Accountants show renewed pricing power as rates gain 5.7%.

By CPA Trendlines

CPA firms are raising prices again as they enter 2026, even as hiring remains weak and wage pressures show little sign of easing. The combination is tightening margins across the profession.

MORE Outlook 2026, Pay, Hiring, Pricing

A CPA Trendlines analysis of new pricing data shows that billing rates for core CPA firm services are rebounding sharply, reversing an earlier soft patch and vaulting fees to near record highs. At the same time, employment growth across accounting firms has stalled, while wage growth remains elevated, underscoring the growing imbalance between pricing power and labor costs.

Taken together, the data point to an industry that is regaining some pricing power but still struggles with structural labor pressures that pricing alone cannot fix.

Prices rebound

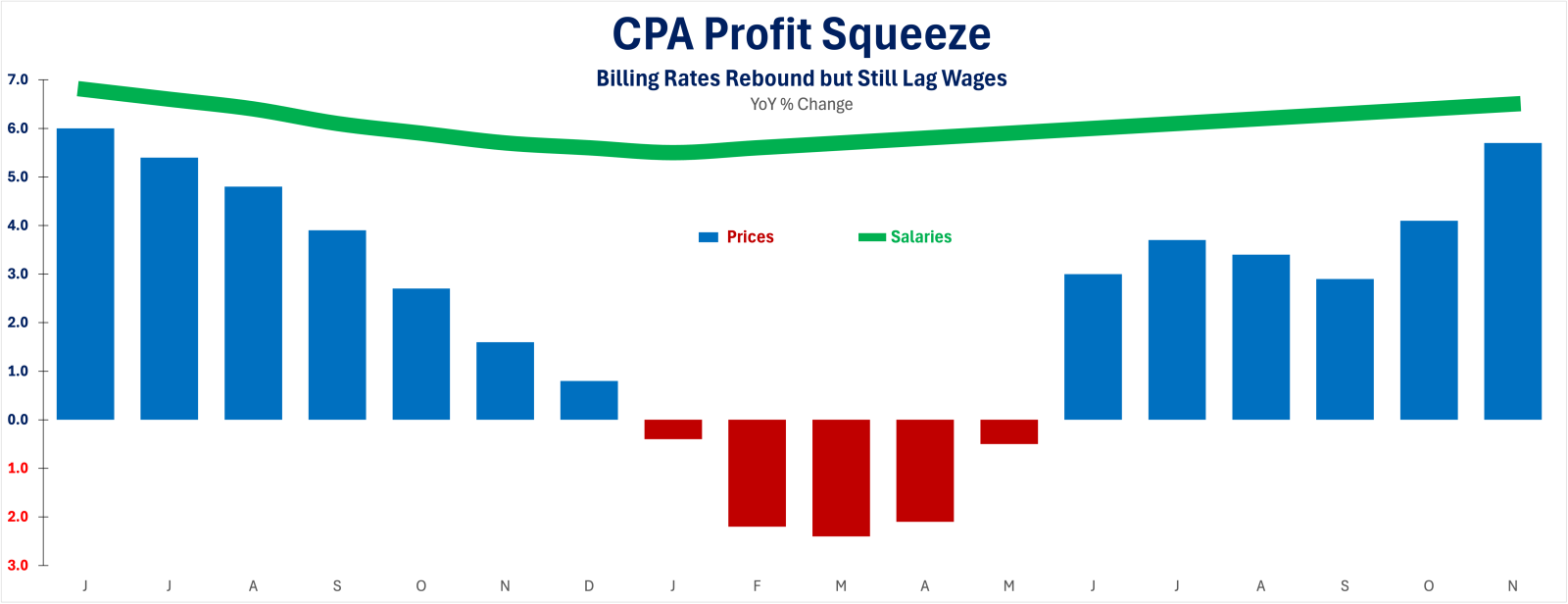

Prices are up 5.7% from a year earlier, the fastest pace since May 2024. That compares with a 4.1% year-over-year increase a month ago and 2.9% before that, indicating a marked re-acceleration.

Pricing had been considerably weaker a year ago. Year-over-year price changes were negative through last April, reflecting unusually soft pricing in late 2024. The turnaround since mid-year reflects both firmer pricing decisions by firms and easier comparisons to last year’s depressed levels.

Long-term context: prices near record levels

In the long term, CPA service prices remain historically elevated.

After stalling in the early 2010s due to the financial crisis, CPAs have steadily raised rates over the past decade, with a pandemic-era spike.

Last year’s peak represents the highest price level recorded. Even with modest pullbacks in August, September, and October, the pre-2026 rebound leaves prices firmly near that peak. The data show little evidence of broad-based discounting as firms move into 2026.

Hiring remains weak

While pricing has strengthened, labor-market data for accounting firms paint a more constrained picture.

Employment across accounting, tax preparation, bookkeeping, and payroll services has stagnated over the past year. Year-over-year job growth slowed steadily through 2024 and turned negative in 2025, reflecting both reduced hiring and selective payroll contraction.

By November 2025, employment in the sector was down roughly 1.1% from a year earlier, a decline that followed months of marginal losses, signaling that firms are no longer expanding headcount to meet demand as they did earlier in the post-pandemic recovery.

The weakness in hiring contrasts sharply with pandemic conditions earlier in the decade, when firms added staff aggressively despite rising wages. Today’s readings suggest a more cautious posture, with firms relying on pricing and internal capacity rather than workforce expansion.

Wages stay elevated

At the same time, wage pressures are not easing.

Average hourly earnings for production and nonsupervisory employees in accounting firms are posting year-over-year gains well above historical norms. Wage growth is running at a 6.5% annual rate.

Even as hiring has slowed and total hours worked have trended lower, wage growth remains strong, keeping labor costs elevated per employee. For firms, the combination means higher costs without the offsetting benefit of headcount growth.

The divergence between weak employment growth and strong wage growth has become one of the defining features of the accounting labor market. It reflects both ongoing competition for experienced staff and firms’ reluctance—or inability—to reset compensation downward.

The squeeze between prices and labor costs

The juxtaposition of rebounding prices and persistent wage pressure highlights the core economic challenge facing CPA firms. Prices are rising again, but from already high levels and at a pace that, while improved, remains constrained. Wages, by contrast, continue to grow at rates that reflect structural tightness in the labor market rather than cyclical fluctuation.

Hiring, meanwhile, has become the adjustment valve. Instead of expanding payrolls to chase revenue growth, firms are holding the line on headcount, absorbing demand through existing staff and pricing rather than volume.

That strategy shows up in the data. Employment growth has flattened or turned negative, even as earnings climb and prices rebound. The result is margin pressure that pricing alone has not fully relieved.

Shifts in workforce dynamics

The labor data also point to subtler shifts inside firms. With total employment constrained and average earnings rising, workforce composition is likely to change. Firms appear to be prioritizing experienced and supervisory staff while limiting growth at lower-cost levels. That approach helps manage risk and maintain service quality, but it also raises average labor costs.

At the same time, average hours worked have edged lower, suggesting that firms are spreading work across existing teams rather than extending hours or adding staff. While that may help mitigate burnout in the short term, it further concentrates costs among a smaller workforce.

These dynamics reinforce a broader trend: growth in accounting firms is becoming less about adding people and more about managing pricing, utilization, and mix.

The outlook for 2026

As firms enter 2026, the combined pricing and labor data point to an industry operating under tighter constraints. Pricing power has returned after a weak start to 2025, and firms have largely preserved historically high fee levels. That offers some relief after months of soft pricing. But wage pressures remain entrenched, and hiring has not resumed meaningfully.

The data suggest that firms are navigating a narrow path by raising prices where they can, retaining senior talent, and limiting headcount growth to protect margins. Whether that balance can be sustained will depend on the client’s tolerance for higher fees and the firm’s ability to extract productivity gains without overburdening staff.

For now, the latest data show an industry that has stabilized pricing but not solved its labor problem. Prices are rising again, but the economics of growth remain constrained—setting the tone for another year of careful trade-offs in CPA firm management.