The 2026 filing season will have an increasingly uneven pricing structure.

By CPA Trendlines

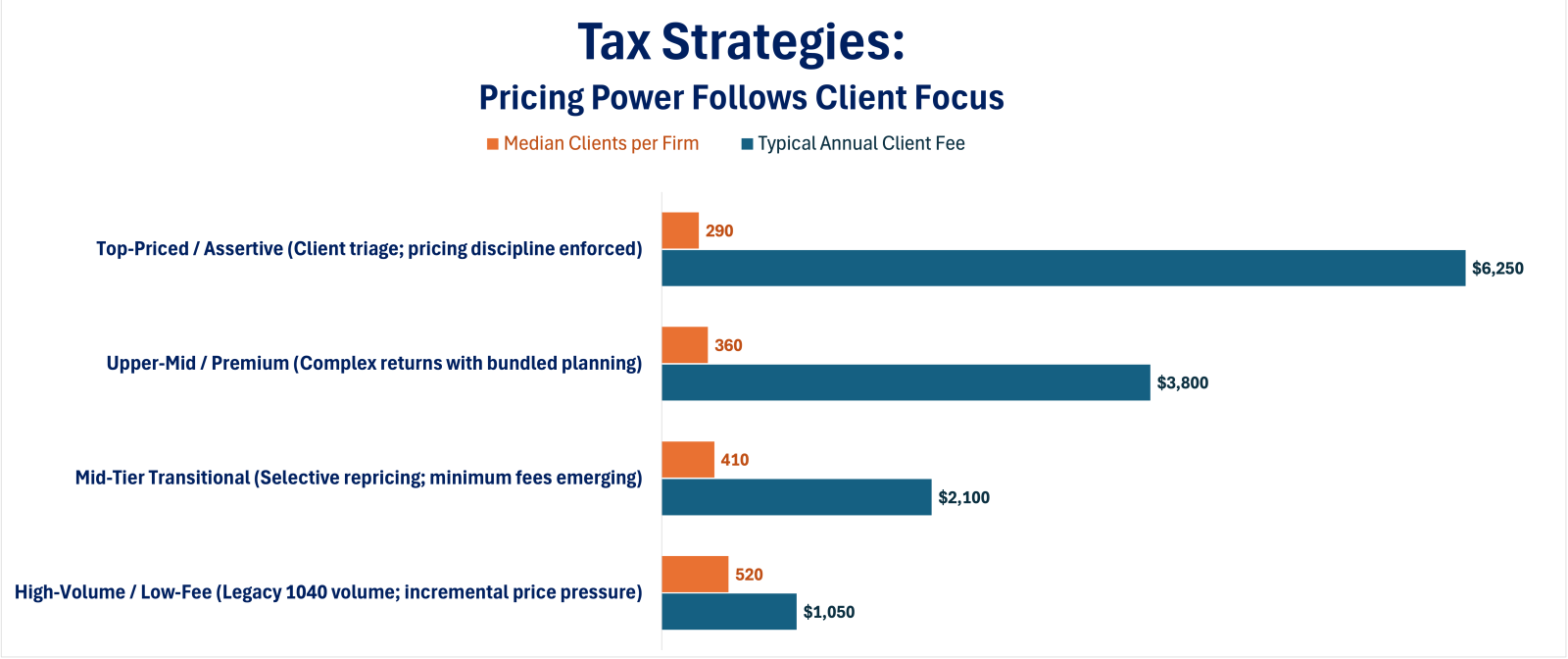

Top-priced tax practices are driving typical annual client fees toward $3,000 and above this year, according to the CPA Trendlines Busy Season Barometer survey, underscoring how rising costs are pressuring most firms even as a smaller group gains pricing power through scale, selectivity, and tighter engagement control.

JOIN the Busy Season Barometer survey. Get the results. | MORE TAX and PRICING

One CPA respondent put it bluntly: “We are raising rates again this year. Some clients will leave. That’s fine. We can’t keep doing $400 returns when staff wages keep rising.” Another practitioner described a more selective approach: “We didn’t raise everyone equally. We raised prices where the work was painful and left simpler clients mostly alone.”

TO READ THE FULL ARTICLE