Why the IRS Is Still Doing Data Entry By Hand

Five recommendations are offered to improve processing. Start with scanners.

Five recommendations are offered to improve processing. Start with scanners.

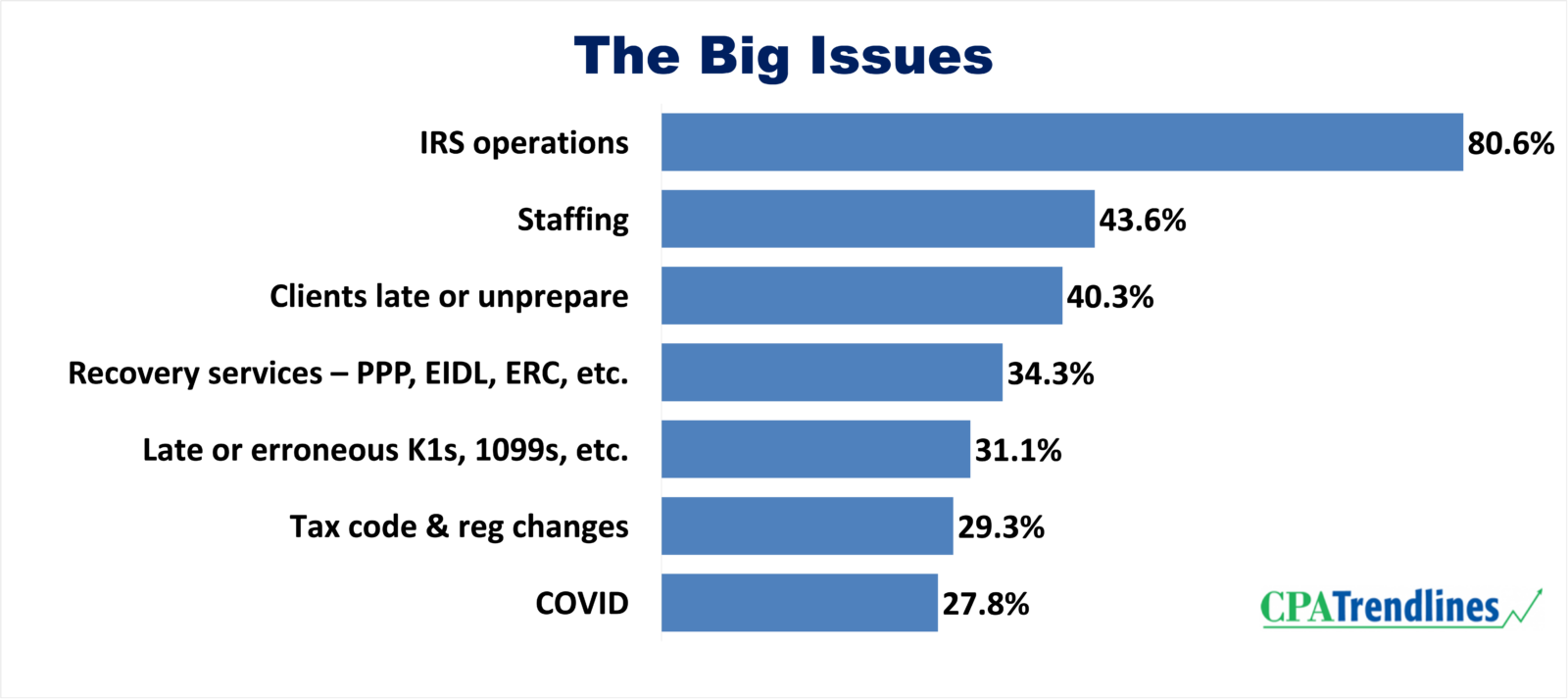

Want to know the top trends and issues this year?

Join the survey. Get the answers.

Start here.

By CPA Trendlines Research

Here’s something you’d better explain to your tax clients, lest you get blamed:

MORE: News on IRS Is Maybe Sort of a Little Bit Good | Why We All Hate the Tax Code | How Bullish Are You This Tax Season? | Accountants’ Top Problems for Tax Season 2023 | Tax Season 2023: Better or Worse?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Three ways to fix the program.

Three ways to fix the program.