Tax Refund Totals Up 10%

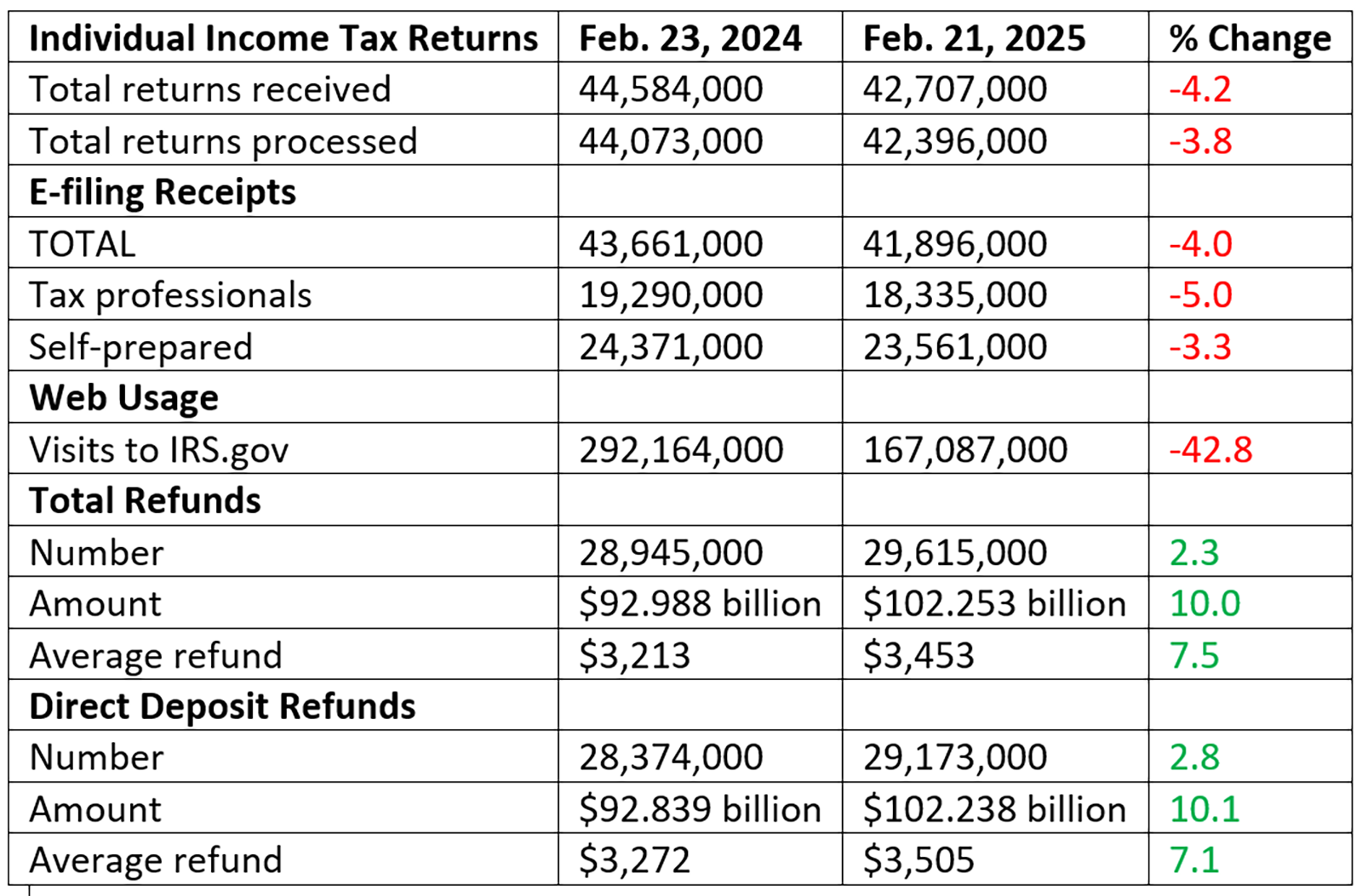

Tax pros hold 44 percent of the market, one-half percentage point less than a year ago.

By Beth Bellor

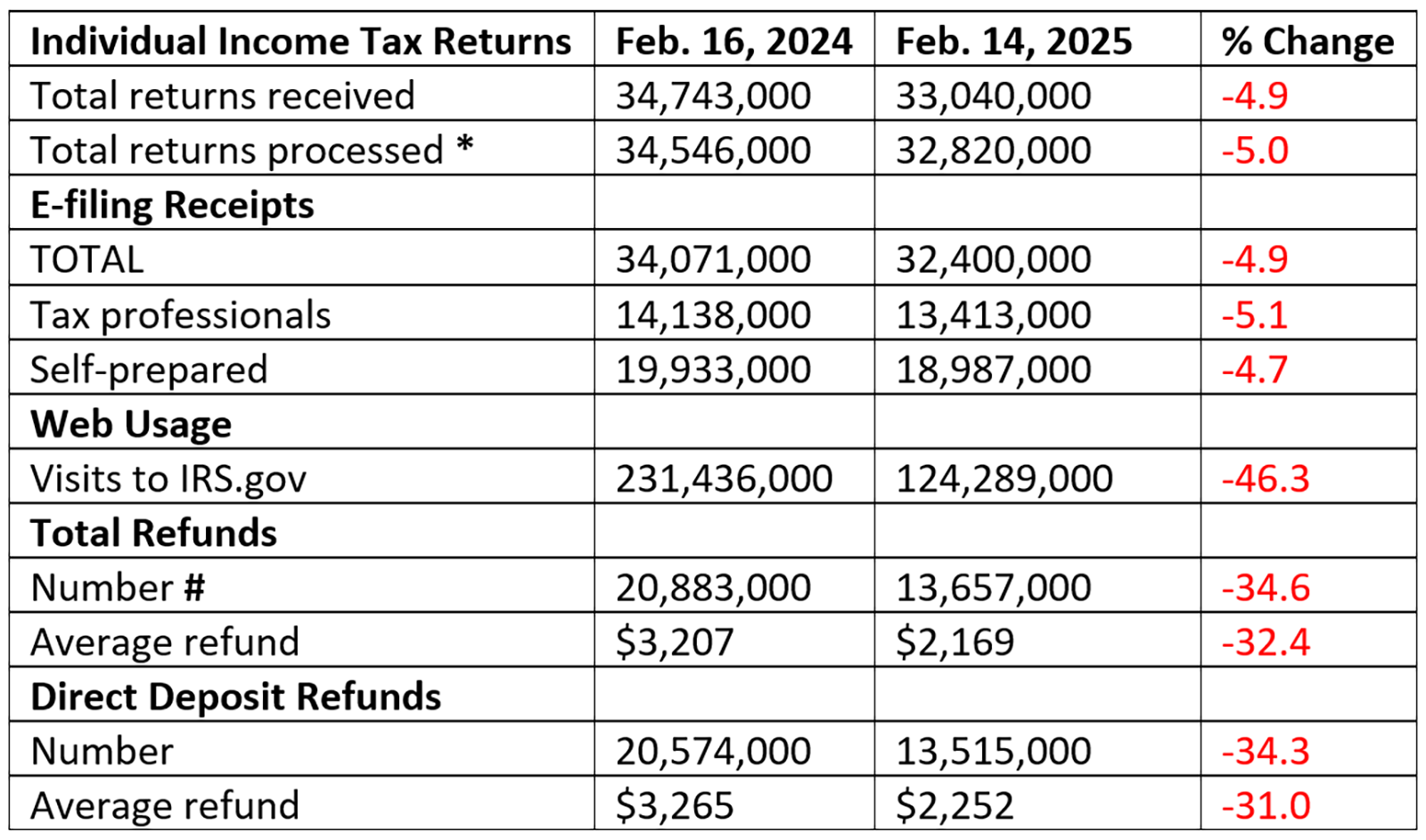

For the first time this busy season, the IRS is reporting not just refund numbers and average amounts but also the total amounts refunded. It’s good news: up 10 percent for both total and direct deposit refunds.

MORE: Tax Refunds Plummet, but No Worries | Tax Refunds Up 18% Early On | First Tax Filing Reports Are In

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

As of Feb. 21, the most recent data available, the agency had received 42.7 million individual income tax returns, down 4.2 percent from the same period in 2024. It had processed 42.4 million returns, down 3.8 percent.

READ MORE →