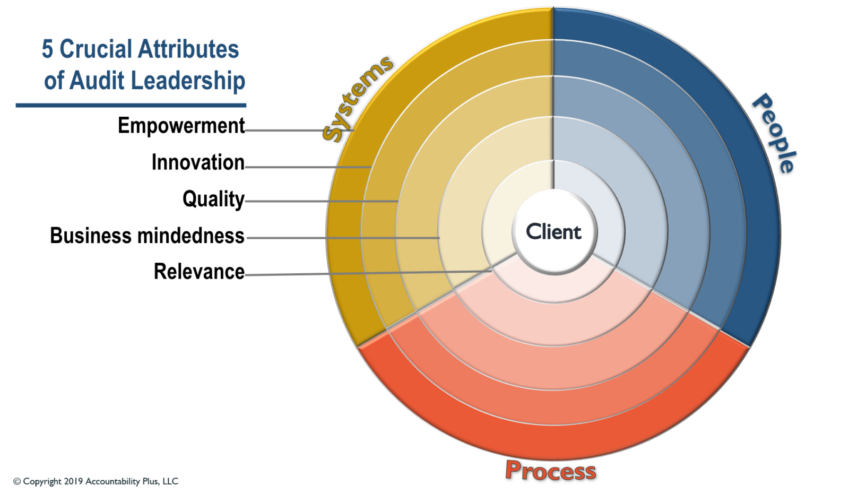

The Five Essential Attributes of Audit Leadership

Bold new roadmap for advancing the audit from a commodity in danger of irrelevance…

…to a valuable range of services that clients need and want.

By Alan Anderson

President of ACCOUNTability Plus, LLC

“Alan Anderson: Always the Visionary”

Foreword by Anthony Pugliese, CIA, CPA

President and CEO, Institute of Internal Auditors

Choose the Print + PDF eBook Upgrade to start reading instantly.

And get the printed handbook shipped free in the U.S. as soon as it rolls off the presses.

$279.95 – $295.00

The Five Essential Attributes of Audit Leadership

Bold new roadmap for advancing the audit from a commodity in danger of irrelevance... ...to a valuable range of services that clients need and want.

By Alan Anderson

President of ACCOUNTability Plus, LLC

"Alan Anderson: Always the Visionary" Foreword by Anthony Pugliese, CIA, CPA President and CEO, Institute of Internal Auditors

Choose the Print + PDF eBook Upgrade to start reading instantly. And get the printed handbook shipped free in the U.S. as soon as it rolls off the presses.

TO READ THE FULL ARTICLE

Continue reading your article with a CPA Trendlines Pro membership.

[Contact service-team@cpatrendlines.com for special pricing on bulk orders]

See more Alan Anderson at CPA Trendlines here

CONTENTS

Part 1 – Overview

Chapter 1 – The current state of audit and three important questions

Chapter 2 – What are the results of the failure of leadership?

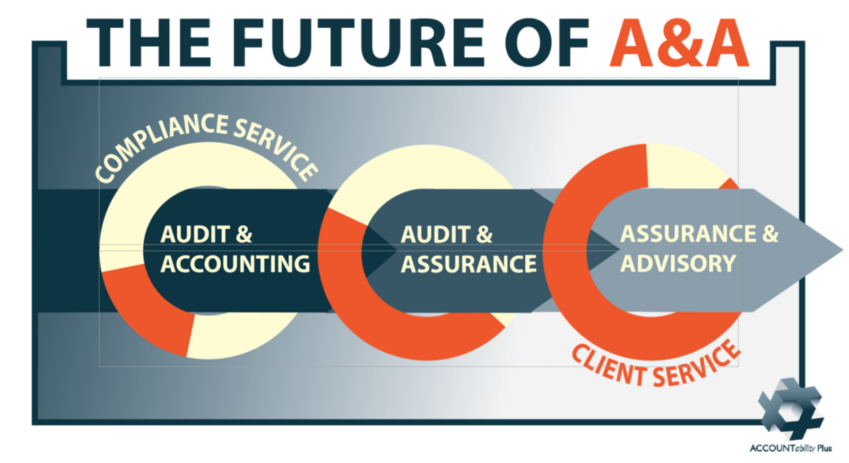

Chapter 3 – What could the future of audit be?

Chapter 4 – How do we build an audit of the future?

Part 2 – Leadership must believe the audit is relevant

Chapter 5 – What is relevance in audit?

Chapter 6 – How do we drive relevance in audit?

Chapter 7 – The benefits of relevance

Part 3 – Business Mindedness

Chapter 8 – How the ‘business expert CPAs’ get their business wrong

Chapter 9 – Minding the business of your firm

Chapter 10 – How would we improve this business if we were running it?

Chapter 11 – How a business-mindedness approach helps you build a better firm

Part 4 – Quality

Chapter 12 –What does quality in audit leadership mean

Chapter 13 – Creating a culture of quality assurance

Chapter 14 – Moving from quality control to quality assurance lets you advance from Auditing & Accounting to Assurance & Advisory

Part 5 – Innovation

Chapter 15 – What is Innovation?

Chapter 16 – How do we bring innovation into audit?

Chapter 17 – What will innovation do for your firm?

Part 6 – Create a Culture of Empowered Staff

Chapter 18 – Empowerment in audit has become an oxymoron

Chapter 19 – How to create a culture of empowerment

Chapter 20 – Benefits of empowered teams

Part 7 – The Audit of the Future

Chapter 21 – What got us here won’t get us there

Epilogue – Why artificial intelligence is no threat to auditors

ALAN ANDERSON

Always the Visionary

By Anthony Pugliese, CIA, CPA

President and CEO, Institute of Internal Auditors

Since the day I met Al Anderson in 1999, he has been advocating for change in the accounting profession. Al was a visionary at a time when very few CPAs embraced the changing nature of what they should be doing or even could be doing. He saw the future coming at a time when it was much harder to imagine the far-reaching impacts that technology might have on accounting.

My first conversation with Al was a job interview for what turned into 21 years at the Association of International Certified Public Accountants, including nine years working directly for Al and then 13 years as COO. Before my tenure at the AICPA, I had been at Deloitte for eight years, and while I loved it there – the culture, the people, and the variety of clients and industries – I wanted a change of pace. I loved Deloitte and auditing but was looking for something new and different.

Thankfully, I’ve had the great good fortune to meet the right people at the right time who offered me the right opportunity throughout my career.

Al Anderson was one of those people.

The ideas in this book are not new to me. But I wouldn’t have thought of the profession as I think of it today if I hadn’t had Al as a boss and mentor for as long as I did. Al and I and our assurance services group at the AICPA would talk about things that have now been given names, like artificial intelligence and robotic process automation, and many of his predictions have come true.

A vision for the future of the profession

He saw then, as he does today, how the need to make sure we moved as a profession into a new era of providing value-based versus commodity-based services would be crucial to our survival.

Even back then, he talked about looking through the windshield, not the rearview mirror.

The traditional financial audit is looking in the rear-view mirror – just at a single time. He was especially interested in client performance measures and even assuring those measures. Al did that while at McGladrey, and he saw how much value the clients placed on it. The value to the clients was much greater than the fees they paid to McGladrey.

He always talked about what would make the client happy and provide the most value, which isn’t the financial audit. Not that audits aren’t of value, but they’re not what management or boards look at with the most enthusiasm. Audits have become a commodity, but providing clients with what they want will always be valuable.

The unique thing about Al is that he sees the problem but doesn’t just stay in the moment. He’s a few yards ahead, trying to think about the solution. That’s not a common skill among accountants, who tend to focus on what they’ve got going on. That’s no surprise, given the almost impossible and horrific workloads in public accounting.

That’s a problem he’s had real-world experience with, not just with McGladrey, but with the hundreds of firms he saw at the AICPA, where he was able to gauge reaction to big events in the world, and with the many firms he has worked with through his company, ACCOUNTability Plus.

The ideas here aren’t based on theory but on his work with CPAs repeatedly struggling through the same problems.

Today’s talent crunch creates a firestorm for the profession and the AICPA.

When I was in public accounting, there was a big enough talent supply that the sweatshop mentality – which persists to this day – wasn’t a deterrent. But today’s shortage and the insurmountable workloads are forcing a change.

Talent shortage forces change

People have been discussing the talent shortage in accounting for years as the pipeline of accounting students has been drying up. But when states like Minnesota rally behind proposals to drop the education requirement from 150 to 120 hours, it is a huge indicator of how bad the problem has become.

When I was in college, the profession had a different kind of allure that is no longer there. Becoming a partner at a Big Eight firm was a prestigious career goal. Now it’s different. Being a partner at the Big Four, or even a top 100 firm, while prestigious, is no longer the goal.

Today’s young people aren’t willing to sacrifice as much of their lives for their careers.

My 21-year-old son – the son of the CEO of the Institute of Internal Auditors – doesn’t see the payoff of the hurdles to becoming a CPA and audit partner. Like many of his generation, my son wants a rewarding career. And I don’t know if the accounting firm proposition would be rewarding to him. It’s certainly not positioned as one anymore.

The personal rewards of accounting

To make this profession more attractive to younger generations, we need role models and people who can talk about their firms, what they do, and how they impact the people and businesses they work with. We need audit leaders who embrace and exemplify the kinds of changes Al describes in this handbook and who can demonstrate that becoming an auditor can be a personally rewarding career and that they can have a real impact on the businesses they work with.

Instead, today’s leaders think they can solve the problem by paying higher salaries or having compressed work weeks. But you must still get your work done and meet deadlines. And in busy season, what does a compressed work week look like? Six days instead of seven?

Because firm leaders aren’t on campus evangelizing why it’s so great to be an accountant and aren’t providing the motivation and inspiration to join their firms, today’s students learn about audit from their professors, supplemented with what they learn online. Being an auditor differs from what young people learn in the classroom.

The profession’s next evolution can begin with the auditors

While the AICPA is trying to change the profession with the CPA Evolution project, those ideas are just starting to make their way into most classrooms for the January 2024 launch of the new exam. Before the CPA Evolution initiative, the exam hadn’t evolved significantly since 2004, and college coursework follows what’s on the exam. No disrespect to academia, but that’s where I would look for inspiration on the profession’s transformation.

It is paramount that audit leaders start making this profession more appealing to future generations, or this profession will not survive.

And if we don’t solve the CPA pipeline issue, there won’t be enough auditors to do the work at some point. To get audits done, there will be pressure to allow other professions and other qualified people to do the work, which threatens the whole profession.

That makes this handbook relevant to the very survival of the profession. Relevance is one of the key themes woven through this handbook. This profession won’t survive if it’s no longer relevant to the needs of business owners.

But it’s not just for auditors

The leadership model Al describes in this handbook is not just for auditors – but for anyone who wants to remain relevant in accounting. Remaining relevant is imperative for the profession. We all need to know where to head if we want accounting to remain viable.

The profession’s tax side may think this doesn’t apply to them. However, tax preparers are at a higher risk of becoming less relevant because they have skills they haven’t begun to utilize. We still teach that the best person to help you with financial planning advice is probably your CPA, who prepares your taxes. They have a wealth of knowledge about stock sales and investments and small businesses, yet they rarely step forward and give advice. But like audit, tax preparation is becoming a commodity service.

Clients often choose their auditor and tax professional based on who can do it the cheapest.

No one wants to provide a commodity-oriented service after that much education and experience. It’s not personally rewarding.

The advice lately for audit and tax has been to fire the clients with the lower ROI. So those fired clients get picked up by CPAs who are OK with the lower ROI and lower fees, which leads to further commoditization of the audit and tax preparation, becoming a self-perpetuating problem.

Al pulls no punches in this handbook when he describes a bleak future for the profession if nothing changes. But if you don’t know what’s happening, you can’t know what you must change. You don’t know that you need to stop eating unhealthy food if you don’t know how bad your cholesterol is or if your blood pressure is through the roof. Transforming the profession requires firm leaders to adopt a frame of mind that is open to and wants to change.

Reason for optimism

At the same time, Al demonstrates his optimism for our capacity to change. One of Al’s advantages is that he is more left-brained and creative than most CPAs. So, throughout this handbook, he has many examples of really small but impactful changes that can make a big difference to teams and clients. Following his lead, you can make the work more intellectually and personally rewarding for your team and more valuable to your clients.

Al is one of the best mentors I’ve ever had, and I’m fortunate to have him as a colleague and a friend. Having him walk into my life early in my professional career changed my perspective on the future of the profession I’m proud to be a part of. I started young and impatient, whereas Al was very patient and good at getting me to slow down without actually saying so. Instead of calling me on the carpet when I made a mistake, he would tell me the right story at the right time or give me the right example so that I could figure out what I did wrong. Al always leads by example.

And he practices what he preaches.

Reading this handbook is like having Al as a gentle, patient mentor by your side, pointing out how we have failed and guiding us to fix what’s wrong.

This handbook is a wake-up call for leaders of accounting firms. If you’re not already implementing what Al suggests, you must start today. The handbook isn’t esoteric knowledge for just a few elite leaders. It’s a must-read for anyone – from an aspiring student in accounting to firm leaders with decades of experience.

Tomorrow will be too late if we don’t start making these changes now.

– From the foreword

THE CURRENT STATE OF AUDIT

Three Important Questions

By Alan Anderson

The other day, I picked up a college textbook on auditing from 2001.

Even back then, that book listed these as “critical forces on the profession:”

- Increasing market saturation with relatively little opportunity for growth

- Perceptions that financial statement audits have become a commodity

- Price competition and continual pressure to reduce fees

- Cost pressures that have resulted in the reduction of time devoted to engagements

- Perceptions that the incidence and severity of alleged audit failures have increased

Not much has changed in the 20-plus years since that book was published. Today, many college students who learned auditing from that textbook are in leadership positions at audit firms. They were warned what we were up against that we are still facing those same “critical forces,” which have only exacerbated since then, indicating the ossified state of leadership in the audit profession.

Today, the current state of the audit is in jeopardy, and our profession has had a big stake in putting it there.

The audit has evolved into what I call “chopping down trees.” Auditors spend a lot of time ticking, tying, and tracing amounts from an invoice to a ledger sheet, a print-out, or a spreadsheet without understanding what business the entity is in or whether a particular transaction makes sense for a client. We have driven down the value to a series of checklists. We don’t make the time to communicate with our clients and staff to find out what matters to them. Clients don’t receive anything remotely useful to them to improve their businesses.

A recent report by the World Economic Forum2 puts audit as number four in the top 20 jobs, with decreasing demand by 2025 through advances in automation and AI. Now, this report looked at tasks in different occupations that can be automated, not on the totality of the work. That report also says, “The tasks where humans are expected to retain their comparative advantage include managing, advising, decision-making, reasoning, communicating and interacting.” That means that to remain a viable profession. Auditors will need to get better at the tasks that machines can’t do as well as humans.

Audit is seen by many as a commodity, or if not, it’s well on its way to becoming a commodity. Tech changes that are already here pose an existential threat to audit. Yet most auditors keep their heads in the sand, ignoring the coming tsunami of change that is changing almost everything about the accounting world. Who will need a historical financial statement audit when bots, AI, and blockchain provide all the assurance lenders and stakeholders currently get from their auditors?

Our clients are leveraging technology to run their businesses. Financial dashboards give them an almost real-time view of their business performance, and they can monitor many of those dashboards from their phones.

According to an EY survey of 1,000 CFOs and finance professionals worldwide, over half think that bots and automation will perform about half the accounting tasks humans currently do over the next three years.

If that’s the future on the industry side, what does the future on the audit side look like?

Will there even be a need for audit if technological innovations can monitor transactions in real-time?

Some of these innovations are not new. A good 25 years ago, I was working with a sunflower seed broker who matched companies that grew sunflower seeds with companies that bought sunflower seeds as a component for the birdseed they made. The banker providing financing for their line of credit connected the bank’s system to the client’s general ledger system. The banker could constantly monitor what was happening in the general ledger and track the difference between payables and receivables. Each transaction was quite large, and each one impacted the line of credit use.

Why would the banker need an audit if they had some metrics to kick out a notification when there was a deviation? The banker performed a continuous, real-time audit connecting to the sunflower seed broker’s general ledger.

Just think: The financial services industry had the means 25 years ago to move to real-time GL connection with banking customers but hasn’t yet taken advantage of the opportunity to move banking into the modern world. It’s a matter of time before the audit is disrupted out of existence. As Pascal Finette said in a keynote at Digital CPA in 2019, “What kills you does not look like you.”

Yet we’re still auditing like we have for decades.

Let me do a little history lesson to understand how we got here.

A history lesson

When I started at McGladrey (now RSM), we wrote audit programs by hand and thought about what we needed to do to carry out our audit procedures. And then, the firm got a copy machine. That started the arts and crafts period of public accounting. Because we were going to do the same as last year every year, we would make a copy of last year’s handwritten audit program, cut out the sign-offs, tape that on a new page, make sure to draw the lines for the sign-offs, and then we’d make a copy of that. Then, we had our audit program for the new year.

So, that served as the springboard to the standardized audit program. At the same time, the standards were starting to grow, so we needed some way to make sure we were covering the voluminous requirements.

At the same time that I was learning to be a better auditor, technology was advancing. And we auditors started throwing some computers at the way we did audits. So, we put our audit programs in Word documents and made them more legible than handwritten copies. Then we didn’t need the copy machine anymore.

Technology evolved, and we developed paperless ways of doing the work. No more lugging heavy binders of paper. No more camping out at the client’s photocopying machine.

We scrapped our red pencils and two-hole punches. But what did we accomplish with that?

We’ve reproduced what we used to do on paper in a paperless environment. If you printed out the electronic file of your workpapers, wouldn’t that electronic file be almost a 100% replica of what that paper file looked like 25 years ago? We threw technology at the audit without thinking something might need to change. Is that a good return on our investment in technology?

Then, at the same time, the fixed fee in the marketplace became much more prevalent. Now, we’re stuck in a fixed-fee environment. Efficiency matters now. So, what we’re doing in today’s world of the audit is teaching our staff to fill out forms faster, as opposed to thinking about the audit.

Instead of learning to ask the next best question, staff are focused on asking the one question and getting the yes/no answer to move on.

And so, we’ve created an environment of filling out forms and checklists, and if I fill out enough checklists, I certainly must have done an audit. The result is that our staff is not getting the mentoring and coaching that they need to help them understand this process.

When the staff accountants in your firm do fundamentally the same work as last year every year, they don’t learn how to audit. What they learn is how to fill out the forms repetitively every year.

After five years of doing that, these staff accountants don’t have five years of experience, but they do have one year of experience repeated five times.

If I had to fill out all the forms that audit staff fill out today, I wouldn’t be in public accounting. I didn’t get into accounting to fill out forms. I entered public accounting because it was the best place to learn about business. I thought the best businesspeople were CPAs in public practice.

We’ve evolved from paper and pencil to technology, but we’re not teaching the staff what audit is really about. Their focus is on the forms and not on what matters most to the client – the bottom line.

The three questions

When I started noticing this disconnect between what the audit staff focused on and what the audit was supposed to be, I asked three questions. First, it was just one, then it was two, and now it’s three.

What was the bottom line on your last audit?

I’ve asked over 400 people that question, and so far, only one person has known the answer. And, of course, the individual came up to me at the end of the session and said, “Al, I’ll have to be honest with you. They told me you always ask that question, so I looked.”

Managers and partners are relying on the work of those staff auditors, and they don’t know this one key metric. When I was a staff auditor, we paid attention to this as a team. This was important to know. So, I started asking a second question.

How many pages were in the disclosure checklist?

Out of the 80-plus people I’ve asked this second question, none of them knew what the bottom line was on their last audit, but over half knew the answer to this question. Does this sound like a group focused on the client or the checklists?

So, then I added a third question.

How does the client make money?

Of the 60 people I’ve asked, one gave me this answer: “That wasn’t my audit section. I don’t have to know.”

How can you possibly do work in audit and not know what a client’s goals are?

I don’t believe it’s the staff’s fault. I believe the leadership of that audit, and maybe of the whole firm, dropped the ball.

And it’s not just that particular firm. I believe that audit leadership has failed to ensure that audit continues as a valuable service for our clients. As a whole, we as audit leaders are not helping our staff to understand better what an audit is all about, what a client’s all about, and really what we are as a firm when we deliver audit services by just filling out forms.

– from Chapter 1

ABOUT THE AUTHOR

Alan W. Anderson is the President of ACCOUNTability Plus, LLC, a global leader in accounting and assurance advancement. He is the Founder of A&A Leaders Leagues, a collaboration of leaders redefining A&A for the future. He is a frequent speaker and educator who works directly with auditors and firms to transform their A&A services. Over his career spanning over three decades, Al worked from staff auditor to Senior Vice President at the AICPA before creating ACCOUNTability Plus, LLC. He continues to participate in “Auditing in the Future” initiatives and is committed to his vision of redefining A&A.

Anderson has remained at the forefront of optimizing audit and people processes for decades. More importantly, he is passionate about helping transform audit and accounting into a service that delivers the best, most value-added outcomes. He has worked on the design of the Audit of the Future for the AICPA and has worked with many state societies and technology providers.

Contact: accountabilityplus.com

See more Alan Anderson at CPA Trendlines here

Transforming Audit for the Future

$279.95 – $295.00

You may also like…

-

Sale!

ADVISORY ESSENTIALS

ADVISORY ESSENTIALS 77 Ways to Wow! The Complete Guide to Small-Business Consulting

By Edward Mendlowitz, CPA

Plus: 125-Item Toolkit, with Fully Customizable, Immediately-Useful Practice Aids

$377.00 – $477.77 Learn More -

FROM CAS TO CASH

FROM CAS TO CASH Client Accounting Services: The Definitive Success Guide

The Why, What, and How of CAS

By Hitendra R. Patil

More than 300 pages of ideas, insights, tips, tricks, and best practices for your CAS success

PLUS – Bonus Downloadable Toolkits (Included FREE with every order)

$439.95 – $459.95 Learn More