Thursday, Nov. 12: The Biggest Tax Screw-Ups! with Eric Green

Learn from Cases I Screwed Up So You Won’t Have To!

2 pm ET / 11 am PT

2 hours, 2 CPE, 2 IRS CE

View Details

Learn from Cases I Screwed Up So You Won’t Have To!

2 pm ET / 11 am PT

2 hours, 2 CPE, 2 IRS CE

View Details

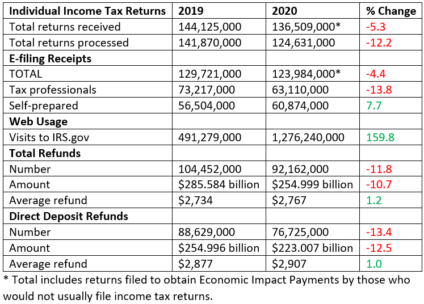

Final IRS stats for Busy Season 2020 shows professionals filed 0.5% fewer returns than last year and lost market share to DIY’ers.

BUSY SEASON BAROMETER:

How accountants are battling the Coronavirus recession

Join the survey. Get the answers.

By Beth Bellor

CPA Trendlines Research

In what may be an alarming turning point for the profession, tax practitioners finished an already chaotic and bruising Tax Season 2020 after preparing a total of 73.8 million e-filed returns – a decline of 400,00, or 0.5 percent, from Tax Season 2019 – the first such reversal on record. Ever.

MORE on TAX SEASON 2020: Say Hello to the New 24-Month Busy Season | When COVID ‘Got Real’ | Tax Pros Hold eFiling Market Share as Tax Seasons Winds Down | The Top Six IRS #FAILS this Tax Season (So Far) | How COVID Has Pulverized IRS Operations | The Mystery of 10 Million Missing Tax Returns | COVID Cuts Accounting Profits | Why Busy Season May Never Be the Same Again | COVID Tests Accountants’ Entrepreneurial Talents | Pro Tax Prep Stalls to a Crawl amid Covid-Extended Season | Clients, Revenues, Profits – Trending Down, Down, Down |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

“If you are in public accounting and relying on personal return revenue, the results this year are troubling as it is the first time that professionally prepared returns actually fell from the prior year,” says Jon Baron, the longtime CEO of Thomson Reuters Tax & Accounting, and now a venture capitalist with more than a couple startups in stealth mode.

Misunderstandings and shortcuts in the workplace can create a hostile and stressful environment.

By Steven E. Sacks

The NEW Fundamentals

With more people using mobile devices for communication shortcuts, are we facing troublesome challenges in speaking in a recognizable language in the U.S.?

MORE: Why Proper Communication Is Critical | Syncing Up for the COVID Era | The New COVID-19 Workplace: Are You Prepared? | How to Create Effective Internal Communications | Profit Is Not a Mission | Confronting Leadership: Not Such a Bad Thing | New Opportunities for a ‘New Normal’ | Is Trust Elusive?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

While it may be convenient for some, for others it leaves them scratching their heads. I am not seeking to be a public scold. However, if you want your communication to be effective, then understand your audience, situation, and topic.

This is especially relevant with teams working virtually, and at a distance, in the Age of COVID.

READ MORE →

No, it’s not too early to begin planning.

No, it’s not too early to begin planning.

By Ed Mendlowitz

Tax Season Opportunity Guide

Marketing takes many forms. Further, many accountants are not trained in marketing. I also know that while most CPAs want more business, they are too busy with what they have to be actively seeking new business. Additionally, marketing can be external, internal or retentive.

MORE: 4 Reasons Not to Let Staff Go After Tax Season | Nine Keys to Success and Growth | What Kind of Accountant Are You? | COVID Tests Accountants’ Entrepreneurial Talents | Have You Gotten Where You Wanted Yet?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

External is where new clients are solicited. That takes effort, ingenuity, time and maybe even some money.

READ MORE →

Refunds up but barely.

BUSY SEASON BAROMETER:

Congratulations! You survived Tax Season 2020!

Today’s Bonus Question: What’s next?

Join the survey. Get the answers.

By Beth Bellor

As the extended 2020 tax season drags to a close, nearly all the touchpoints remain in the red.

MORE: Tax Pros Take Bigger Share of E-filings | The Mystery of 10 Million Missing Tax Returns | Tax Pro E-Filings Down 20 Percent | IRS Web Traffic Doubles over Year-Ago | COVID Drowns IRS in New Filings | 2020 Tax Season Comes to a Screeching Halt | The Tax Season 2020 Dumpster Fire | Tax Pros Fall Behind 6.2% in Returns Filed | Tax Pros Trail by 908,000 Returns | Tax Pro IRS Filings Lag by 532,000 | Tax Pro E-Filings Lag by 512,000 Returns | Tax Pros Kick into High Gear | Slow Start for Tax Pro E-filing | Data Points Down as Tax Season Opens | The Fight for New Tax Clients

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The Internal Revenue Service had received 142.4 million individual income tax returns, down 2 percent from the same period in 2019, as of July 3, the latest data available. It had processed 130.6 million returns, down 9.5 percent.

READ MORE →

Refunds up, but not by much.

Refunds up, but not by much.

By Beth Bellor

Ever so slowly, the professionals are closing the gap with the DIYers in tax preparation.

MORE: The Mystery of 10 Million Missing Tax Returns | The Tax Season 2020 Dumpster Fire | The Fight for New Tax Clients

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The Internal Revenue Service had received 139.9 million individual income tax returns as of the week ending June 26 – the latest data available – down 3.5 percent from the same period in 2019. It had processed 128.5 million returns, down 10.6 percent.

READ MORE →

While tax professionals’ efiling pace remains stalled, DIYers grow by 4 million.

While tax professionals’ efiling pace remains stalled, DIYers grow by 4 million.

BUSY SEASON BAROMETER:

How accountants are battling the Coronavirus recession

Join the survey. Get the answers.

By Beth Bellor

With less than a month to go before 2020’s extended tax deadline, the grind continues.

MORE: Tax Pro E-Filings Down 20 Percent | IRS Web Traffic Doubles over Year-Ago | COVID Drowns IRS in New Filings | 2020 Tax Season Comes to a Screeching Halt | The Tax Season 2020 Dumpster Fire | Tax Pros Fall Behind 6.2% in Returns Filed

Exclusively for PRO Members. Log in here or upgrade to PRO today.

And the question is: Where are 10 million tax returns that should have been filed by now by professionals?