Four Ways to Handle Federal Tax Liens

There’s more than one route to satisfying the IRS Collection Division.

By Eric L. Green

IRS tax liens can have a profound impact on an individual’s situation, affecting their ability to get loans, sell property or engage in business activities. As such, it is crucial for individuals to understand how IRS tax liens work and the options available for getting rid of them.

MORE: The IRS Is Coming! Get Your Clients into Compliance | Tax Chat: Eric Green Reveals The Tax Rep Guide to Tax Season

Exclusively for PRO Members. Log in here or upgrade to PRO today.

In this article we discuss approaches and factors to consider when dealing with IRS tax liens, offering insights and advice to help taxpayers navigate this process.

Understanding IRS Tax Liens

Before discussing ways to remove tax liens, it is important to get a basic understanding of what they entail. A tax lien represents a right against a taxpayer’s assets, and is used by the IRS to secure its interest in the taxpayer’s assets – both those owned at the time and those later acquired.

READ MORE →

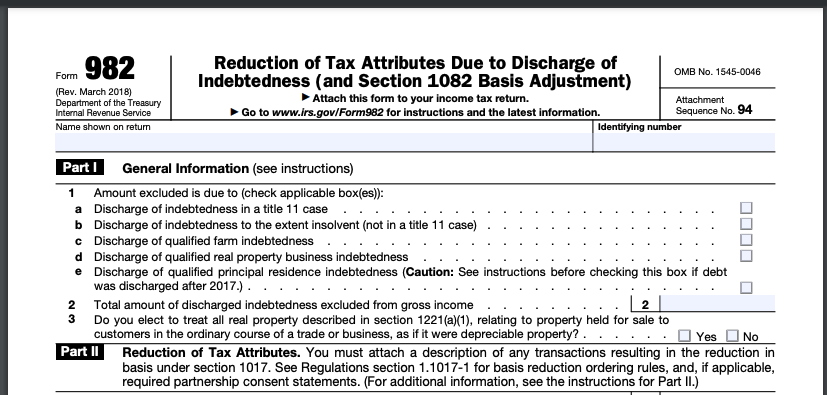

Meet Form 982.

Meet Form 982.