The IRS teases new update on IRA beneficiary distribution rules.

Update: IRS Admits Mistake. Official Revision Imminent

By Seymour Goldberg, CPA, MBA (Taxation), JD

Special for CPA Trendlines

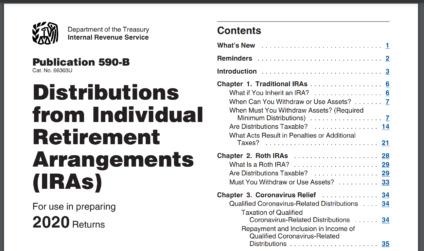

Many practitioners are waiting for the Department of the Treasury to issue proposed regulations under the Secure Act that cover the required minimum distribution rules that apply to IRA beneficiaries commencing in 2021.

MORE in TAX and PERSONAL FINANCIAL PLANNING: How a Few of the Wealthiest Skate Around the IRS | 173% Increase in IRS Correspondence Backlog | How to Attract the Super-Rich | How Small Firms Find New Growth as Family Offices | 12 Ways to Stress Less This Busy Season | Don’t Fire That Staffer on May 18!

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The distribution rules regarding an IRA owner are not a big deal, but the distribution rules regarding an IRA beneficiary or an IRA trust are a big deal.

TO READ THE FULL ARTICLE