A shorter season to date makes comparisons difficult.

By CPA Trendlines Research

The Internal Revenue Service has fired up the machinery and begun cranking out tax returns. And so begins our annual ritual of tracking how well they do that.

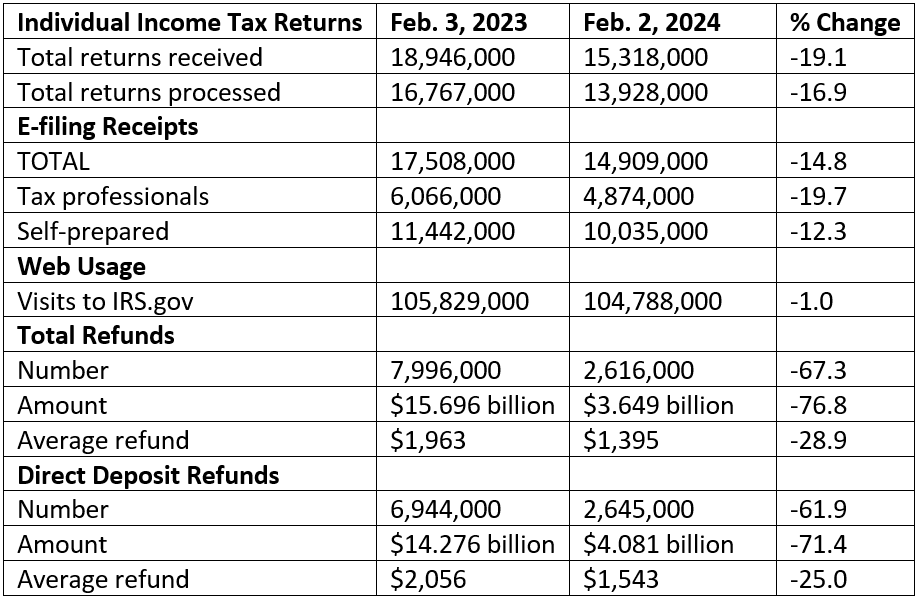

All of the initial figures are double-digit down, largely because of seven days’ fewer collections. The 2023 filing season began on Jan. 23 vs. 2024’s Jan. 29, so 2023 totals cover 12 days as opposed to this season’s five days.

The IRS, of course, puts a shiny spin on this, saying that considering the loss of seven days, filing season statistics “show a strong start to filing season 2024, with all systems running well.”

Running well, hmm? That remains to be seen.

In the first week of filing, the agency received 15.3 million individual income tax returns, down 19.1 percent. It processed 13.9 million returns, down 16.9 percent.

E-filings

Electronic filings totaled 14.9 million, down 14.8 percent. Professionals submiited 4.9 million, down 19.7 percent, and do-it-yourselfers turned in 10 million, down 12.3 percent.

Tax pros handled 33 percent of week 1 tax returns.

Website traffic

Visits to IRS.gov numbered 104.8 million, down just 1 percent.

Refunds

Total refunds numbered 2.62 million, down 67.3 percent, in the total amount of $3.7 billion, down 76.8 percent. The average amount was $1,395, down 28.9 percent for this time period.

Direct deposit refunds numbered 2.65 million, down 61.9 percent, in the total amount of $4.1 billion, down 71.4 percent. The average direct deposit refund was $1,543, down 25 percent.

UPDATE: The IRS later added this footnote: Total refunds issued represents returns received and processed in 2024 – the current year only. The number of direct deposit refunds represents returns received in the current and prior year but processed in 2024.

3 Responses to “Tax Pros File 33% of Early Returns”

Shlomo Halberstam CPA

Logical that filing volume is down. Taxpayers anticipating possibly increased Child Credit refunds would rather file correct returns later than incorrect ones sooner and wait for the IRS to send them the difference.

Jon Bell

Where are the Total owed columns

CPA Trendlines Research

Thanks for the question. That data should be available from the IRS when they add up all the numbers at the end of the season. But don’t hold your breath.