But are trends already on the upswing again?

By CPA Trendlines

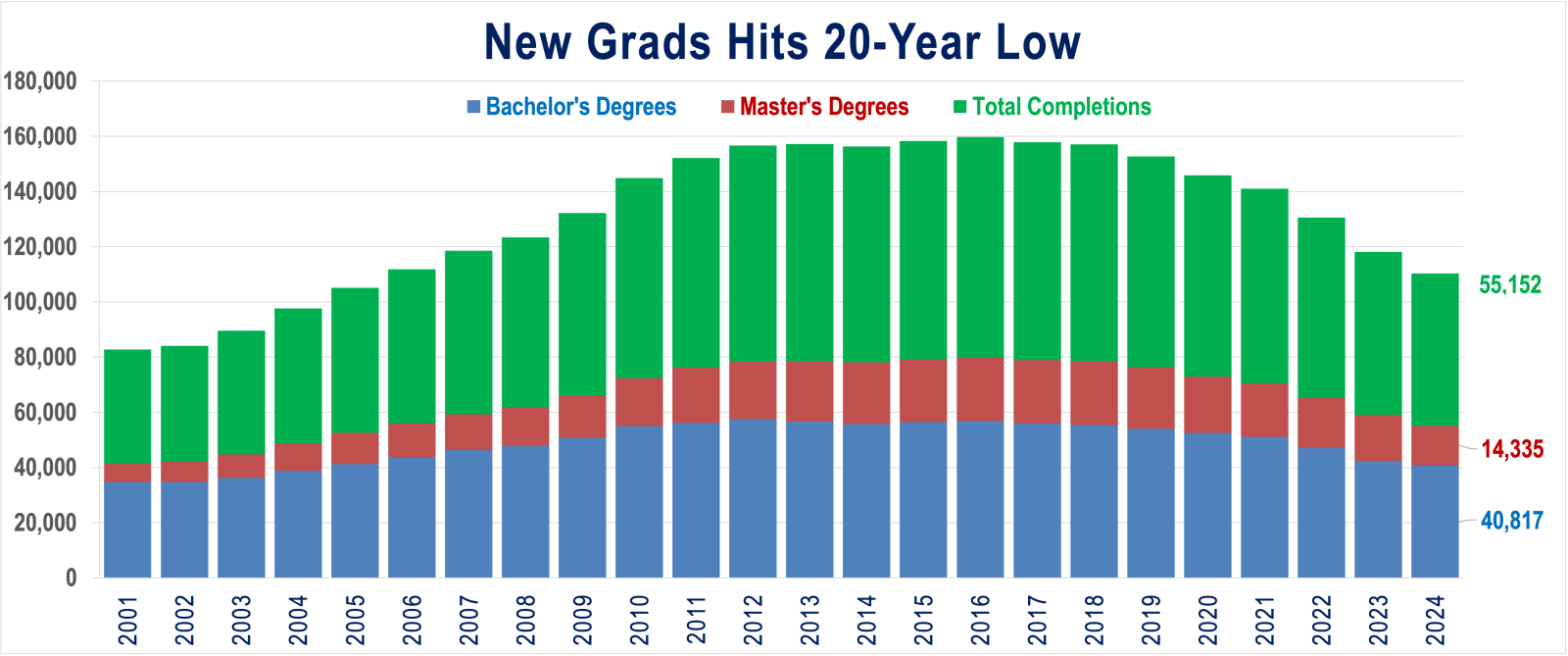

The pipeline of U.S. accounting graduates has fallen to its lowest level in roughly 20 years, capping a decade-long slide of about 17% in completions even as demand from public accounting firms remains strong, according to the latest release of a much-watched study.

In this report:

The tension between shrinking supply and resilient demand

Bachelor’s degrees: From mid-2010s peak to current lows

Master’s degrees: A steep 15% drop in the last academic year

CPA Exam Trends: The new baseline

Potential Turning Point? New growth in enrollments

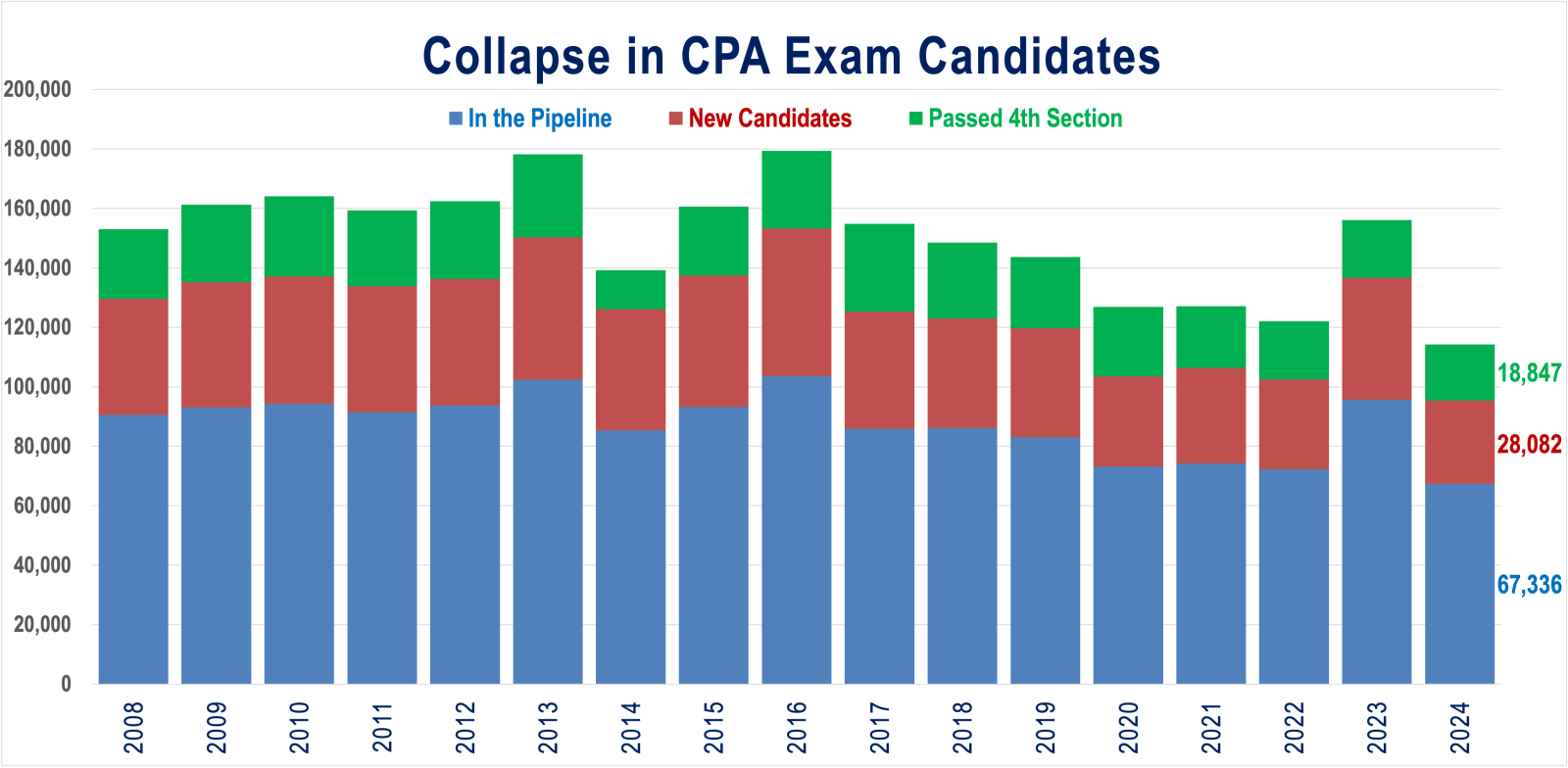

In addition, the CPA exam pipeline has thinned over the past 10 years, with new candidates and successful passers both down from earlier peaks, though 2023 saw a temporary surge tied to the rollout of the CPA Evolution exam.

New research is also revealing that while auditors remain in steady supply, the tax profession is facing a severe and deepening talent drought.

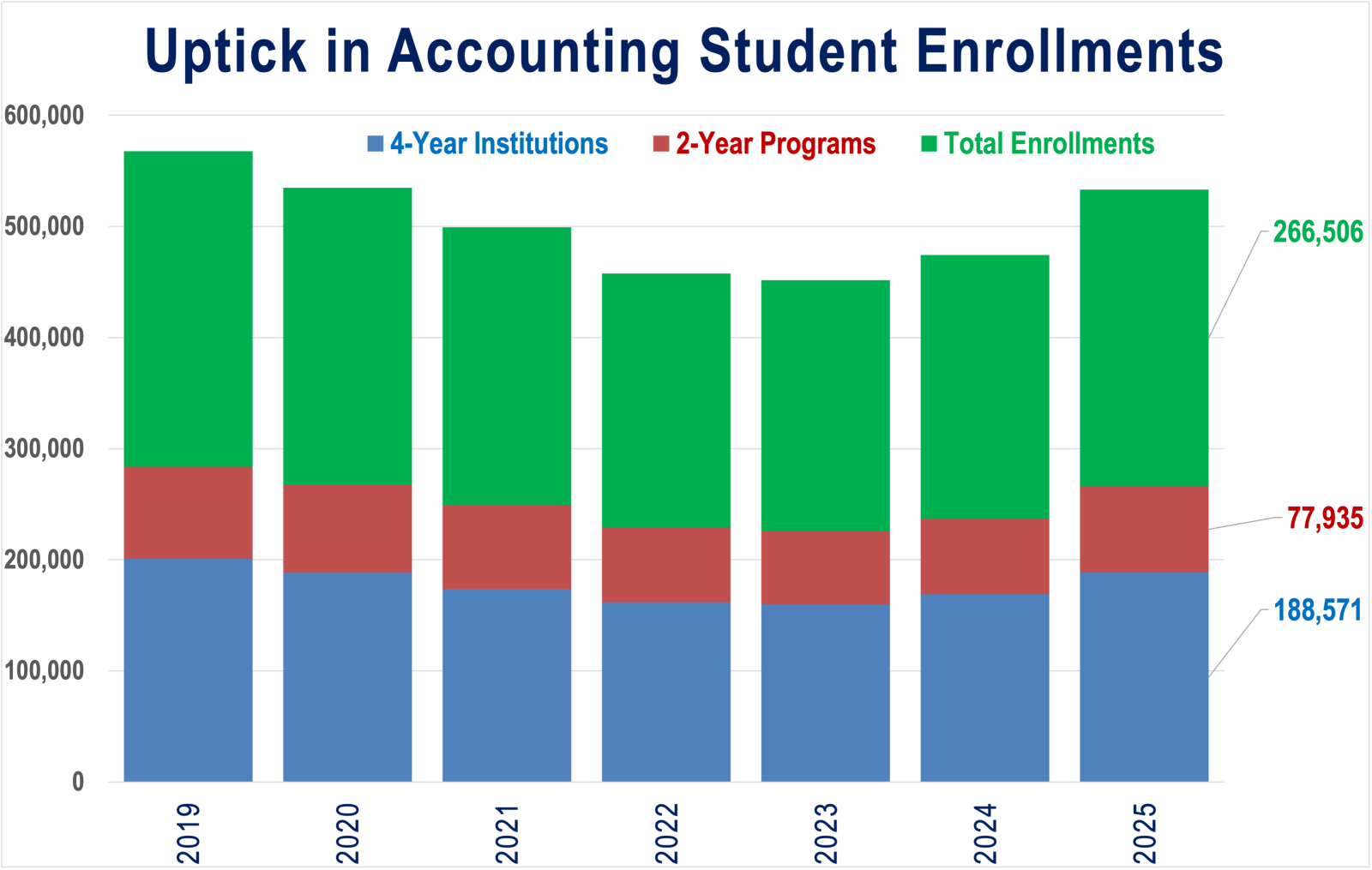

And yet, new enrollment data point to a possible turning point, with accounting program enrollments up double digits in 2024–25 and firms signaling plans to keep hiring as many or more graduates in the year ahead.

Bachelor’s and master’s accounting degrees combined fell to 55,152 in the 2023–24 academic year, down 6.6% from the prior year and roughly 24,000 below the mid-2010s peak, according to the AICPA’s annual report on the supply and demand of new-accountant labor.

Over the last 10 academic years, total accounting completions slid from about 79,000 in 2014–15 to just over 55,000 in 2023–24, a drop of roughly 30% that outpaced the overall 13% decline in U.S. undergraduate enrollment reported over a similar period.

“While we continue to see a contraction in the supply of accounting graduates, it’s encouraging the rate of decline has slowed year over year,” said Jan Taylor, the AICPA’s academic-in-residence. “That suggests some of the initiatives the profession has pursued in recent years are starting to have an effect.”

The numbers tell a story of tension between shrinking supply and persistent demand: college completions down roughly 30% from their 2014–15 peak, new CPA candidates well below prior highs, and firms still eager to hire more graduates than the system is producing.

Whether the recent uptick in enrollments marks the beginning of an “accounting comeback,” as the New York state society CPA Journal, will depend on how quickly the profession can turn policy changes, scholarship dollars and culture shifts into sustained growth in degrees and CPA licenses.

Bachelor’s degrees in accounting have borne much of the damage, slipping from about 56,400 at their mid-2010s high to 40,817 in 2023–24. Over the most recent three years, bachelor’s completions dropped 10.3% from 2021–22 to 2022–23 and an additional 3.3% in provisional 2023–24 figures, signaling the decline may be moderating but has not reversed.

Master’s degrees in accounting and taxation have fallen as well, sliding from nearly 23,000 at their 2015–16 peak to 14,335 in 2023–24, including a 7.6% decline from 2021–22 to 2022–23 and a steeper 15% drop in 2023–24.

The data show how sharply the pipeline has contracted since the mid-2010s.

In 2014–15, U.S. institutions reported 56,397 bachelor’s and 22,777 master’s accounting graduates, totaling 79,174. By 2018–19, totals had drifted down to 76,314, with 53,991 bachelor’s and 22,323 master’s degrees, before sliding further to 70,531 in 2020–21.

The fall accelerated over the last four years. In 2021–22, there were 65,292 total completions, including 47,058 bachelor’s and 18,234 master’s degrees. The following year, 2022–23, totals dropped to 59,050, reflecting 42,194 bachelor’s and 16,856 master’s graduates. Provisional 2023–24 data show just 40,817 bachelor’s and 14,335 master’s degrees, for a combined 55,152 — the lowest in two decades.

The new stats reveal a thinning candidate pool despite periodic surges around major exam changes.

New CPA candidates peaked at 49,597 in 2016 before dropping into the low-30,000 range in the early 2020s and then rebounding sharply to 42,626 in 2023 as candidates rushed to sit for the exam ahead of the January 2024 CPA Evolution rollout.

In 2024, new candidates fell back to 28,082, though the report notes that candidate behavior typically normalizes after a change year and that early 2025 data show another uptick.

The number of unique CPA candidates — those in the system in a given year — follows a similar trend, climbing above 100,000 in 2013 and 2016 before declining to 67,336 by 2024.

Candidates finishing the exam have also declined: 26,911 completed their fourth section in 2010, compared with 18,847 in 2024, a drop that may be affected by a change in how the National Association of State Boards of Accountancy reports scores.

Surveyed firms report hiring 11,985 new graduates in 2024, about 75% of whom held accounting degrees. Three in four firms that hired in 2024 say they expect to bring on the same number or more accounting graduates in 2025.

Outside observers say that the imbalance between supply and demand is putting pressure on both employers and clients.

“Employers worldwide report an acute shortage of qualified accounting professionals,” the Association to Advance Collegiate Schools of Business wrote in a July commentary, noting that 83% of finance leaders in a 2024 CFO survey said they could not find enough accounting talent.

For the first time in years, several data points suggest the bottom of the accounting pipeline may be in sight.

While degree completions continue to fall, National Student Clearinghouse Research Center data show two consecutive semesters of roughly 12% year-over-year growth in accounting enrollments during the 2024–25 academic year.

The National Pipeline Advisory Group’s final report, released in August 2024, called for coordinated action by firms, state societies, regulators and universities to reshape the profession’s value proposition, modernize the academic experience and make licensure more accessible. “Now more than ever, we need a cohesive, unified, data-driven, and flexible approach to address accounting’s talent shortage,” the group wrote.

The AICPA report dedicates a full section to pipeline initiatives, underscoring the central role the issue has come to play for the profession’s largest organizations. The AICPA cites the launch of the National Pipeline Advisory Group, faculty boot camps to modernize introductory accounting courses, and an industry-wide “pipeline pledge” that asks individual CPAs to speak with students and support candidates as examples of concrete responses. The report also cites the Center for Audit Quality’s public-awareness campaign, which uses social media and classroom partnerships to counter “outdated misperceptions” about accounting work.

Regulators and standard-setters have also moved beyond licensing barriers. Many state boards have temporarily extended CPA exam credit windows from 18 to 30 months, adopted pandemic-era credit relief for candidates whose scores expired, and supported congressional changes allowing Section 529 education savings to cover CPA exam fees and review courses. At the same time, the AICPA and state societies are advocating for federal recognition of accounting programs as STEM fields and collaborating with colleges to reclassify curricula to incorporate more technology content.

Experts and state societies attribute a mix of factors, including pay, workload, education requirements, and perception issues, to the long-running decline in accounting majors.

The New York State Society of CPAs warns that “without intervention, the shortage of CPAs will continue to worsen as baby boomers retire and fewer young professionals enter the field.”

Other observers view the profession as losing a “war for talent” to tech companies, startups, and alternative finance roles.

Outsourcing firm RedHammer argues that years of incremental declines in accounting degrees — typically 1% to 3% annually since 2015–16 — have quietly added up to a “crisis” just as regulatory and ESG demands require more, not fewer, skilled accountants.

The AICPA stops short of declaring a turning point but notes that rising enrollments and early 2025 CPA exam activity could foreshadow future gains in graduates and licensees if the profession sustains recent momentum.

The AICPA cautions that broader demographic trends — including an expected decline in high-school graduates over the next decade — mean that even a stabilized or slightly growing accounting pipeline will require continuous outreach and innovation.

The National Pipeline Advisory Group’s final report urges firms and educators to view the next few years as a window of opportunity to “rebuild the pipeline for accounting talent” before shortages cause more visible damage to financial reporting and corporate governance.

According to a report published in the July/August 2025 issue of The CPA Journal, the narrative of a broad-based accounting crisis masks a sharp divergence in how new graduates choose their career paths. Megan Grady and Jon Durrant, professors at California State University Fullerton, analyzed employment data and found that the decline in new hires is almost exclusively concentrated in tax and advisory services, while audit hiring has remained resilient.

The study highlights a troubling trend for public accounting firms. Between 2014 and 2020, the number of graduates hired into audit positions actually increased by 7 percent. In stark contrast, hiring for tax roles plummeted by 34 percent during the same period. The drop was even more precipitous for “other” specialized fields, such as financial forensics and business valuation, which saw a 77 percent collapse in new entrants.

This disparity persists despite clear financial incentives to choose tax. The authors noted that tax professionals typically earn higher starting salaries than their audit counterparts, a gap that has widened significantly in recent years. By 2025, the salary difference had grown to approximately $7,500 to $8,000 in favor of tax associates.

Grady and Durrant suggest that money alone is not the primary driver of student decisions. Instead, the disparity appears rooted in the perceived long-term value of the experience. Students often view auditing as a versatile stepping stone to executive leadership roles, such as chief financial officer or general corporate management. Conversely, tax is frequently perceived as a hyper-specialized field with limited “exit opportunities” outside of public accounting firms.

The report also identified a significant shift in where graduates are choosing to start their careers. Historically, the standard career trajectory involved starting at a public accounting firm to gain licensure and experience before moving to private industry. That pipeline is eroding.

In 2014, nearly 78 percent of graduates with bachelor’s degrees in accounting began their careers in public accounting. By 2020, that figure had dropped to roughly 53 percent. The data suggests that a growing number of graduates are bypassing the grueling hours associated with public accounting firms to accept positions directly in the private sector.

The researchers argue that broad initiatives to address the pipeline, such as general salary increases or scholarships, may be inefficient if they do not specifically address the image problem facing the tax profession. They concluded that firms and educators must do a better job of communicating the career flexibility and remote work potential inherent in tax roles to combat the view that the specialization is a career dead end.

Industry compensation data for 2025 confirms the significant wage gap highlighted in recent academic research, showing that tax professionals continue to command a substantial premium over their audit counterparts even at the entry level.

According to the Robert Half 2025 Salary Guide, a standard benchmark for the accounting profession, the midpoint starting salary for a Tax Services Associate in public accounting was $70,250, compared to $62,750 for an Audit/Assurance Services Associate. This $7,500 differential directly corroborates the findings published in The CPA Journal, which estimated the gap at approximately $7,500 to $8,000.

The data indicate that this premium expands rapidly as accountants gain experience. For senior associates—typically those with two to three years of experience—the gap widens further. Recent projections for 2026, released by Robert Half in late 2025, show the midpoint salary for Senior Tax Associates hitting $95,250, while Senior Audit Associates trail at $86,250—a difference of $9,000.

Interestingly, the newest 2026 salary projections suggest that audit salaries are beginning to accelerate in an attempt to catch up. The projected entry-level gap for 2026 has narrowed slightly to roughly $6,000 ($71,000 for tax vs. $65,000 for audit), driven by a sharp 3.6% year-over-year increase in starting audit pay.

Still, the financial incentive has not yet been enough to reverse the pipeline trend, with students continuing to flock toward audit roles for their perceived career mobility.