More Highlights: “Tax Season from Hell.” The pandemic pivot. Small business outlook. Digitally-powered recovery.

By CPA Trendlines

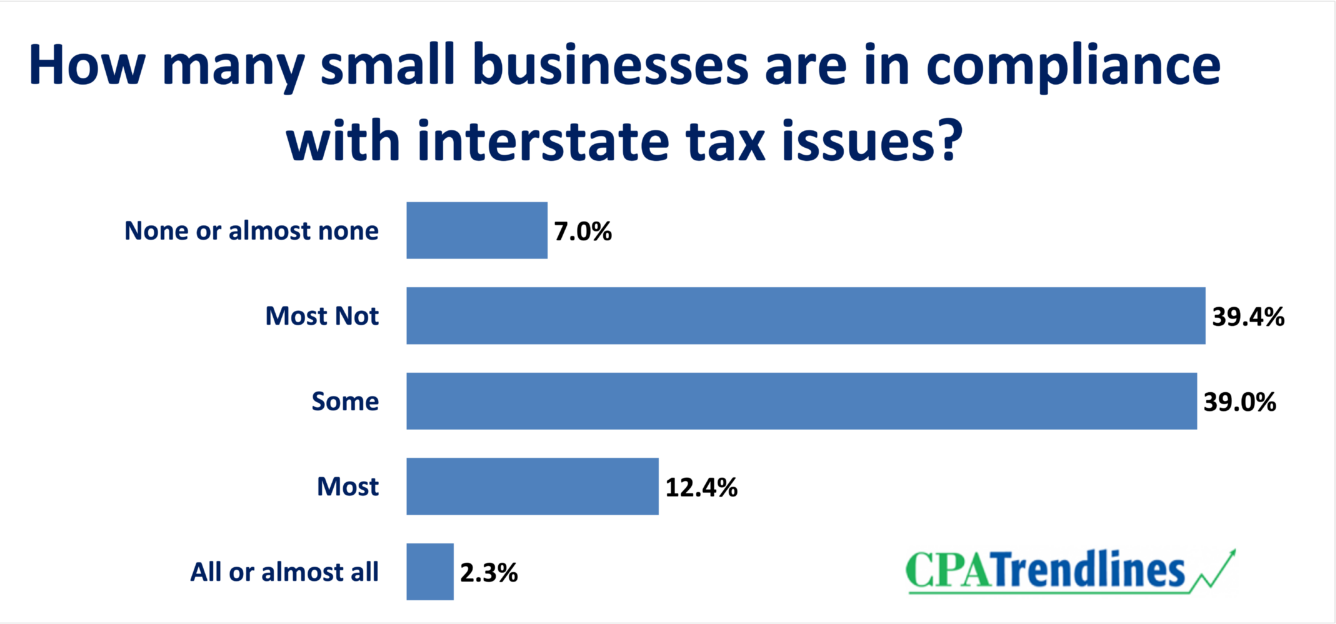

Three years after the notorious “Wayfair” decision, accountants say a vast number of small businesses face new and burdensome interstate sales tax measures. But only a few accountants appear ready to help, according to new research by CPA Trendlines.

MORE: Survey: Rough Seas Ahead for Small Business

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Most accountants believe that 98 percent of small businesses – virtually all – are failing to fully comply with all the interstate sales tax issues they may be liable for. And yet, about 71 percent of accountants are falling short of handling all their clients’ sales tax issues, with about 12 percent saying they address “most” issues, 36 percent handling “some,” and 24 percent handling none, according to the new study conducted in conjunction with Avalara, the tax management software company.

TO READ THE FULL ARTICLE