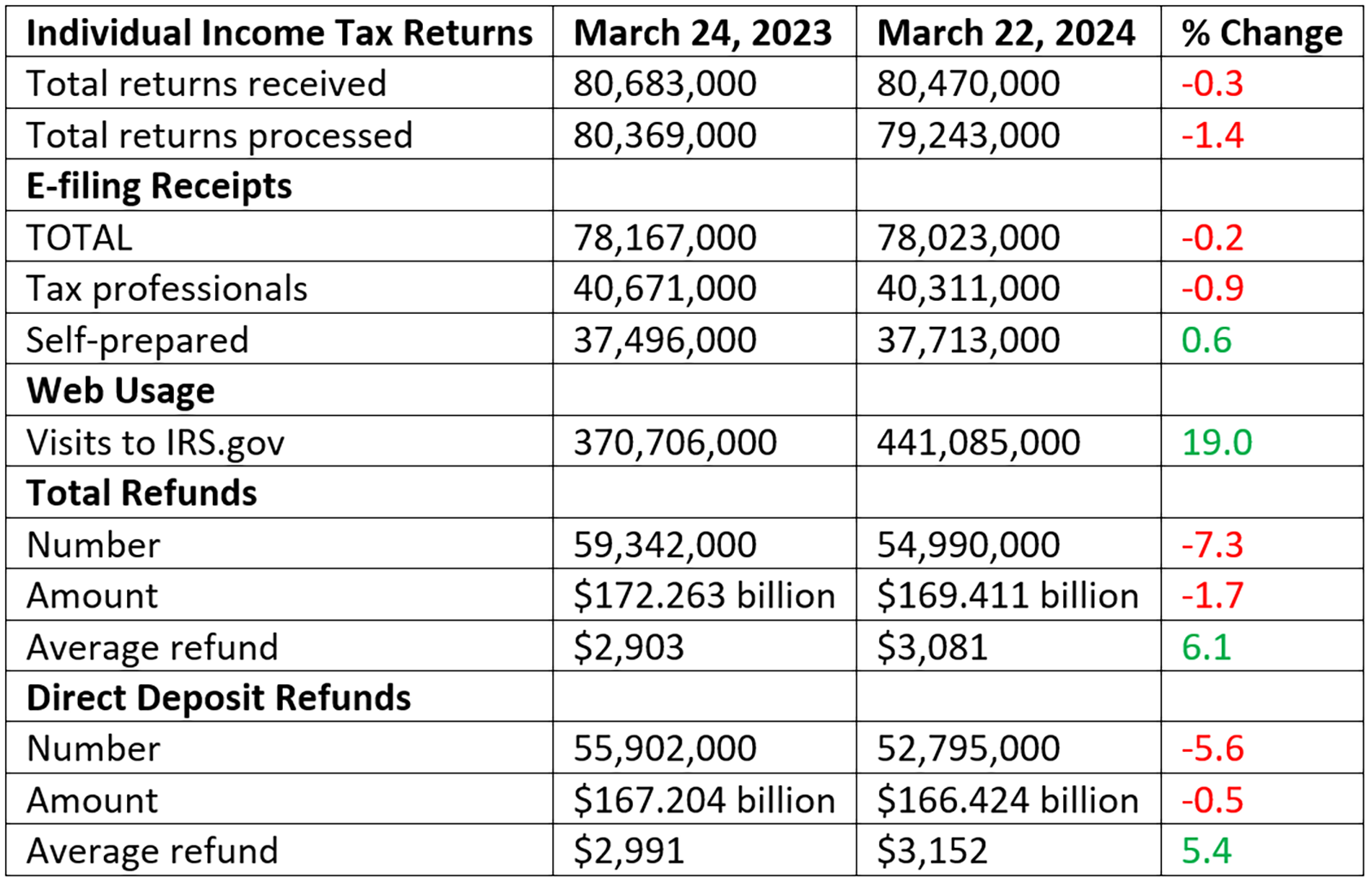

Refund numbers are down but amounts are up.

Refund numbers are down but amounts are up.