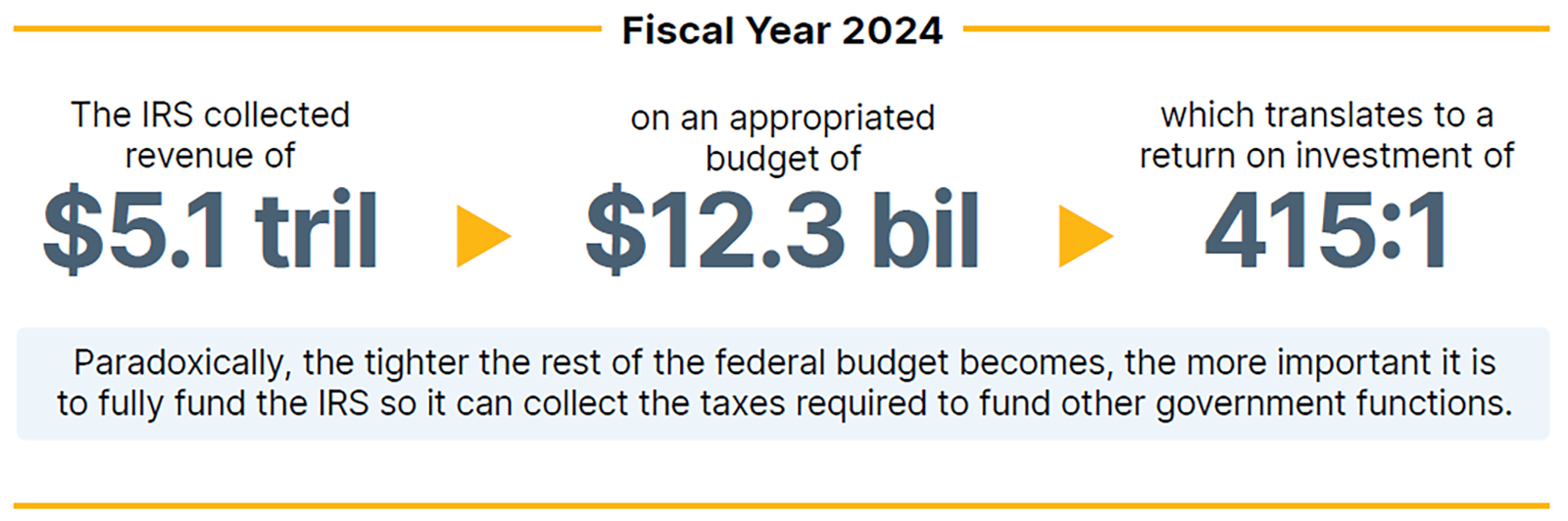

From a business perspective, funding the IRS is an excellent investment.

By CPA Trendlines Research

The Internal Revenue Service’s Taxpayer Services and Business Systems Modernization accounts got short shrift in the big-time funding provided by the Inflation Reduction Act. But still, the combined total of $8 billion they got has gone a long way to improve the taxpayer experience.

MORE: Tax Season 2025 Begins. Ready or Not. | Every Tax Reviewer Should Be Able to Answer These Ten Questions | Art Werner: Corporate Transparency Act and FinCEN Reporting | Quick Tax Tip | Taxpayer Advocate Sees Big Improvements at IRS | Ask Tax Clients the Right Questions | Major Changes to Circular 230: Implications for Tax Professionals | Cornerstone Report | Art Werner: Due Diligence and IRS Enforcement | Make ‘Done But’ Tax Returns a Thing of the Past | Six Methods for Getting Paid Faster This Tax Season | Use Humor to Get Tax Documents in Early | Art Werner: Busy Season Predictions

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Here’s the breakdown of the original account allocations at the IRS:

- Enforcement: $45.6 billion, 58 percent of the total

- Operations Support (e.g., rent, phones, paper, etc.) $25.3 billion, 32 percent of the total

- Business Systems Modernization (including tech upgrades): $4.8 billion, 6 percent of the total

- Taxpayer Services: $3.2 billion, or 4 percent of the total

TO READ THE FULL ARTICLE