Average refunds are down by double digits.

Average refunds are down by double digits.

By Beth Bellor

CPA Trendlines Research

More people have gotten tax refunds in 2023, but fewer dollars have gone out. This is as the IRS kicks back refunds nearly as fast as it receives returns.

MORE: Pros Handle 45% of Income Tax Returns | IRS Processing Returns as Fast as It Gets Them | Only 39% of Tax Returns Filed by Pros | Tax Season Opens with Refunds Up 85%

Exclusively for PRO Members. Log in here or upgrade to PRO today.

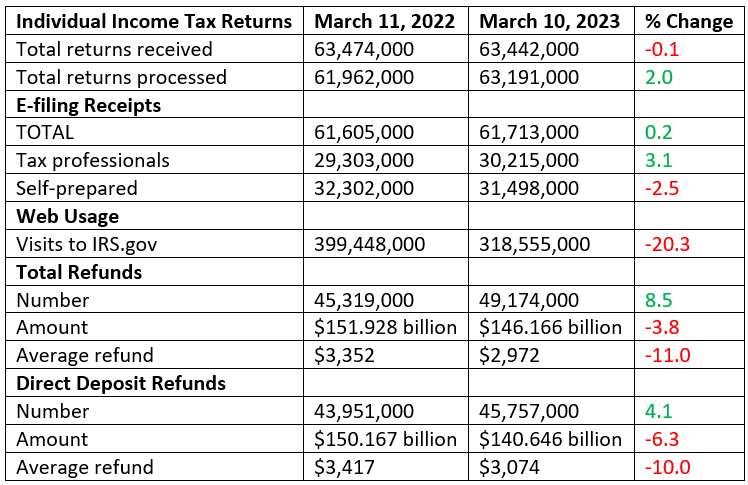

As of March 10, the latest data available, the IRS had received 63.4 million individual income tax returns, down 0.1 percent from the same period in 2022. It had processed 63.2 million returns, up 2 percent, for an impressive 99.6 percent completion rate.

TO READ THE FULL ARTICLE