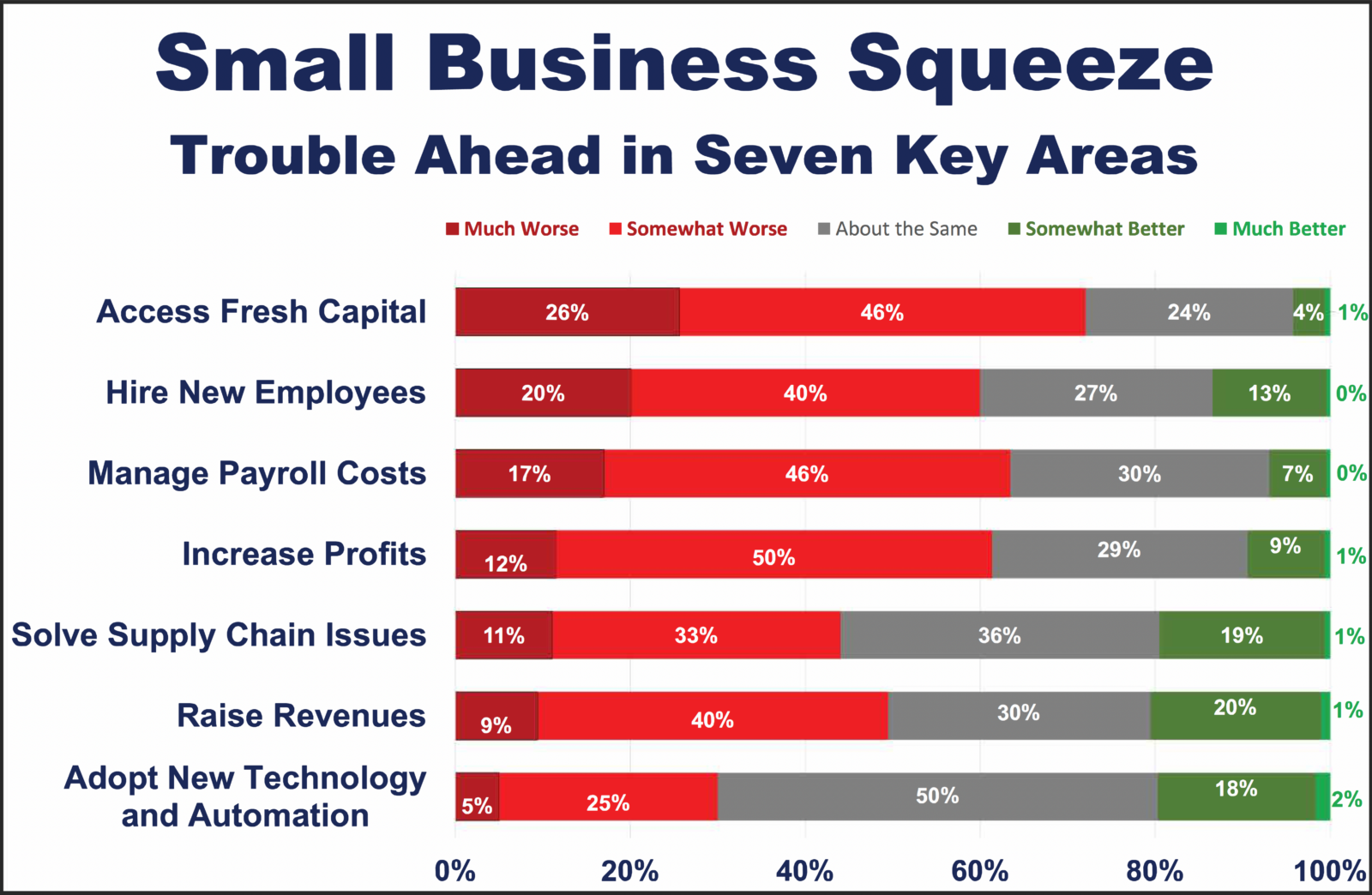

Accountants Raise Alarms on Small Business Outlook

The Avalara Accountants Confidence Report points to difficulties ahead for small businesses to access capital, increase profits, raise revenues, hire new employees, and control costs.

Avalara, Inc., a leading provider of cloud-based tax compliance automation for businesses of all sizes, released a new survey of over 500 Main Street accountants representing more than 100,000 small businesses.

Survey responses revealed that looming economic headwinds could create challenges for small businesses in the next 12–18 months. The survey, conducted during the 2023 tax season, shows that accountants believe small businesses will face challenges in accessing fresh capital, increasing profits, managing payroll costs, weathering supply chain difficulties, and hiring new staff.

Get the instant download here:

The Avalara Accountants Confidence Report

The 2023 Avalara Accountants Confidence Report, produced in conjunction with CPA Trendlines, queried trusted advisors with clear insights into the financial health of small business clients. The report measures accountants’ attitudes and outlook on a variety of pressing issues, leading with sentiment on the health of small business clients, and providing a read on the national economy and the state of smaller accounting practices. Accountants were surveyed as they combed through business clients’ financials and prepared their tax returns.