Tax Refund Totals Up 4%

Electronic filings take a dip.

By Beth Bellor

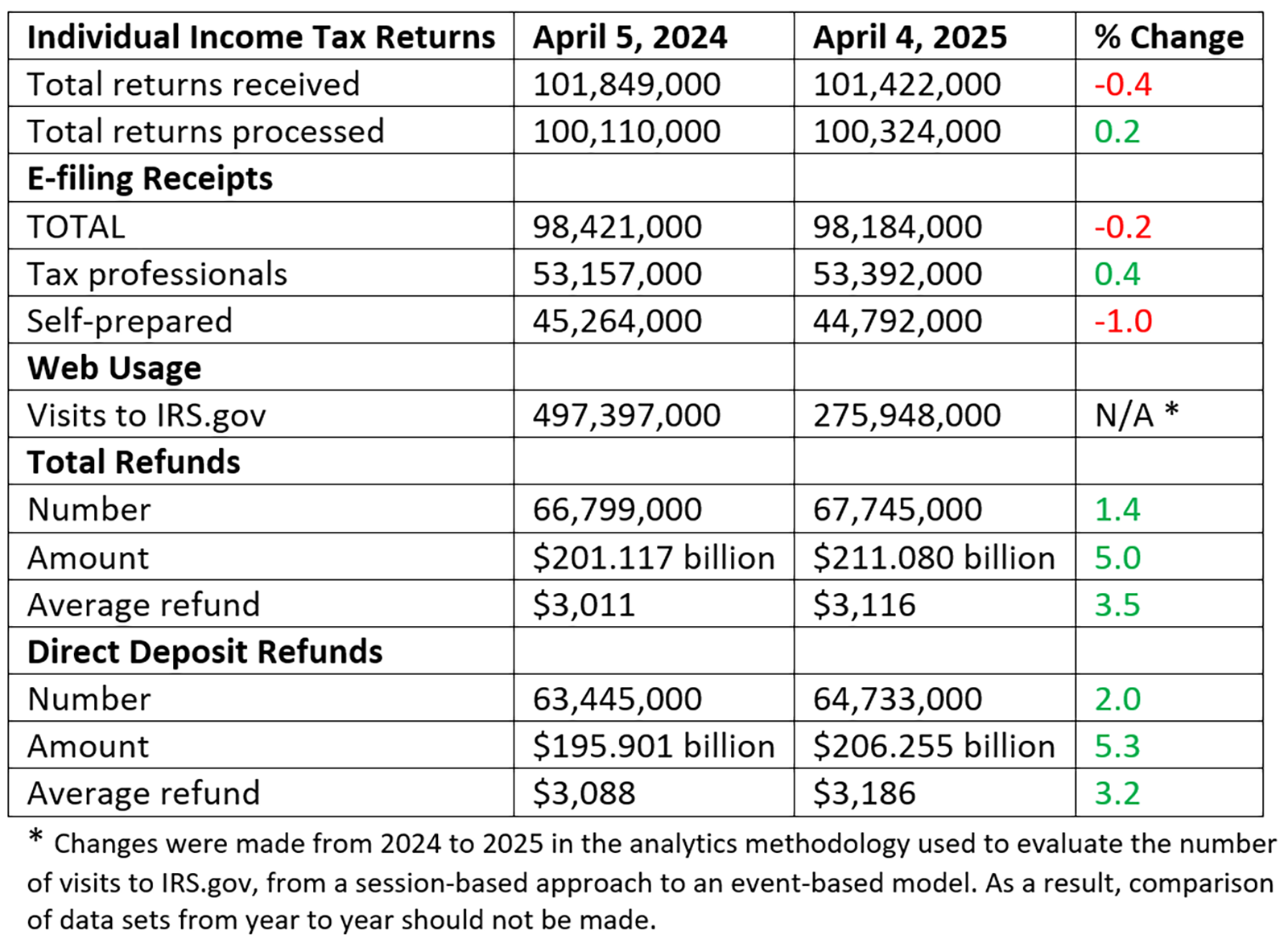

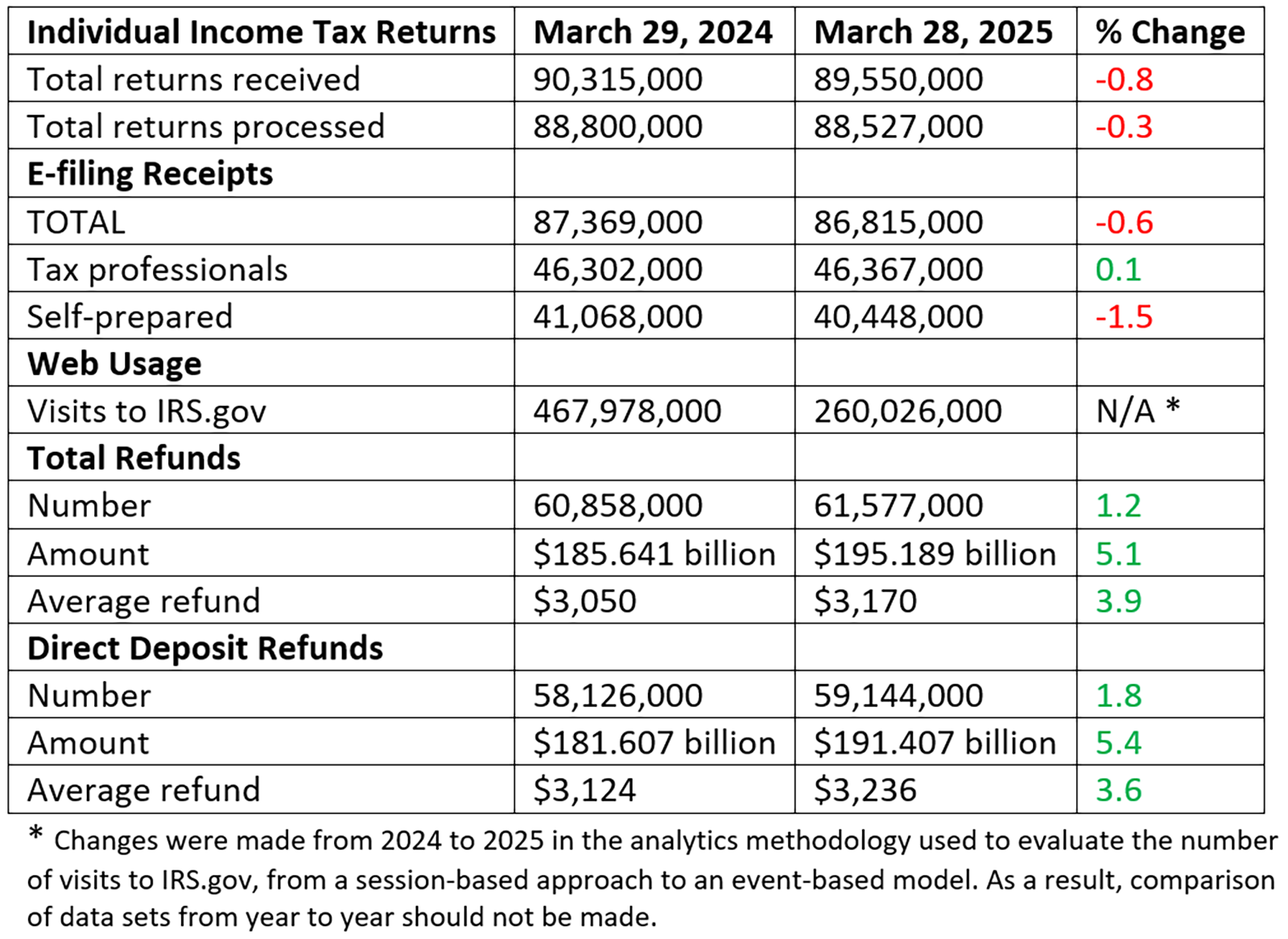

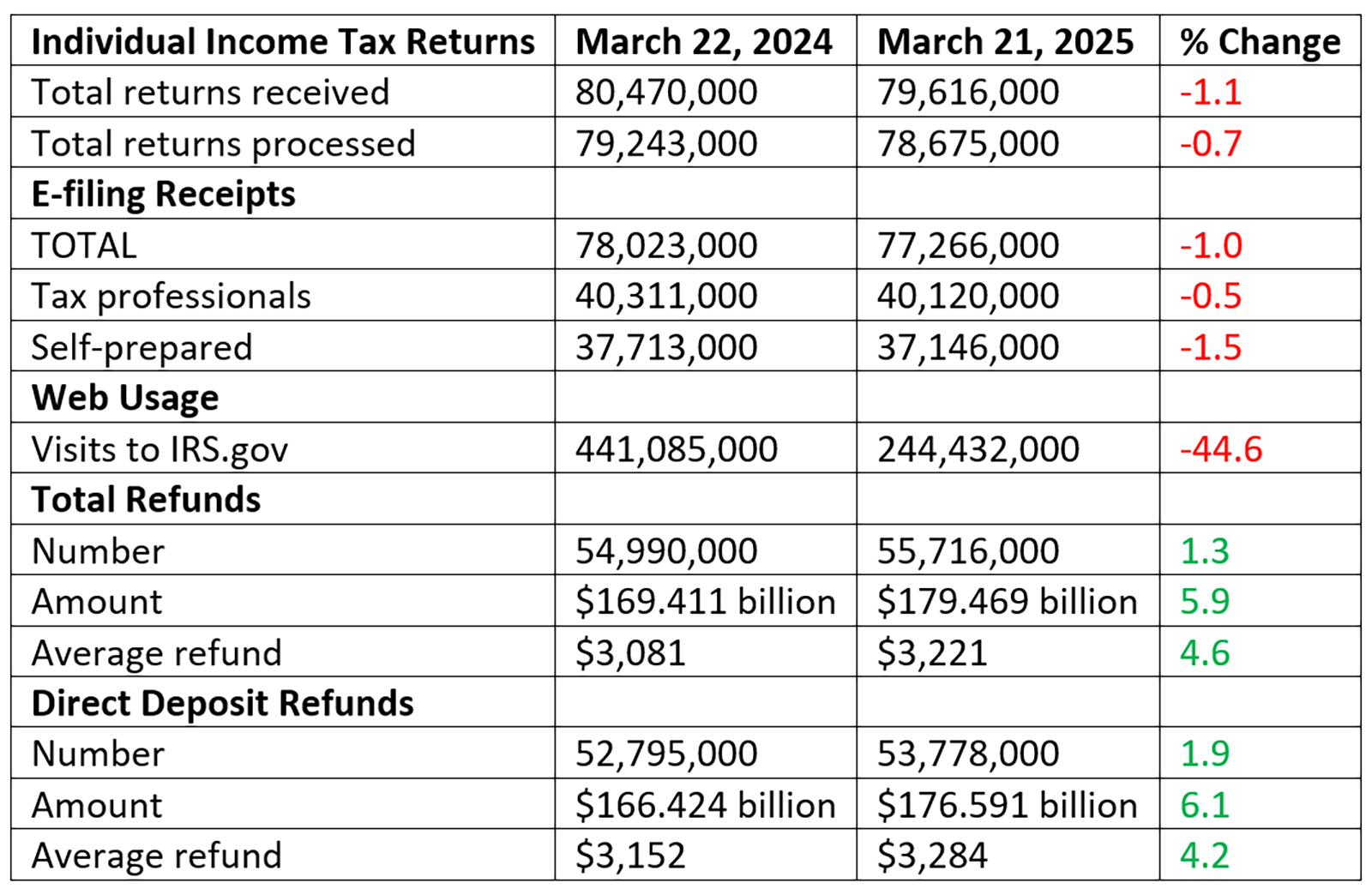

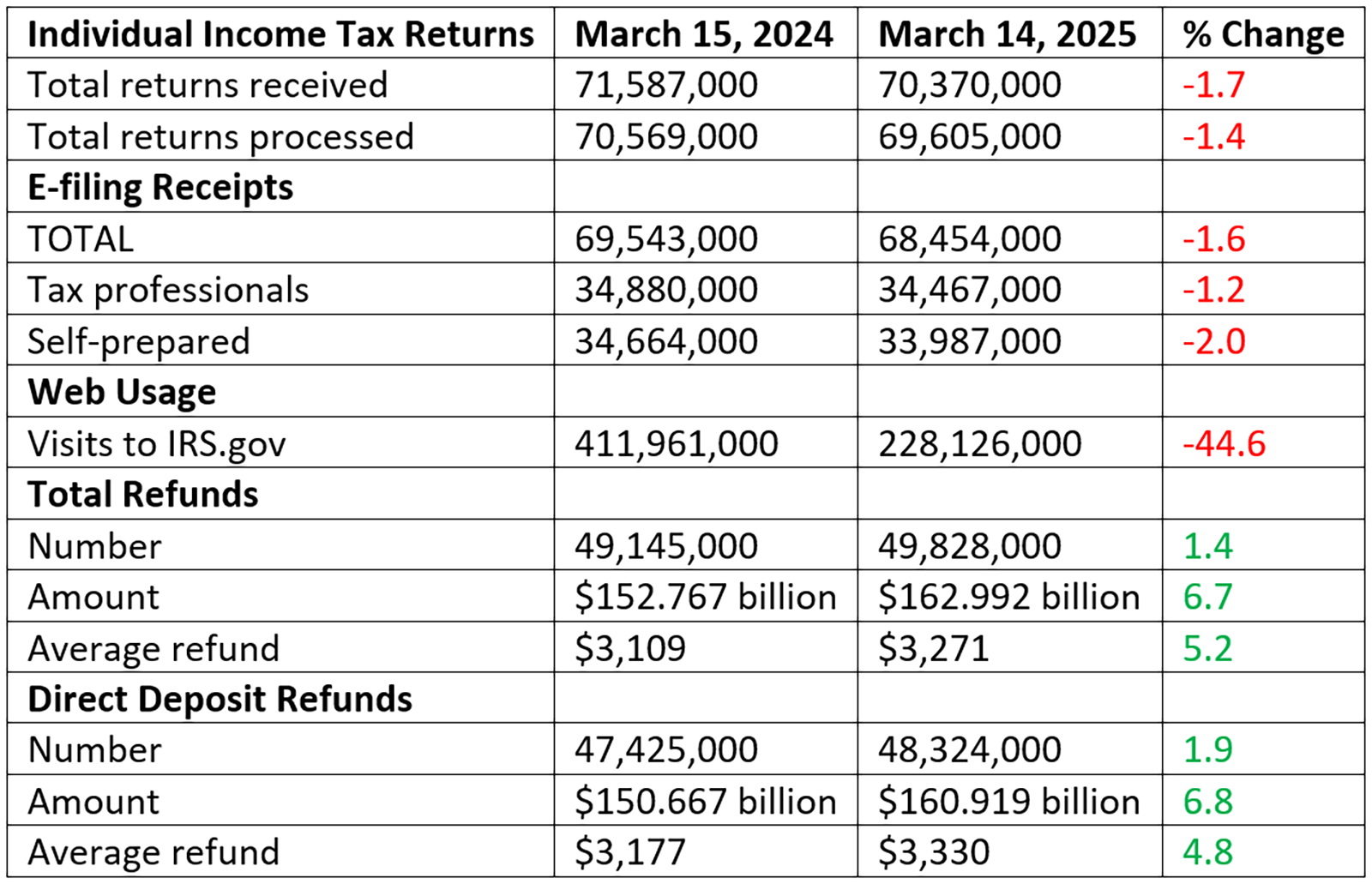

In the last days of Tax Season 2025, processed returns and e-filings by tax professionals both slipped back into the negative.

MORE: Refunds Up 5% as Tax Returns Top 100 Million | Tax Pros Rev Up Filing Pace as DIYers Lag | Tax Returns Nearly Match 2024 Rates | Tax Pros Edge DIYers in E-Filings | Tax Refund Totals Up 7% | Tax Pros Handle 46% of E-Filings | Tax Refund Totals Up 10% | Tax Refunds Plummet, but No Worries | Tax Refunds Up 18% Early On | First Tax Filing Reports Are In

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

As of April 11, the Internal Revenue Service had received 117.6 million individual income tax returns, down 1.7 percent from the same period in 2024. It had processed 116.3 million returns, down 1.5 percent.

READ MORE →