CPA Profession Facing More Battles Across the Country

Disputes revolve around required hours, definitions and “substantial equivalency.”

By Steven Sacks

The NEW Fundamentals: Thriving in Disruption

Of all the states whose legislature has run amok this past year, the Florida legislature passed House Bill 813 – Certified Public Accountants – by both the Florida House and Senate. This bill creates a new “retired status” license category for CPAs. The legislation will now be sent to Gov. Ron DeSantis for consideration for being signed into law.

MORE: 150 Hours Revisted: The Profession Needs a Makeover | How Do You Value Your Most Important Asset? | Which is Better: A Year of Education or A Year of Experience? | Sell Service, Not Hours | Private Equity vs. the CPA Firm Partnership | CAS or CAAS? Getting Clarity | Fine-Tuning the Subscription Fee Model | When Cyber-Crime Hits Close to Home | How to Build a Winning Proposal | Six Ways to Fix Your Firm Agreement

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Exclusively for PRO Members. Log in here or upgrade to PRO today.

According to the Florida Institute of CPAs CEO, the thinking behind this is to “… uphold retired CPAs’ profound sense of pride and accomplishment and preserve their professional identity.” However, they cannot reflect to the public that they have an active license because many believe the public thinks that if you have “CPA” after your name, you have an active license. If an individual wants to return to public practice, they can complete 80 hours of CPE every two years as part of renewing their license.

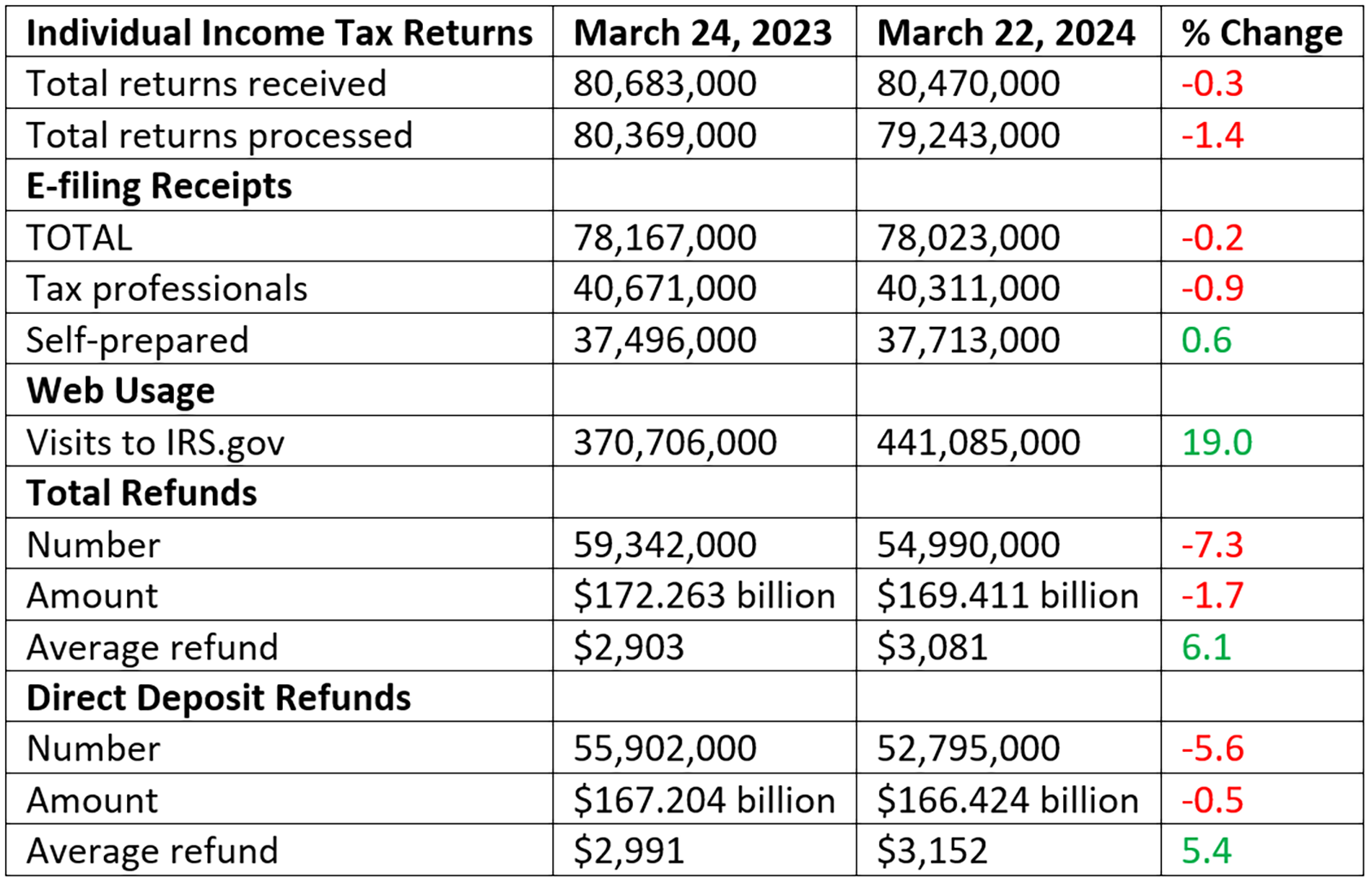

Refund numbers are down but amounts are up.

Refund numbers are down but amounts are up. One-quarter of accountants see trouble ahead for the source of their bread and butter.

One-quarter of accountants see trouble ahead for the source of their bread and butter.