Why is the busy season better for CAS accountants?

By CPA Trendlines Research

With busy season 2026, accountants specializing in client accounting services are reaping the benefits of a year’s worth of hard work, in a smoother path to April 15, more compliant clients, and higher fees, according to the CPA Trendlines Busy Season Barometer.

JOIN THE BUSY SEASON SURVEY. GET THE RESULTS

MORE BUSY SEASON BAROMETER | MORE CAS | MORE OUTLOOK 2026

The Busy Season Barometer marks the 2026 tax season as the breakthrough moment when CAS crosses from merely an aspirational experiment to a routine part of the service mix for small and midsize firms.

While tax law changes, IRS delays, and client delays absorb much of the attention in Busy Season 2026, the CAS movement is reshaping how practitioners plan for the year. CAS is expanding through process discipline, structured engagements, deeper staff development, and more consistent planning conversations with clients. Unlike previous years, when CAS growth was merely an aspiration, this season’s Barometer reveals a more grounded shift, borne out by a few key readings.

Across the pooled Barometer waves from September through January, CAS-heavy firms report far higher “typical client” economics than firms where CAS is not the top revenue line. The median typical annual fee per “typical client” is $10,000 for CAS-heavy firms, versus $1,000 for non-CAS-heavy firms. At the same time, CAS-heavy firms report a smaller client load with a median of 205 total clients handled, compared with 462 for non-CAS-heavy firms.

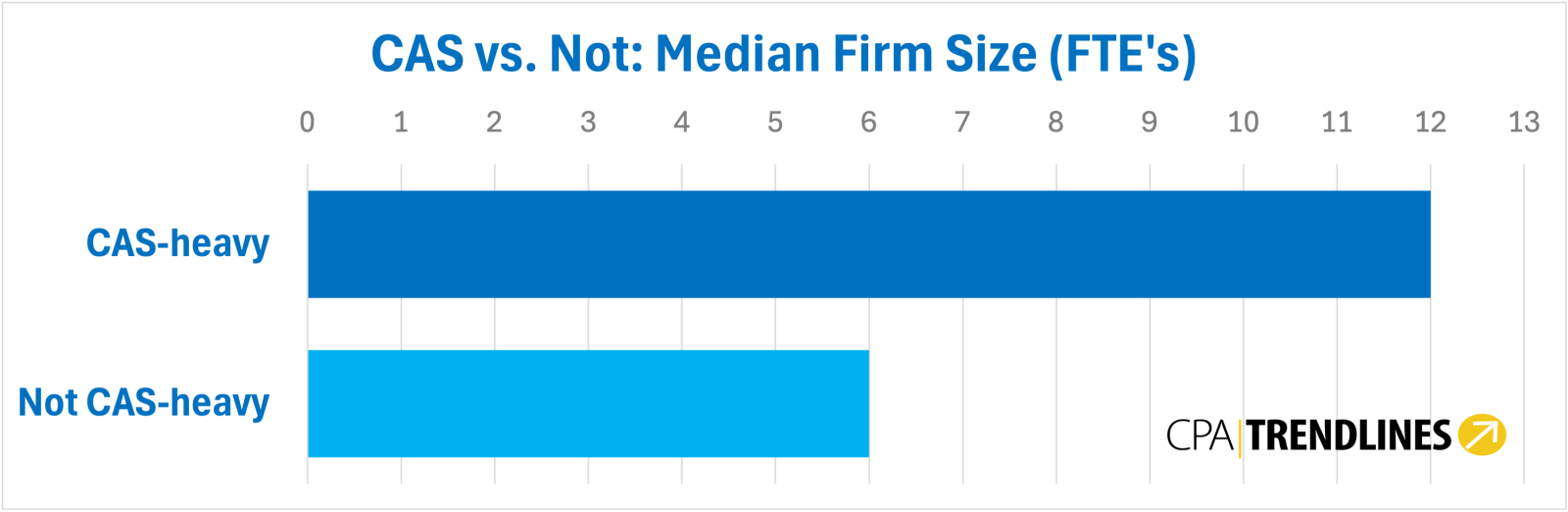

CAS-heavy firms also skew larger in staffing. The median firm-size midpoint is 12 people for CAS-heavy firms, versus 6 for non-CAS-heavy firms.

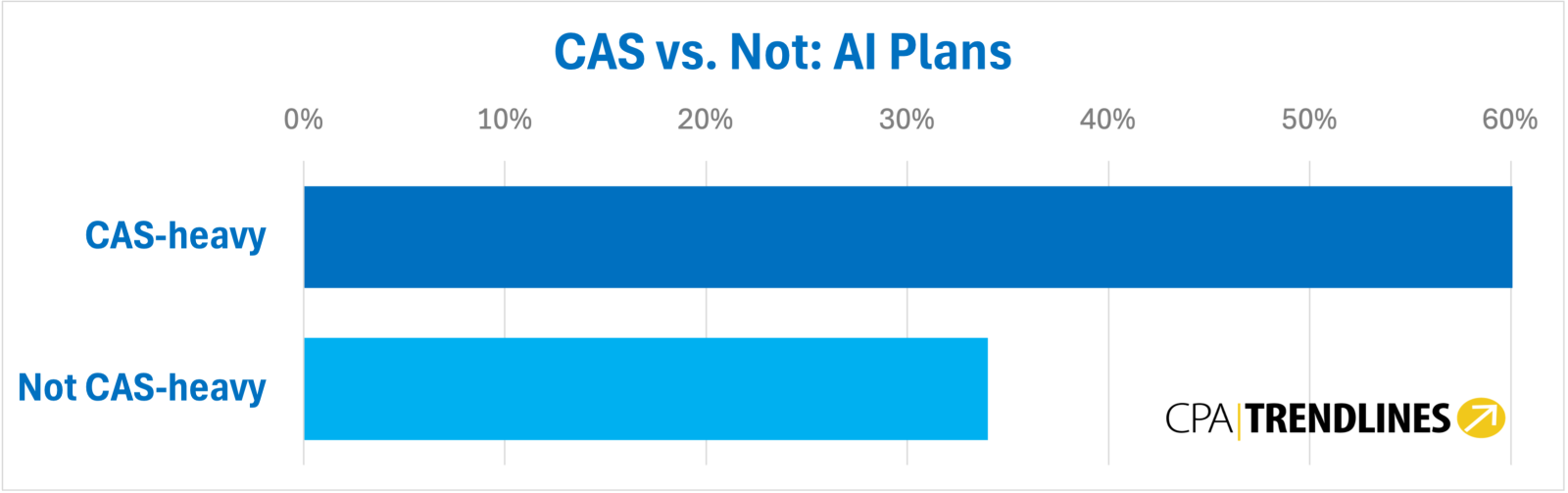

On technology posture and near-term sentiment, CAS-heavy firms are more likely to be considering AI-related tech options: 66.7% versus 34.0%. They are also more likely to say AI’s greatest potential value is in CAS/advisory work, 50.0% versus 26.6%. And CAS-heavy firms are more pessimistic about the business outlook for their clients: 58.3% say client conditions will worsen, compared with 34.5% among not-CAS-heavy firms.

Hitendra Patil, True Advisor®

In the newly published “True Advisor® – The Definitive Success Guide for Client Advisory Services,” CAS guru Hitendra Patil says the shift described in the Barometer is already well underway.

In a benchmark CAS study, Patil says, 73% of CAS-minded. firms have been delivering CAS for more than five years—evidence that advisory is moving from pilots to embedded practice areas.

The same dataset, based on CPA Trendlines research, underscores why firms are investing. The average annual revenue per CAS client is 2.6 times that of non-CAS clients.

The survey also clarifies what clients are paying for. The most cited expectations were more frequent contact, cited by 76.4% of accountants, and decision-making advice, at 60.6%, followed by tax planning baked into the relationship, 59.8%, and proactive or deeper advice, 55.1%.

SOPs for CAS

CAS-based firms are adding planning services, refining workflows and allocating more internal resources toward advisory capabilities. The change is not sweeping or disruptive. It is methodical. Firms are building CAS capacity in the same way they build tax-season readiness—through repeatable process improvements and incremental steps that shift more value into higher-yield segments.

Practitioners describe the trend in practical terms rather than abstract strategy. Many cite the need for standard operating procedures around CAS work. Others highlight increasing client appetite for proactive planning.Several mention the importance of training younger CPAs to provide advisory insights rather than only compliance delivery. These themes appear consistently across the verbatims, reflecting a profession that is preparing to meet clients’ advisory expectations even as it manages the traditional pressures of tax season.

This steady expansion of CAS aligns closely with firms’ expectations for their financial metrics. Practitioners foresee stronger economics at both the client and engagement levels. More than two-thirds expect revenue per client to rise this year, and nearly as many anticipate increases in profit per client.

CAS accountants worry for business clients

The Barometer also reveals a more cautious outlook for clients themselves. Roughly half of respondents believe conditions for business owners will worsen in the coming year, and an equal number are concerned about the broader economy.The tension between rising firm-level economics alongside apprehensive client conditions creates a distinctive advisory opportunity. As clients brace for economic uncertainty, firms increasingly see CAS as the channel through which they can provide guidance, stability and planning support.

CAS-driven firms understand that clients will reward a cadence of structured touches and actionable insight, which is precisely the process and year-round planning routines firms describe in this season’s Barometer survey.

Yet Patil notes that CAS “still does not feel fully mature” because many firms’ internal readiness—“people, processes, pricing, and positioning”—lags the ambition.

Trainin and pricing

In the same study, the top obstacles were hiring or training CAS staff, cited by 29.5% of firms, and pricing CAS services, at 28.7%. Only 9.6% said they were “delighted” with their pricing strategies. The combination of both pricing and capacity constraints helps explain the push toward standard operating procedures, documentation, and repeatable packaging as firms head into 2026.

CAS development is also bound tightly to process discipline. Many Barometer respondents describe a renewed emphasis on aligning teams on workflow expectations, improving documentation, standardizing communication protocols, and clarifying roles during peak periods.

Comments such as “trying to get everyone on the same page with respect to process,” “implementing improved processes,” and “training to spread the work out.”

Staff development

Staff development sits at the center of this trend. CAS requires judgment, communication and financial fluency, and firms know these capabilities must be cultivated. Firms are using internal structure to stabilize workloads and support higher-value engagements, as heard in comments, such as:

- “trying to get everyone on the same page with respect to process,”

- “implementing improved processes,” and

- “training to spread the work out.”

Several practitioners cite training younger CPAs as a priority, emphasizing the need to prepare them to advise rather than simply prepare. Others note that staff retention and capability-building are intertwined. Advisory services demand continuity; turnover threatens not just capacity but also the relational equity that CAS depends on.

Client management

Client management plays a pivotal role as well. CAS is most effective when clients understand their responsibilities and participate proactively. Practitioners spoke of encouraging clients more assertively, stratifying them into extension groups, scheduling earlier appointments and engaging them in planning conversations throughout the year. These actions illustrate the operational side of advisory work because CAS is not an abstract value proposition but a rhythm of structured touches, steady insight and disciplined communication.

Taken together, these dynamics show that CAS is moving beyond aspiration and into execution.

Today, advisory work stands not at the periphery but at the center of how practitioners think about growth, differentiation and the future of the practice.