Nine Ways to Choose Your PR Person

The rules of the game have changed.

By Bruce Marcus

Professional Services Marketing 3.0

EDITOR’S NOTE: CPA Trendlines was privileged to have a long relationship with Bruce W. Marcus, who was ahead of his time in his thinking and practice in marketing for accounting. We are publishing some of the late expert’s evergreen work, which retains wisdom for the present.

There was a time when all you needed was a roll of nickels and a phone booth, and you were in the PR game. Of course, all clients expected then was that you get their names in the paper. For most of the publicity clients in those days, that was sufficient.

MORE: When Bad News Happens to Good Firms | Why Accountants Should Be Nice to Journalists | Ten Keys to Crafting Ads | Four Things to Know About Social Media | Internal Communications Are Underrated | Four Things Better Than a Company Song | Let’s Lose the Word ‘Image’ | The Risk In Not Understanding Risk | What Your Marketing Program Can and Can’t Do

Exclusively for PRO Members. Log in here or upgrade to PRO today.

“Those days” were the late 1920s and 1930s, before PR became public relations, and before we were beset with such glorious concepts as “image,” and “positioning,” and “niche marketing.” Today, public relations is infinitely more sophisticated than that, as is the public relations client. The public relations program for any modern corporation is to its publicity ancestor as desktop publishing is to hieroglyphics. And of course, the public relations program for the professional firm is different, too.

But to have a sophisticated public relations program requires not just a sophisticated practitioner, but a sophisticated client. A firm, if it knows how, will always find a good public relations practitioner or consultant, but a consultant is only as capable as the firm he or she serves.

READ MORE →

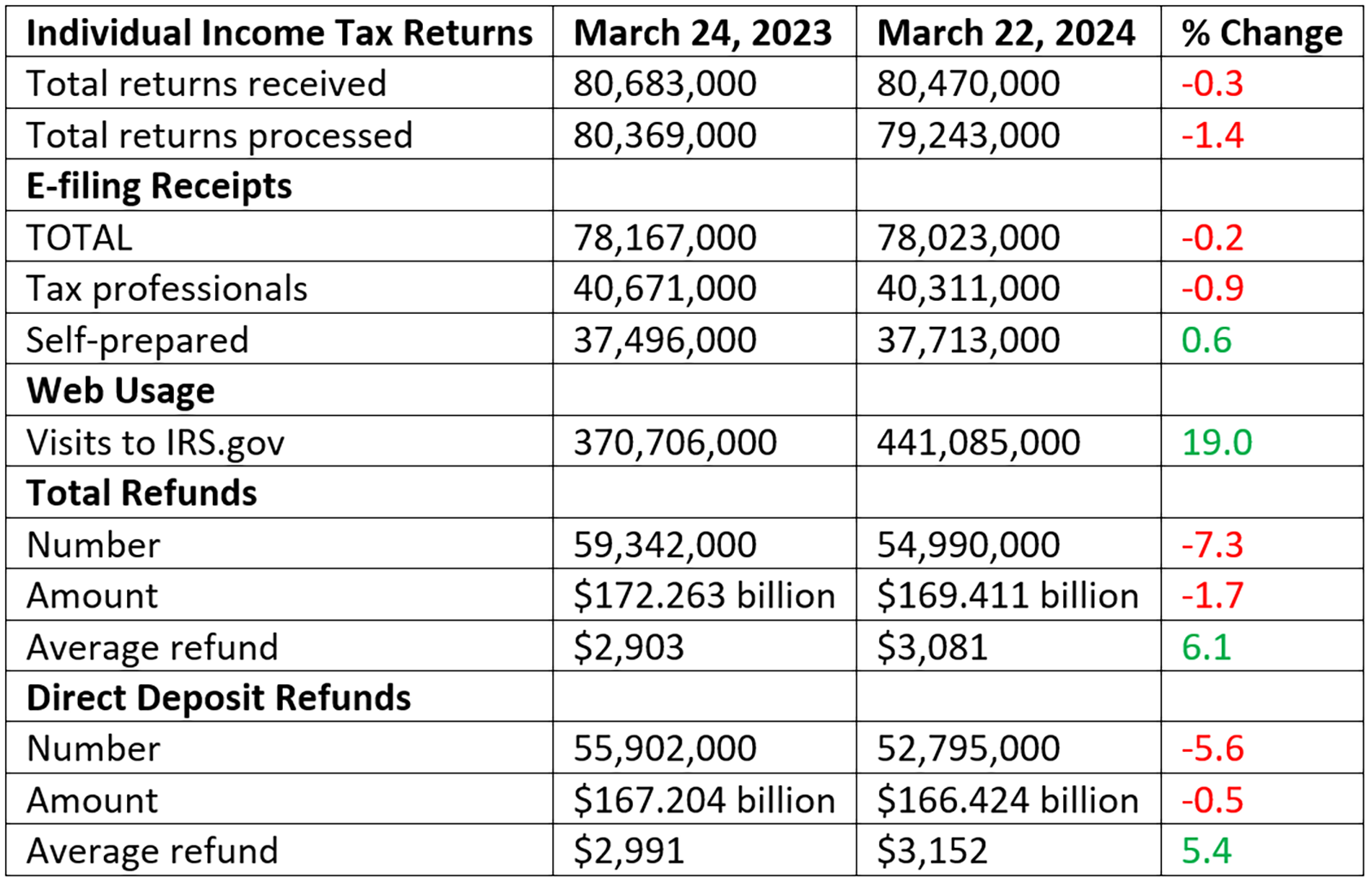

Refund numbers are down but amounts are up.

Refund numbers are down but amounts are up.