Accountants to the Rescue as Startups Struggle

Three ways that you can help.

By CPA Trendlines Research

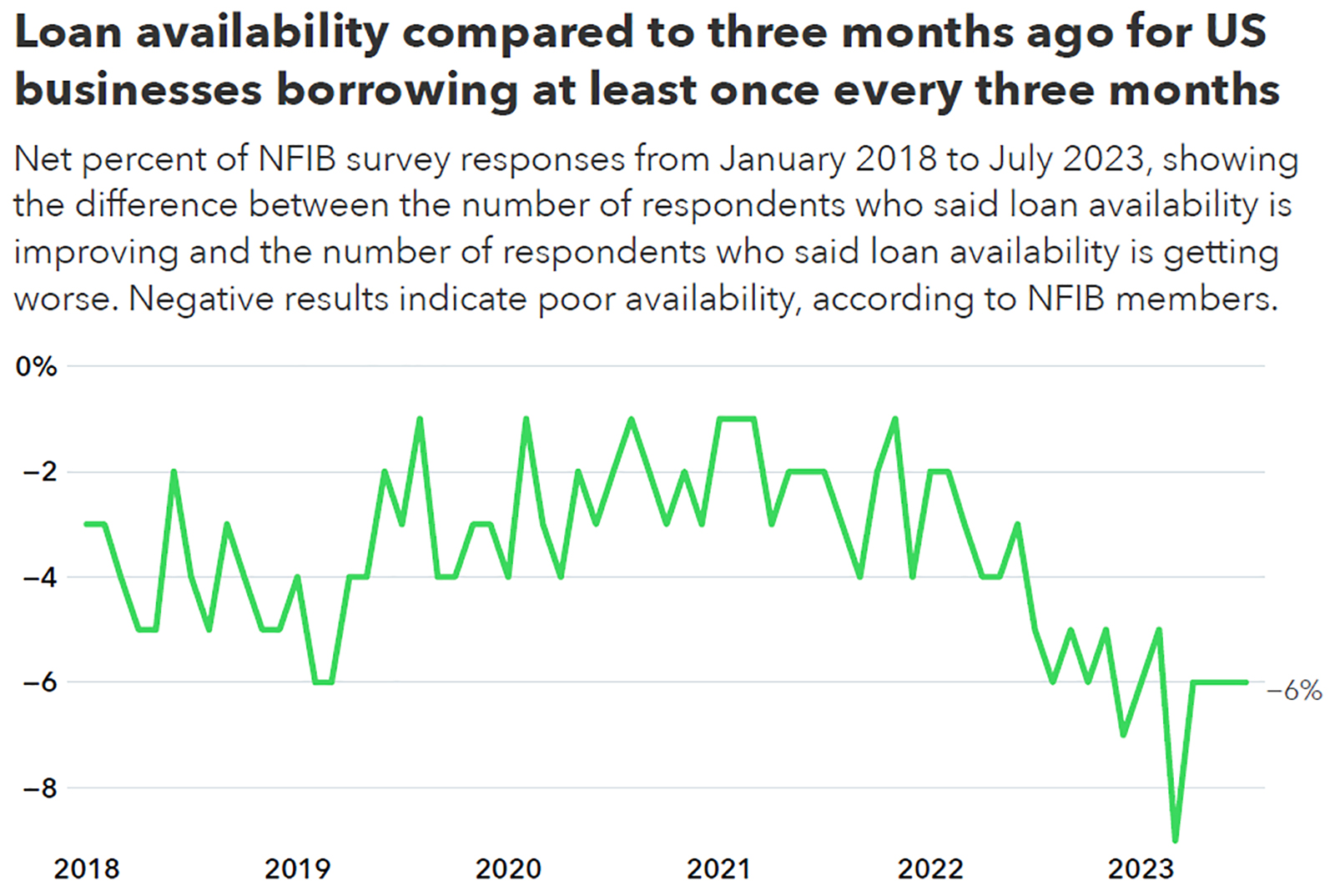

Small businesses rarely make the headlines, but as a whole they represent a huge portion of the American economy. More than 98 percent of all American businesses have fewer than 100 employees, and 77 percent have between one and 10. Together they account for 36 percent of the national workforce.

MORE: Talent Gap Widening: Be Very Scared | Accountants Hopeful, Concerned and Confused about AI | Looking for Recent Grads? Good Luck | CPA Biz Is Booming, But for How Long? | Survey Respondents See Exciting Year Coming Up | SURVEY: Accountants Economic Outlook Brightens | Research: Accounting Pros Cautiously Optimistic about Generative AI

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Americans, generally an independent bunch, are known for cranking up new businesses. One in 10 small businesses is less than one year old. The attrition rate is high, of course, but 45 percent have held on for one to 10 years, and they account for 34 percent of small business jobs.

READ MORE →