The happy news for taxpayers: refunds are up.

By Beth Bellor

CPA Trendlines Research

The tax deadline, as most Americans define it, is drawing closer, and the country’s tax pros are gaining about 2 percentage points a week in market share of tax filings. Go, accountants!

MORE: Tax Refunds, Tax Pro Market Share Trending Up | Refunds Up as Tax Pros Tackle 41.5% of E-filings | Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

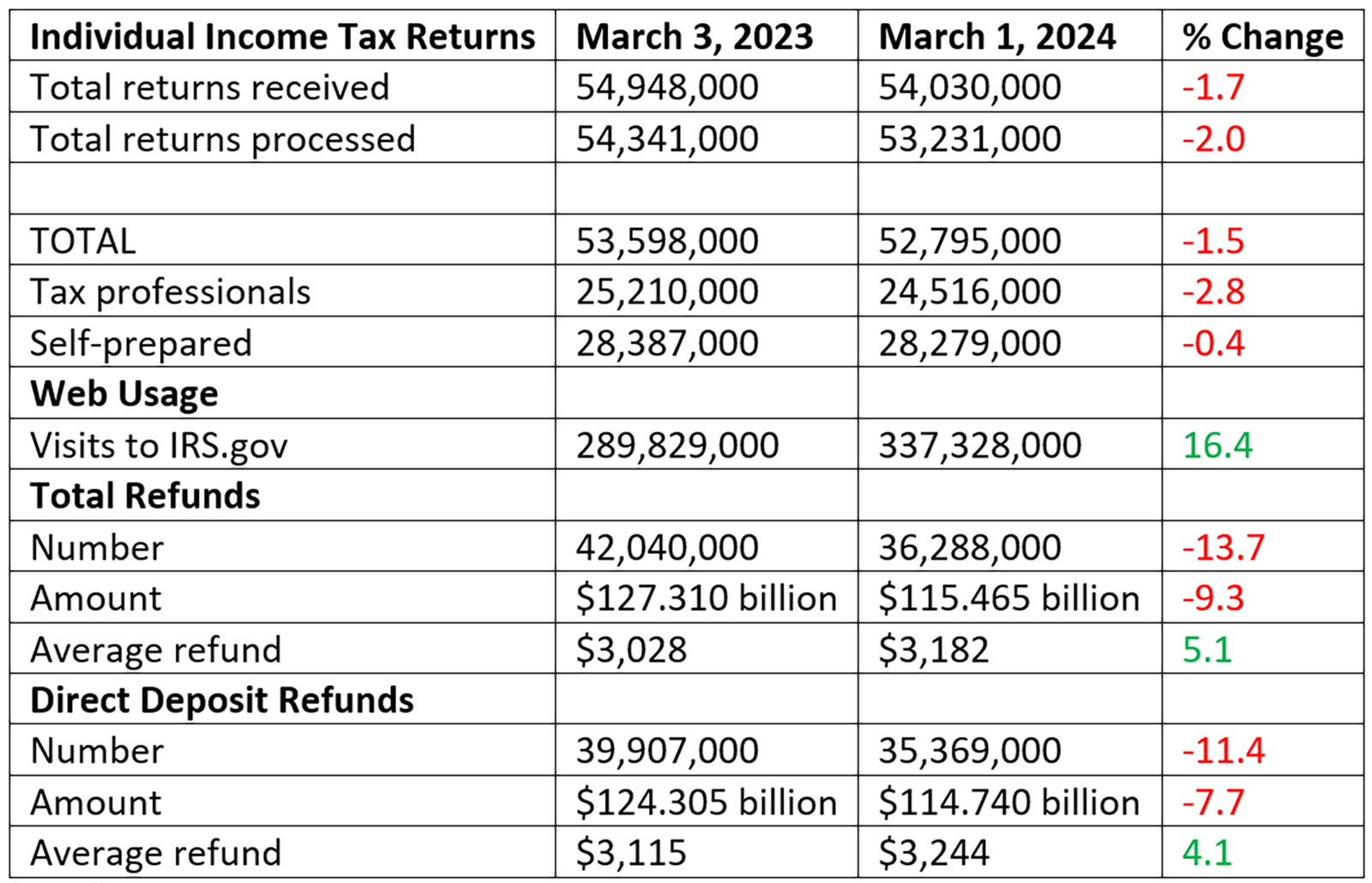

The Internal Revenue Service had received 54 million individual income tax returns, down 1.7 percent, as of March 1, the latest data available. It had processed 53.2 million returns, down 2 percent from one year ago. The 2024 season has been seven days shorter than the 2023 season because of a later start date.

E-filings

Electronic filings totaled 52.8 million, down 1.5 percent. Tax professionals submitted 24.5 million, down 2.8 percent, and self-preparers handled 28.3 million, down 0.4 percent.

Tax pros were responsible for 46.4 percent of e-filings.

Website Visits

Visits to IRS.gov reached 337.3 million, up 16.4 percent.

Refunds

Total refunds numbered 36.3 million, down 13.7 percent, in the total amount of $115.5, down 9.3 percent. The average refund of $3,182 was up 5.1 percent.

Direct deposit refunds were 35.4 million, down 11.4 percent, for a total of $114.7 billion, down 7.7 percent. The average direct deposit refund of $3,244 was up 4.1 percent.