But Some Challenges May Still Be Ahead

via CCH

Accounting firms are doing well weathering the effects of the current economic slump, but unfortunately there may still be challenges ahead, even as the economy picks up, according to the findings of an independent nationwide survey of 100 U.S. accounting firms. The survey was conducted by Opinion Research Corporation, and commissioned by CCH, a Wolters Kluwer business (CCHGroup.com).

According to the survey, despite the downturn, firms have been successful overall in maintaining rates, client services and staff productivity as they carefully manage the bottom line.

But even during the recession, firms reported difficulty in finding good staff. And, with the Baby Boomers about to retire in record numbers, a talent crunch looms on the horizon as the opportunity for business growth returns with the economic recovery.

“The accounting profession has performed well in a poor economy, but it should be a wake-up call for many that staffing challenges have persisted through the recession,” said CCH President Mike Sabbatis. “Firms should be considering right now what they need to do to win that talent war as the economy heats up again.”

The Talent Crunch

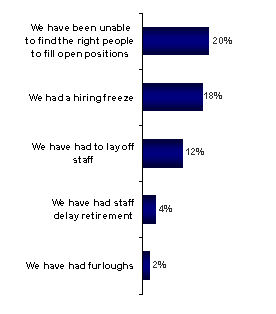

The good news is that the level of job reductions in accounting firms has been relatively low. Twelve percent of firms surveyed had layoffs, while 18 percent instituted hiring freezes. However, firms highlighted difficulty in finding good staff even in the recession, with 20 percent reporting that they are unable to find people to fill open positions despite record-high unemployment rates.

Fifty-six percent said they plan to ramp up hiring as the economy improves. Qualified staff already is in short supply, however, at the same time older workers are heading toward retirement – and they don’t seem to be looking back. According to the survey, only 4 percent of firms have seen staff delay retirement because of the economy. Yet, 26 percent hope to retain or hire older employees as the economy improves as a strategy to fill positions with qualified staff.

“There’s a wide gap between what older employees may be planning to do, and what firms are hoping they’ll do,” Sabbatis said. “Firms need to recognize this now and make certain they’re capturing knowledge that’s about to walk out the door and deploying the right tools and technology to optimize staff and attract new professionals.”

Firms Focus on Practice Management, Client Services and Continue to Invest in Technology

Ninety-two percent of firms pointed to strong practice management as important in ensuring they can manage through the recession, and 90 percent said firms with strong practice management procedures will be able to recover more quickly from the recession.

“The importance of a comprehensive practice management approach is magnified in tough economic times,” said Sabbatis. “If you’re able to clearly see your business and respond to market dynamics, you’re better able to navigate around potential roadblocks and keep your firm on course.”

Even in a contracted economy, none of the 100 firms surveyed reported they lowered their rates. And while a slight majority, 54 percent, said they froze rates over the last year, nearly as many, 46 percent, increased rates.

In terms of the service firms are providing, 28 percent reported they’ve been more likely to over-serve clients and 24 percent said the economy has caused them to be more selective about the clients they retain.

“Firms are catering to the strong clients they want to keep for the long term, while being more wary of keeping clients who may not be as profitable,” Sabbatis said.

Firms also reported that they are keeping a closer eye on the bottom line, with 81 percent more closely monitoring accounts receivables and 68 percent examining staff productivity.

Fifty-seven percent reported that they are more carefully measuring their return on investment in technology, but a large majority have not delayed the purchases as a result. Only 17 percent of firms have delayed hardware purchases and 14 percent have delayed software purchases as a result of the economy. Additionally, 14 percent of firms reported they are accelerating plans to deploy Software as a Service (SaaS) solutions as a result of the economy.

As to when accounting professionals expect the economy to recover, the vast majority of firms surveyed said the economy will improve before 2011, with 55 percent reporting that the recovery will happen this year (28 percent) or by the first half of 2010 (27 percent). Twenty-nine percent believe the recovery will happen in the second half of 2010. Only 13 percent think we’ll have to wait until 2011 to see better days, and 3 percent were unsure.

About the Survey

The survey was conducted by phone for CCH by Opinion Research Corporation from August 6-24, 2009 and included in-depth interviews with 100 partners in U.S. accounting firms. The survey reflects experiences of randomly polled accounting firms ranging in size from firms with five to more than 100 employees.

One Response to “CCH: Accounting Firms Doing Well Through Economic Slump”

Stefanie Dewilde

“Love this!”