Client Clues for Wealth Management Opportunities

How to grow your firm outside of wealth management.

By Russ Alan Prince

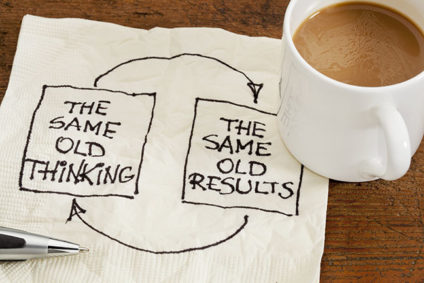

A pervasive problem many accounting firms face with wealth management practices is how little wealth management business they generate. Having an arrangement with a wealth manager or establishing their wealth management practices does not tend to result in very much business.

MORE: Exceptional Teams Are Key to High-Net-Worth Practices | Four Keys to an Elite Wealth Management Team | The Biggest Obstacle to Taking Your Firm Upmarket | Wealthy Drive Expansion of Family Offices | Build Your High-Performing Family Office Practice | Are You Missing Maximum Potential?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Indeed, some accountants will send clients over to the wealth management practice because the client asks them to. However, relying on clients to initiate the referral is something other than a solid business development strategy. Instead, the wealth manager must show accountants how to identify opportunities and make the proper connections.

READ MORE →

Who do your referrals come from?

Who do your referrals come from?