Firms need to look at the busy season as a stepping stone, while their clients are focused on taxes and accounting more than any other time.

Here’s why you need a business development strategy in busy season: READ MORE →

Top nine client management solutions.

NEXT QUESTION: Lessons Learned.

Join the survey; get the results

By CPA Trendlines Research

The CPA Trendlines annual Busy Season Barometer is uncovering some frank and candid talk about clients. Yes, we love them. Couldn’t live without them. Most of the time. But, well, not always.

It’s not that they’re bad people. But let’s face it, they aren’t always sweating tax prep much in advance of April 1, they have no idea what new regulations are in effect this year and their advisories from their CPA are filed under “migraines that can wait.” Plus, they truly believe their CPA is exclusively dedicated to their company and doesn’t really have much else to do but wait around for their phone call.

“No matter how proactive you try to be at scheduling and planning ahead, clients still delay providing information for their taxes,” Bryan Lantz says. “Seems the IRS, Congress and the media are out to make our jobs even more compressed and stressful.” His solution: “Keep communicating with clients to ensure that we can do the best we can at equalizing workflow during busy season.”

From their remarks, CPA Trendlines draws at least nine lessons in smart client management.:

Not enough trained staff, not enough seasonal staff, not enough staff.

Next question: The smartest moves this busy season? Join the survey; get the results.

By CPA Trendlines Research

The CPA Trendlines annual Busy Season Barometer is eliciting a panoply of lessons learned and plans for a smoother season next year. A lot of professionals’ comments this year are nothing short of outright complaint. And not without reason. It’s been a rough year. If the snow didn’t get you, Forms 3115, 8962, 8965 or 1095a did. Plus all things IRS got more complicated, clients got more desperate and, apparently, tensions rose as CPAs and staff stretched themselves to the limits of professional endurance.

One of the main lessons learned is the need for enough staff — enough staff hired early enough and trained well enough. Nancy Casburn at Casburn CPA in Lee’s Summit, Mo., sums up the importance of the softest of software: “Staffing is the most important reason for failing or succeeding at tax season.”

If we can draw any conclusion from all the staff-related lessons reported in this year’s Busy Season Barometer, it is that the profession needs more staff, better trained staff and an availability of seasonal staff. Given the increasing complexity of tax returns, the solution of this problem — more training, more accounting majors — needs to arrive quickly and be broadly based.

‘ACA is PITA BS for CPAs.’ Next year’s plan: ‘Become a monk.’

‘ACA is PITA BS for CPAs.’ Next year’s plan: ‘Become a monk.’

Next question: The smartest moves this busy season? Join the survey; get the results

By CPA Trendlines Research

As Busy Season 2015 grinds down, tax prep professionals are grappling with myriad and continuing issues with new rules, thin staffing and difficult clients, according to the CPA Trendlines annual Busy Season Barometer. But the new Affordable Care Act seems to be causing the most widespread aches and pains among accountants.

Feeling overwhelmed? Here’s how to combat it.

Feeling overwhelmed? Here’s how to combat it.

By Sandi Smith Leyva

The Accountant’s Accelerator

The exact solution to managing your “overwhelm” level will depend on what the source of your overwhelm is. You can also be suffering from more than one source of overwhelm.

Here are five tips to help you manage the most common sources of overwhelm.

Five reasons this is the wrong time to take your eye off the ball.

Five reasons this is the wrong time to take your eye off the ball.

Firms need to look at the busy season as a stepping stone, while their clients are focused on taxes and accounting more than any other time.

Here’s why you need a business development strategy in busy season: READ MORE →

No, coffee is not one of them.

No, coffee is not one of them.

By Sandi Smith Leyva

The Accountant’s Accelerator

Busy season is just around the corner. Can you feel the excitement? Or the dread?

Here are eight ways to boost your stamina and minimize burnout for those of you who are working long hours in the weeks ahead. READ MORE →

How some smart firms spent their summer vacations…

By Hitendra Patil

Pransform Inc.

A new busy season is fast approaching and vacation season is coming to an end. But some firms haven’t been taking time off. They’ve been assessing the lessons from the 2014 busy season to apply to 2015.

More on The Entrepreneurial Accountant: 8 Seconds into the Future: Meet Generation Z • 5 Reasons Gen Y Will Make or Break Your Firm • 3 Ways Amazon’s New Fire Phone Hints at the Future of Accounting • The 8 Traits Creating the Firm of the Future Today • Get More Done, Make More Money: Stop Doing These 17 Things • What Shopping Habits Reveal about Accounting Clients • Create Your “Not-To-Do’s” List • IRS Bitcoin Rule: 5 Things Accountants Need to Know • Tax Season Tips: Train Your Brain to Focus • What the Bitcoin Phenomenon Means for Accountants • Overcoming Your Clients’ Worst Fears • 5 Tech Tips for Reigniting Growth • A Case Study in Using Linkedin • Accountants and Six Fundamental Human Needs • Client Satisfaction Starts with ‘Likeability’ • Why Accounting? Your Clients Want to Know • What’s Next: Predictive Accounting

Here are six of the things that the most innovative firms have been doing. And no, they aren’t what you might necessarily expect. READ MORE →

Accountants scramble as competition surges for bread-and-butter tax work.

Join the survey; get the results.

By Rick Telberg

CPA Trendlines

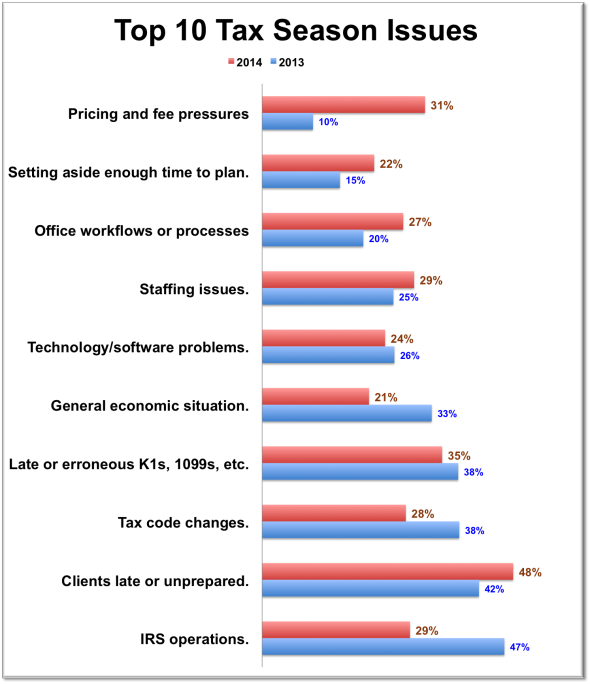

Pricing and fee pressures are surging as the hot-button issues this tax season, according to the CPA Trendlines Busy Season Barometer.

To be sure, late or unprepared clients remain the single biggest issue, with 48% of more than 500 practitioners surveyed in February citing it, followed by tardy 1099s and K1s at 35%. Those metrics are little changed from last February.

But this year, 31% of practitioners are complaining about pricing and fee pressures, which is triple the year-ago 10% figure.

RELATED RESEARCH

Is the Tax Prep Business Topping Out? The number of filings by tax professionals appears to have slowed or even reversed.

Tax Season Metrics Shift for the Better: Key indicators point to a better 2014 than 2013.

Practitioners Plot Fee-Pressure Countermeasures: Competitors vie for clients on price and promises.