Benchmarking ‘Elite’ CPA Firms against the ‘Mainstream’

Looking inside firms with income per partner over $500,000.

By CPA Trendlines

Rosenberg MAP Survey

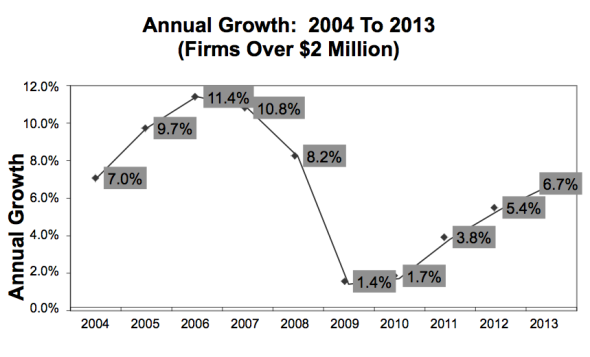

If you’re a firm with two or more partners wondering just how well your business compares to the CPA profession’s “elite” firms, you should be looking for a 5.2% revenue gain this year, according to the new Rosenberg Survey. And your revenue growth last year should have been at least 7.4%, excluding any changes that resulted from mergers.

The survey, based on activity at firms across the country with annual fees ranging from less than $2 million to more than $20 million, defines “elite” as the firms with income per partner of more than $500,000. By comparison, the average income per partner for the profession’s “mainstream” firms is $345,177.

The report provides comparisons for benchmarks including billing rates, partner-to-staff ratios, hours billed annually, staff turnover rates, men-to-women ratios, partner ages, client services and partner compensation.

Top strategy: Compare with peers.

Top strategy: Compare with peers.

Who gets promoted and why in accounting:

Who gets promoted and why in accounting:  New benchmarks and insights on remote access, the Internet and telecommunications.

New benchmarks and insights on remote access, the Internet and telecommunications.