Ask This Before Clients Do

Plus some suggested answers.

Plus some suggested answers.

By Ed Mendlowitz

Tax Season Opportunity Guide

Here are two questions to ask yourself:

- Why should clients use you?

- Why should staff want to work for you?

MORE: 41 Items to Check on Business Tax Returns | 9 Overlooked Tax Season Resources | What’s NOT to Like about Tax Season? | Can Your Reviewers Answer These 10 Questions?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

You should be clear on the responses to the above two questions. If you can’t clearly articulate the reasons clients should use you and why staff would want to work for you, then why should they?

READ MORE →

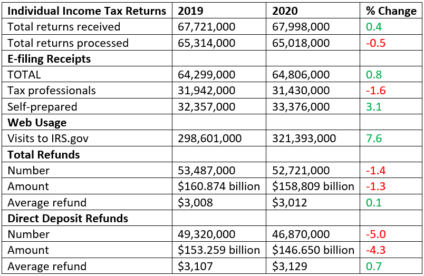

Coronavirus crushes tax prep.

Coronavirus crushes tax prep.

DIYs, refunds are up.

DIYs, refunds are up.