AI Means Clients Need You More Than Ever

Four ways to prepare.

By Hitendra Patil

Rise of The AiCCOUNTANTS

We have discussed that AI-powered functions will become more potent with time. It will not feel like an overnight apocalypse, provided you are keeping yourself abreast of the progress of artificial intelligence in the accounting profession.

MORE: Seven Changes AI Brings to Accounting | Humans Beat AI in Some Aspects | Why Accountants Should Embrace Artificial Intelligence | AI Brings Opportunities for Accountants | Seven Things You Must Know about AI

Exclusively for PRO Members. Log in here or upgrade to PRO today.

But how exactly can you prepare for the era when AI metamorphoses your work?

Before entering the new AI-powered era, let us figure out what is happening now.

READ MORE →

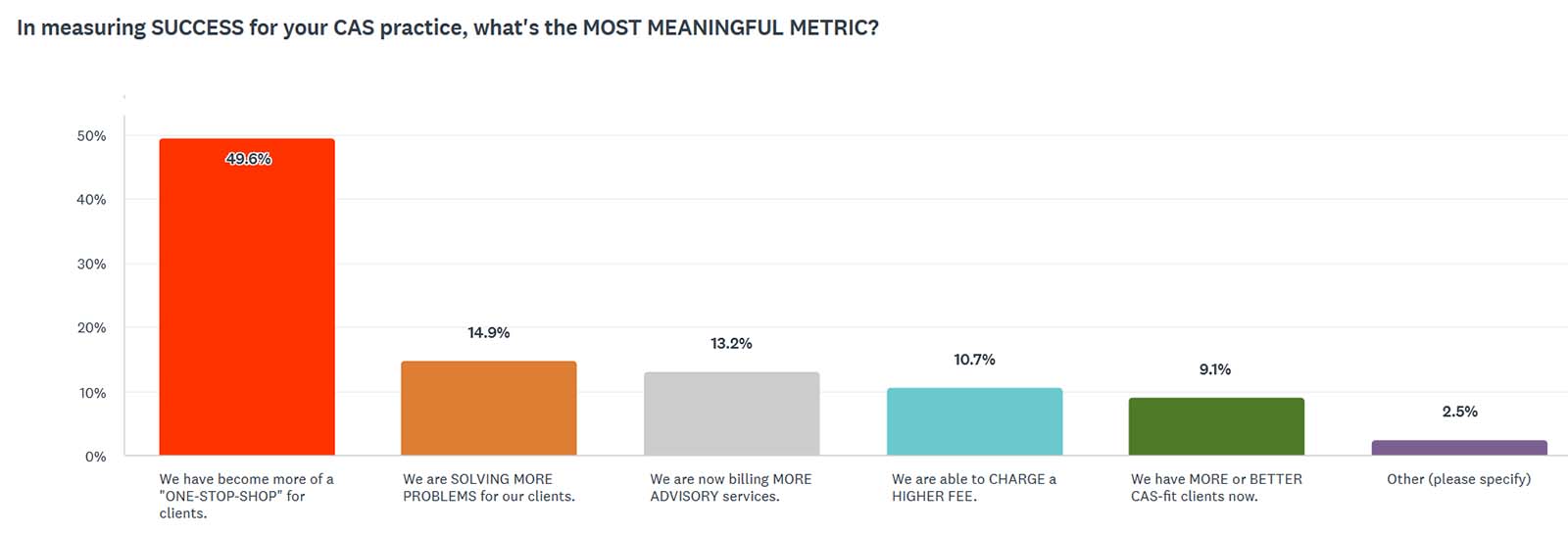

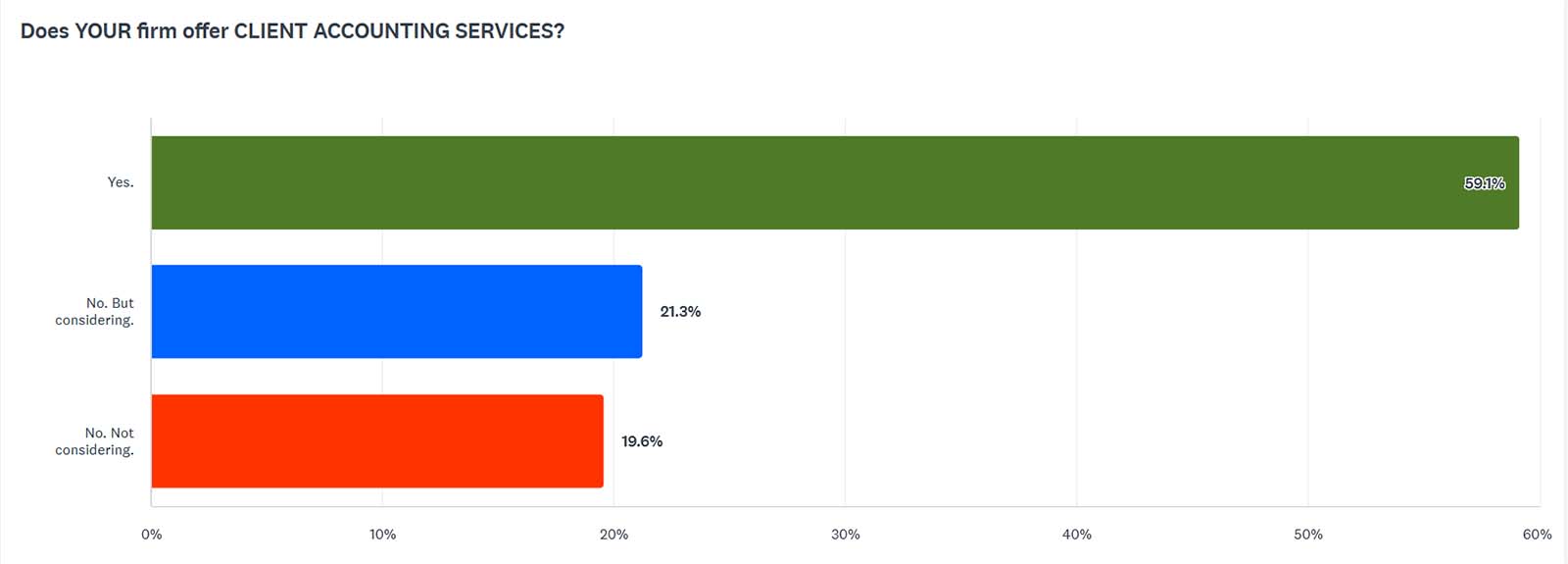

Accountants share which niches offer the best new opportunities.

Accountants share which niches offer the best new opportunities. Survey respondents tell us what their clients want from CAS that they don’t get from other services.

Survey respondents tell us what their clients want from CAS that they don’t get from other services.