M&A BONUS: A 22-point due diligence kit.

By Domenick J. Esposito

8 Steps to Great

Much has been written and discussed regarding succession planning at CPA firms driven by the vast number of founders, leaders and rainmakers who are retiring at a record pace.

MORE by Domenick J. Esposito

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Key takeaways in this post:

- Mid-market sustainable brands generally combine practices as opposed to acquiring or buying practices.

- Spend time to make sure it feels right.

- The easier part is getting the contract signed; the harder part is the integration of the two practices and to make sure 1 + 1 at least = 3.

It is often cited that another baby boomer has turned 65 every eight seconds since 2011. This statistic supports the upward trend in mergers that has been evident in the public accounting profession and the growth of consolidators that make up a healthy number of the Top 100 firms.

In fact, it is safe to conclude that consolidation of these founder firms, rather than significant organic growth, has created many of the mid-market sustainable brands. At this pace, a very large percentage of the approximately 14,000 multi-partner CPA firms (about 90 percent of which are under $10 million in revenue) may be looking at an upward merger in the next few years.

Based on my own personal interactions, more than one out of every two CPA firms of any significant size is either discussing a merger combination, acquisition or sale or is planning to do so in the near future. In many cases, this is occurring because CEOs, managing partners, and other senior partners are not confident in the leadership talents and financial wherewithal of younger partners. In many other cases, it is occurring because these firms are unable to attract and retain talent. And in still other cases, these firms are finding that they are not able to hold onto their growing clients as these clients seek private and public capital. In other words, these CPA firms lack “market permission.”

The bottom line: Many CPA firms are primarily small businesses that are quickly running out of time for succession planning, and it is now time to shift gears into “crisis planning,” bid farewell to traditional internal succession planning and create an expedited action plan.

“Don’t do a merger if 1 + 1 doesn’t at least = 3.”

– Dom Esposito

The Growing Urge to Merge

Here we are in 2016 and GDP growth continues to hover around 3 percent per year. Despite executing on your strategic plan and moving toward a mid-market sustainable brand, your firm’s organic growth rate for the past few years has probably been well below 7 percent or 8 percent (a decent growth rate to create incremental partner compensation and to fund increasing staff payroll, rent and other costs). Without a credible advisory or consulting practice, your organic growth is more likely about 3 percent. How do you propel growth so that you can make investments and improve average partner earnings when you are only growing at about 3 percent? It is very difficult, if not impossible to do.

So it’s obvious that growing a CPA firm in this environment inevitably brings CEOs, managing partners and other senior partners to the crossroads of a merger combination. A word of caution, however: I implore you – no matter how tempting it may be – don’t do a merger combination if 1 + 1 doesn’t equal at least equal 3.

While merely good firms generally acquire practices, mid-market sustainable brands merge or combine practices. To be clear, an acquisition is buying a client list from retiring partners. This happens when a small CPA firm has capacity to handle more clients but has not been able to grow organically. Thus, acquiring a practice from retiring partners makes a lot of business sense.

Acquisitions also occur if a firm is seeking to buy advisory or consulting skills and credentials. There are many boutique consulting firms that want to bolt onto a mid-market sustainable brand to accelerate their growth and monetize, at least in part, the asset they created by getting acquired.

On the other hand, a merger combination is as much the addition of accounting and tax talent as it is the addition of clients. A merger combination makes sense when the combined firm becomes stronger in talent bench strength and revenue base.

Let’s focus on accounting/tax merger combinations as opposed to client list/consulting firm acquisitions. One of the first steps is to understand valuations.

CPA Firm Valuations

The two typical valuation components in most CPA firm merger combinations are capital and goodwill.

Capital is straightforward: It is the firm’s accrual-based capital adjusted for the fair market value of fixed assets, work in process and receivable reserves. It is paid as cash or a note (in some cases the note bears interest), over a relatively short term.

The second component, goodwill, is where a lot of judgment is applied. But suffice it to say that goodwill values have trended downward post-the-financial crisis of 2007. Goodwill is almost always expressed as a multiple of revenues; the generally accepted value of goodwill in the “old” days (circa 2001 to 2007) used to be one times revenue.

The CPA firm valuations we are addressing in this chapter are based on revenues derived from traditional (accounting/audit, tax and, to a much lesser extent, advisory or consulting) revenue. If your CPA firm has significant revenue in non-traditional services such as wealth management, insurance products, pension administration, etc., then these should be valued separately. Valuations also need to be adjusted if your firm has a significant advisory or consulting practice.

The bad news is that current CPA firm valuations now average about 80 percent of revenue plus accrual-based capital. For firms with over $20 million in revenue, goodwill value is below 80 percent of revenue. Clearly, one times revenue is gone. Some of the Next Six mid-market sustainable brands have a valuation cap (3.5 times average partner compensation over the last two or three years).

So, once we get our heads around the new lower value for CPA firms, how do the partners of the merged-in firm allocate the firm valuation among themselves?

The “multiple of compensation” method, the gold standard for most CPA firms, uses relative partner compensation to allocate the goodwill value of the firm. Typically, a firm will use an average of three to five years of a partner’s total compensation (not including fringes) as the starting point. The average compensation is then multiplied by a factor to arrive at the partner’s share of the firm’s goodwill number.

In most firms, the goodwill gets paid out upon retirement in the form of deferred compensation (an ordinary deduction for the firm and ordinary income to the partner). Terms range from five to ten years, with no interest (which makes the true valuation much less than 80 percent). Seven- to 10-year terms are more common than five.

Some firms provide an option to the younger partners (i.e., offering the retirement benefit or deferred compensation plan offered to existing partners).

There are many other retirement considerations, including vesting schedules for age and years of service, death and disability provisions, mandatory retirement ages, post-retirement employment and caps (generally 8 percent to 10 percent) to protect the CPA firm.

Approaching the Market

If mergers or combinations are part of your strategic plan as you move toward a mid-market sustainable brand, I strongly suggest that you retain a professional consultant who has been there and done that. Under the formula, the fee would be based on the following and would be pro-rata (one-third upon closing, one-third 60 days from closing and one-third 90 days from closing):

Fees generally are structured as follows:

- A small upfront retainer, plus small monthly progress bills and reimbursement for out-of-pocket costs, for the time spent for:

- approaching the market

- identifying viable merger candidates

- making sure it feels right

- assisting with post-closing integration

- a significant fee for negotiating and closing the transaction.

These fees are on a contingent basis, generally mirroring the “Lehman formula,” plus any pre-approved out-of-pocket expenses as incurred.

Cumulative Fee Structure Based on Firm’s Annual Revenue

- 5 percent of the first $1,000,000 of firm revenue, plus

- 4 percent of the second $1,000,000 of firm revenue, plus

- 3 percent of the third $1,000,000 of firm revenue, plus

- 2 percent of the fourth $1,000,000 of firm revenue, plus

- 1 percent of any amount in excess of $4,000,000 of firm revenue

Identifying Viable Candidates

When you decide that mergers or combinations are the right path for you to supplement your organic growth and to help you in your quest to become a mid-market sustainable brand, the very next decision is to define what you should be and should not be looking at. Some of your targeted firms will be obvious to you because of your local geography. I refer to these as local “tuck-ins.” Other targets are mostly more strategic and require a lot of patience and time to bring to fruition. Let me explain with a simple illustration of what is commonly referred to as local “tuck-ins.”

Local “tuck-ins” – Let’s say you are a firm with a single office in Manhattan and you decide that you must start growing through merger. You look east and north and conclude that geographic expansion into Long Island and White Plains are easy local “tuck-ins” that can be easily digested and integrated.

Tuck-ins are easy to do, as Manhattan will continue to be your main office. Integration is easy, as partners will work in all three locations. In fact, those servicing clients in Long Island and White Plains may ask to have their main office changed to one of the suburban locations. The same applies to staff. My experience has been that three contiguous offices generally look at their staff as one talent pool, and staff go to the clients they are assigned to – regardless of geography. But once you move beyond the low-hanging fruit of “tuck-ins,” identifying viable candidates becomes a much more deliberate process.

Working the “Circuit”

When it comes to mergers, like everything else, you need a plan. Let’s look at it through two prisms:

First, there are geographic mergers. If you desire to become a mid-market sustainable brand, you will need to be in 11 U.S. financial centers. You will need to accomplish this through a combination of internal transfers, lateral hires and strategic mergers.

I don’t recommend entering into a new geographic market with a local firm that doesn’t do at least $12 million to $15 million in revenues. Anything less will never get your firm to a recognized brand in that geography.

Second, there are strategic add-ons that fill a hole in your toolbox of services, skills and credentials.

Once you have determined the geographic markets and the strategic add-ons that are required, you have to make contact and begin to develop a relationship with these firms. This is a serious commitment of time and needs to be undertaken by the CEO, managing partners and other senior partners.

So how do you make contact? You do it through a reach-out program consisting of:

- picking up the phone and introducing yourself, why you are calling and a request to meet to discuss exploring the merits of a merger

- attending state society managing partner meetings

- attending the semi-annual AICPA Major Firms meetings

Making Sure It Feels Right

Before you decide whether to proceed to due diligence or not, you need to make sure the target opportunity feels right. How do you do that? You do it by you and several of your senior partners meeting and getting to know the senior partners at the target firm. You talk about respective histories, cultures, “sacred cows” or must-haves in a possible deal and the potential upside and synergies that might be derived by the merger.

This has to be the magic sauce that will make a possible transaction very exciting. I look at it as the courtship or romance period. It usually takes several meetings over a couple of months, with very active participation from both sides.

Once the working groups get comfortable with each other, the next step is to create broader buy-in. A meet-and-greet with all the partners from both firms is very advisable. Valuable input can be provided to the senior partners. You also need to establish several committees that must plan for integration in all areas of the practice:

- Human resources and continuing education

- Information technology

- Marketing and sales

- Finance and accounting

- Partner matters

Due Diligence

Look at due diligence from three perspectives:

- culture fit

- commitment to technical excellence and quality client service

- kicking the financial tires

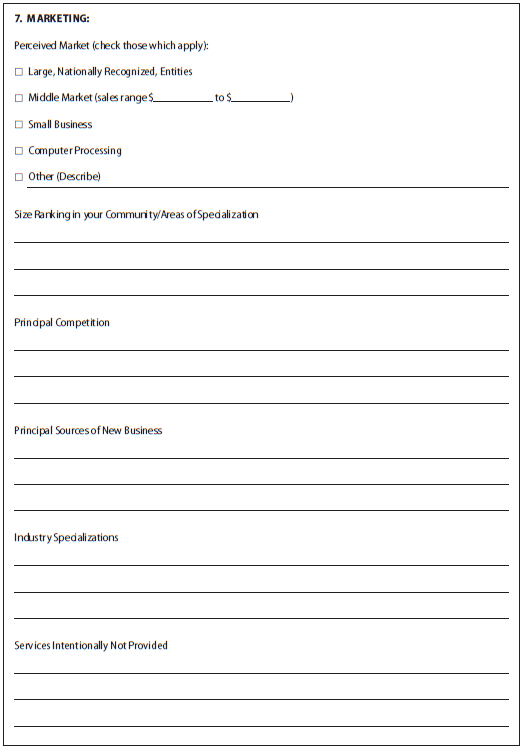

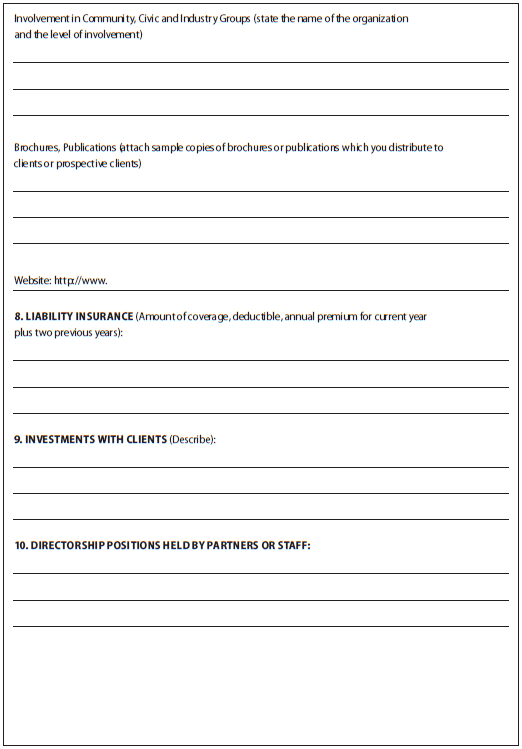

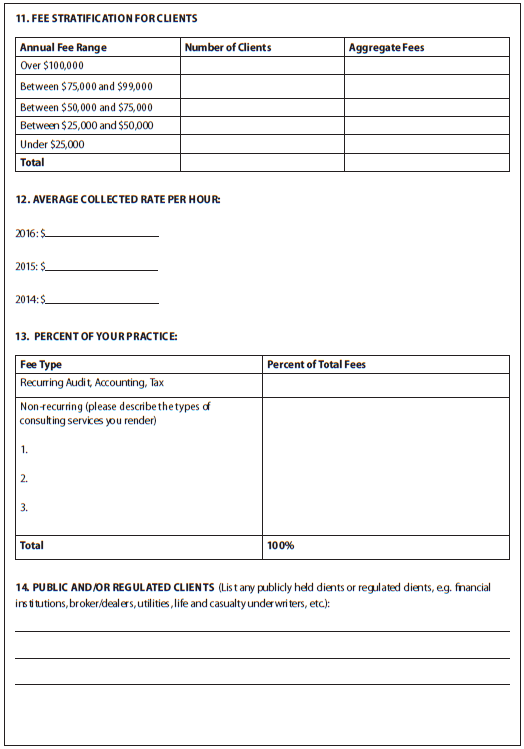

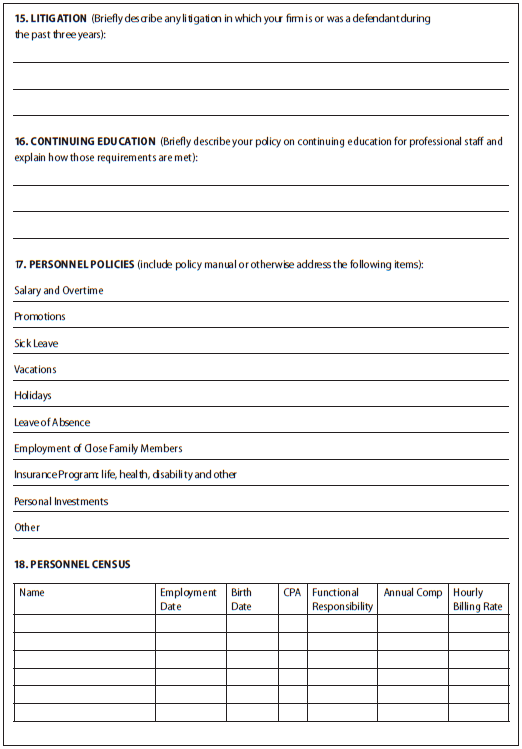

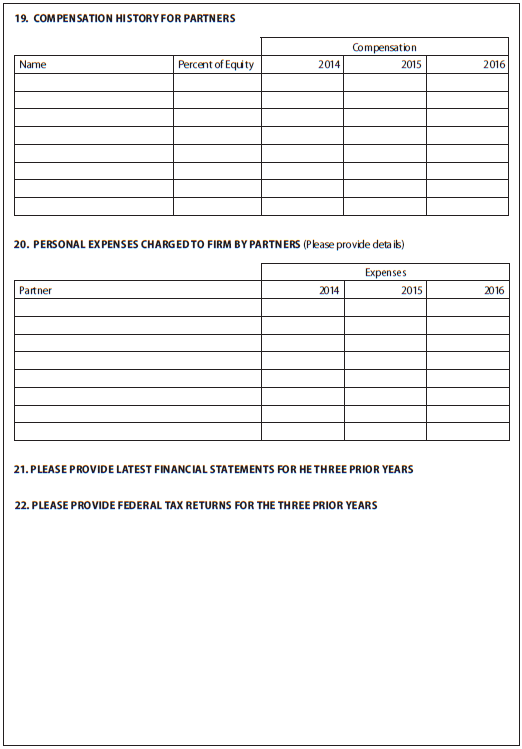

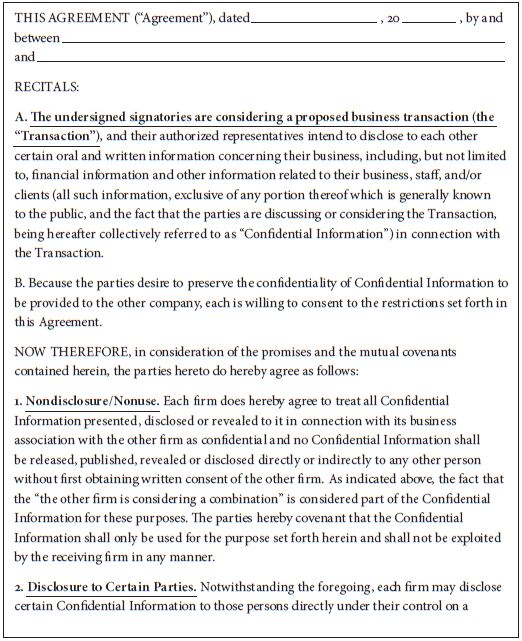

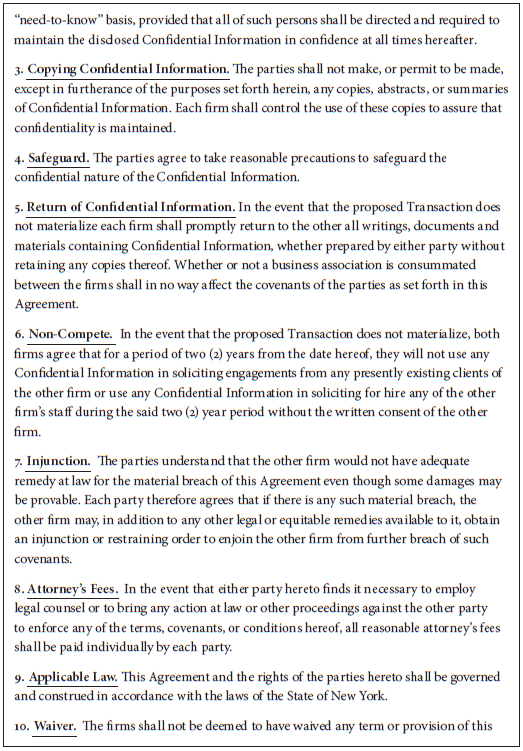

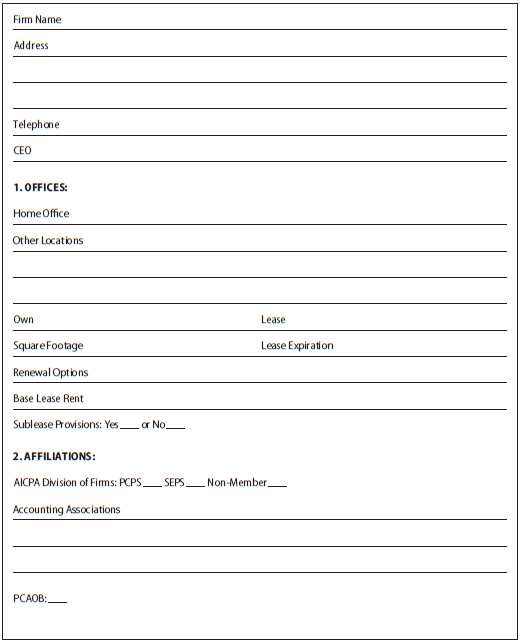

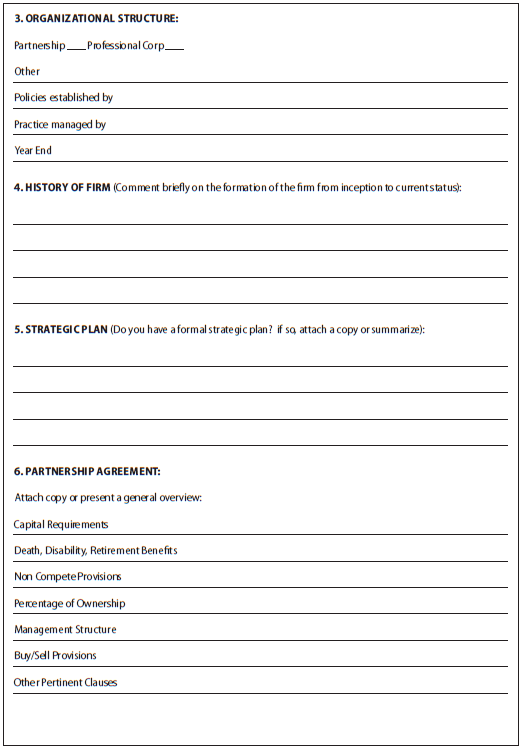

When it comes to the kicking of the financial tires, I recommend that you use a CPA firm combination packet, and confidentiality and non-compete agreement similar to those presented below.

Negotiating and Closing the Transaction

At this point you should have the framework of a transaction, and any potential deal-breakers should have been addressed and successfully dealt with. Now, with the assistance of attorneys, it is time to draft a letter of intent that needs to be signed by the CEO of the continuing firm and all the partners of the target. That usually is followed by a detailed combination agreement that will need to be executed for the deal to be effective.

Integration

I have always said that the easier part of a merger combination is getting the contract signed; the harder part is the integration of the two practices and to make 1 + 1 = at least 3. Integration needs to be driven by the “making sure it feels right” committees that were established to develop integration plans for:

- Human resources and continuing education

- Information technology

- Marketing and sales

- Finance and accounting

- Partner matters

Integration of these practice areas will take about two years. While there will be bumps in the road and some mistakes will be made, it is important that these be kept to a minimum during these tender years of a merger combination.

Example 1: CPA Firm Combination Packet

.

.

.