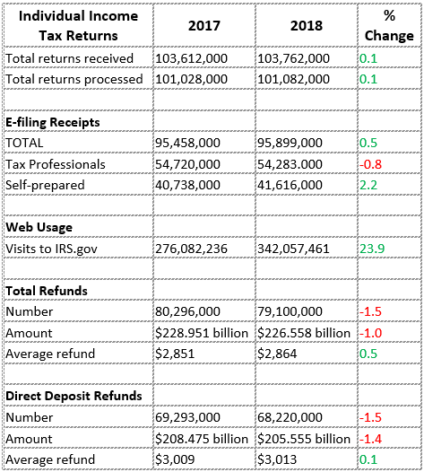

Tax Pro E-Filing Off 2.7% from Last Year’s Pace

By Beth Bellor

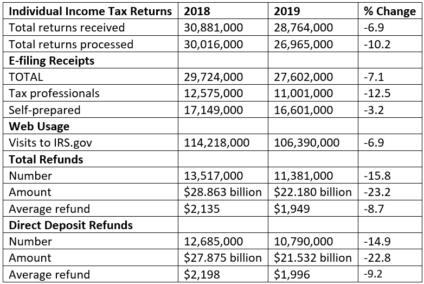

As we wind down the misery that is the 2019 tax season, figures are down all over.

MORE: Wanna Change The Tax World? | Tax Season 2019 Serves Up a Taste of the Future | Tax Professionals File 38 Million Returns | The Big Free-File Flop | The Demise of Schedule A? | Refunds Still Up, but Only by 0.7%

Exclusively for PRO Members. Log in here or upgrade to PRO today.

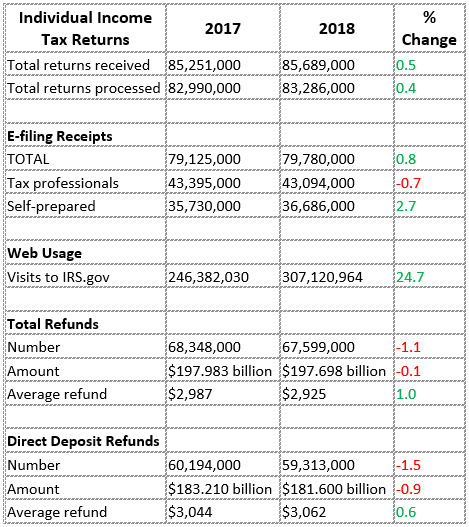

The number of direct deposit refunds is up, but otherwise the only “positives” are self-prepared e-filings and IRS website visits, hardly bright news.

READ MORE →

Refunds remained down in number and total amount.

Refunds remained down in number and total amount.