Refund numbers are down but amounts are up.

Refund numbers are down but amounts are up.

By Beth Bellor

CPA Trendlines Research

The end is in sight. Documents are signed, buttons are pushed and tax returns are filed. The pile is growing smaller.

If you want optimism, don’t look at the latest Internal Revenue statistics. With the 2023 filing season opening Jan. 23 and the 2024 season kicking off Jan. 29, every week of 2024 reporting has seven fewer days of data than the corresponding period the previous year.

MORE: Tax Pros Take the Edge in E-Filings | Tax Pros Handle 46.4% of E-filing | Tax Refunds, Tax Pro Market Share Trending Up | Refunds Up as Tax Pros Tackle 41.5% of E-filings | Tax Pros Handle 37.7% of E-filings | Tax Pros File 33% of Early Returns

Exclusively for PRO Members. Log in here or upgrade to PRO today.

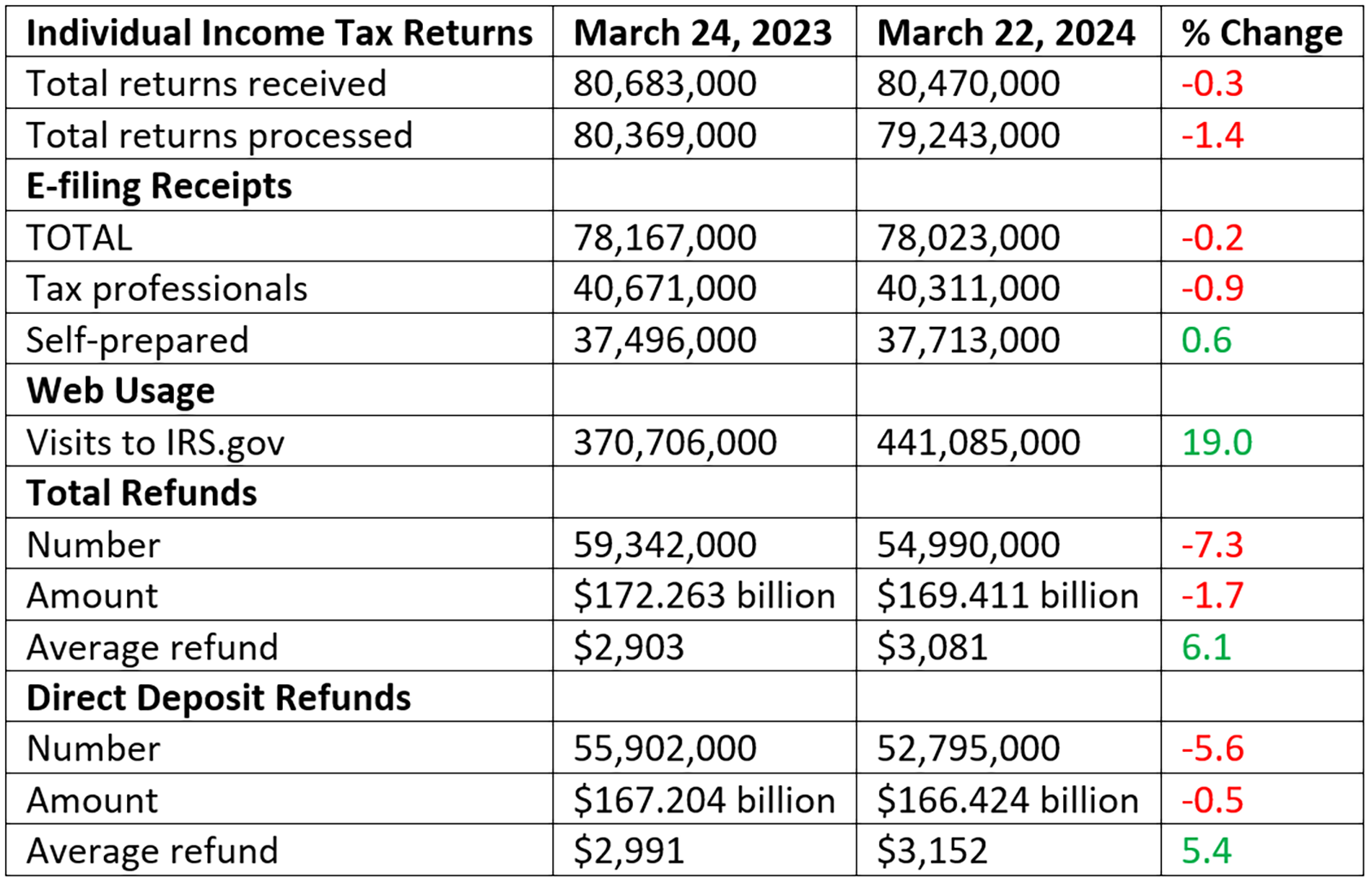

As of the latest report, for March 22, the IRS had received 80.5 million individual income tax returns and processed 79.2 million returns, down 0.3 percent and 1.4 percent respectively from last year. The impact on your firm? Dare we say, none?

Perhaps you’ve been the beneficiary of another stat, though … the one showing tax professionals gaining ever more ground on the self-preparers.

TO READ THE FULL ARTICLE