SURVEY: You’re Probably Not Reading This on an iPad

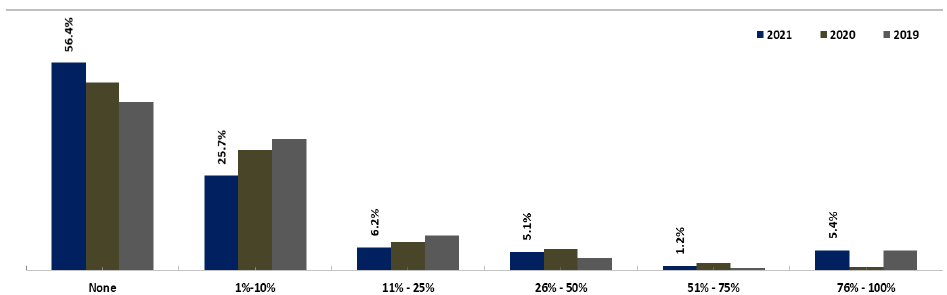

The only uptick appears at the end of the spectrum.

By the Accounting Firm Operations and Technology Survey

Portability has been popular in many ways, but somehow that isn’t extending to iPads and other tablets in the accounting profession.

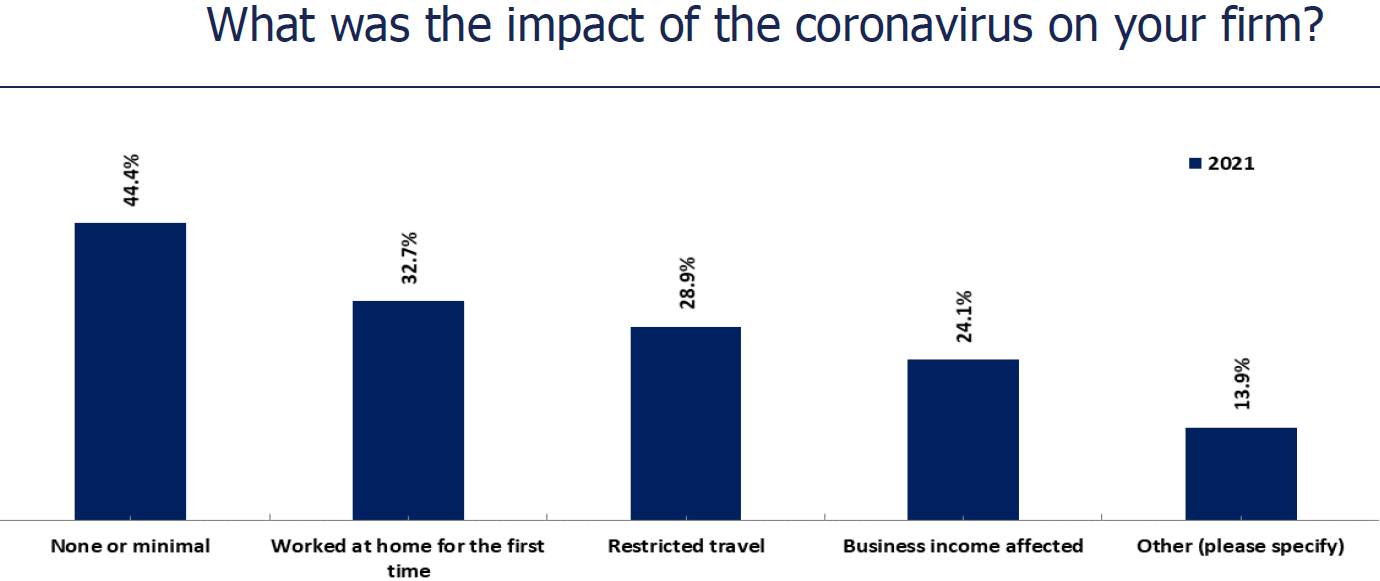

MORE: Cloud Backup Declining | Only 19% of Firms Host Email | Pandemic Changed Work for 64% | Today’s Top 3 Tech Problems: Security, Client Onboarding and Workflow

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Among CPA Trendlines readers, there’s a 74% chance you’re reading this on a desktop computer and a 25% chance you’re on a mobile device (most likely an iPhone), with less than 1% probably using a tablet, based on our Google Analytics figures for the past 12 months.

The heaviest users of tablets and iPads are the largest firms.

READ MORE →

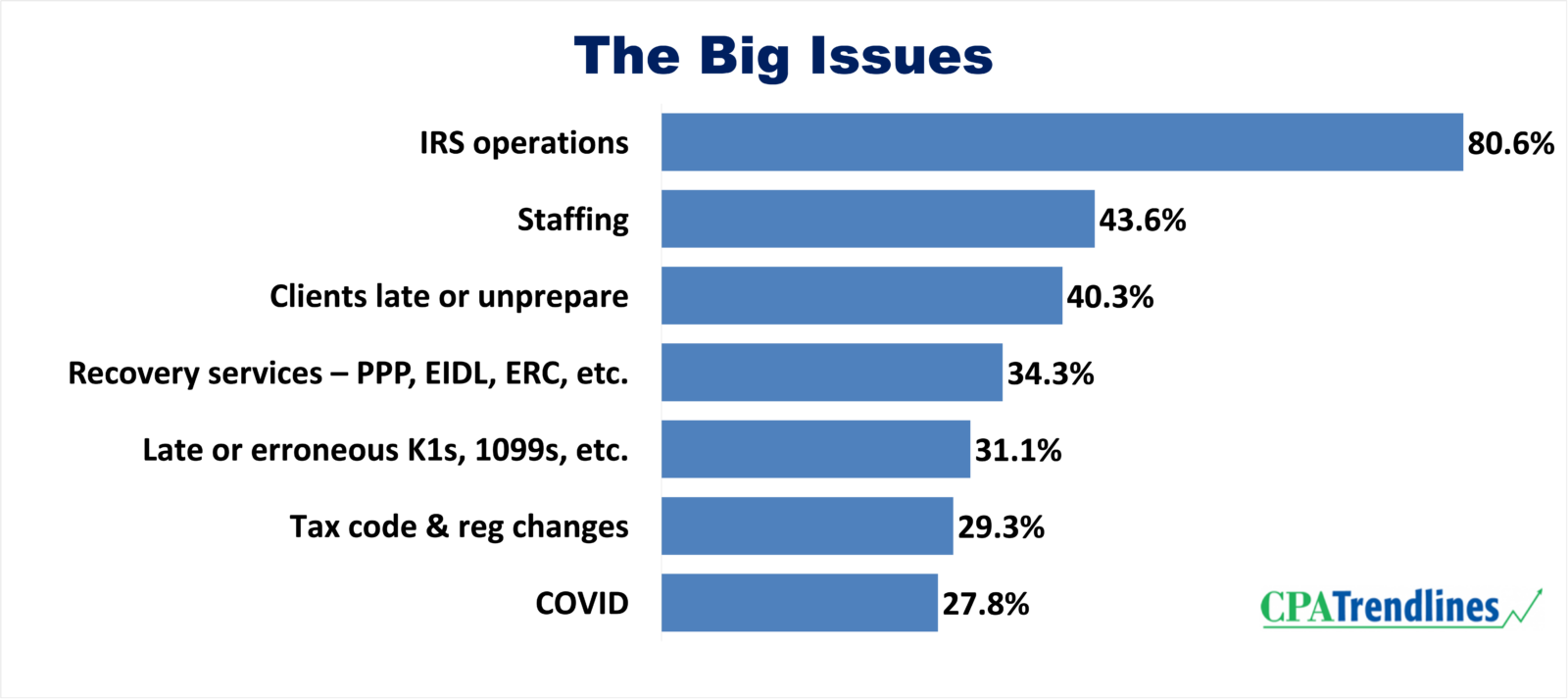

And the IRS already knows what they are.

And the IRS already knows what they are.