Should the April 15th IRS extensions go automatic and paperless? The IRS needs your feedback.

Should the April 15th IRS extensions go automatic and paperless? The IRS needs your feedback.

Vote YES or NO

to add your voice to the discussion

Join the Survey. Get the Results.

By Eva Rosenberg, EA

TaxMama

You CAN affect IRS Policies – Really!

You’ve recently finished up the tedious task of doing extensions for your clients’ pass-through entities.

You’re about to do it again for your individuals and corporations.

Are you feeling like it’s a frustrating waste of time? It’s the same people and businesses that need additional time, year-after-year. You know it. The IRS knows it.

Please fill out our survey and give us your feedback – good or bad. We’d like your honest input – because, really, YOU can change tax policy.

So why go through the charade of the annual extension, when we all know the returns aren’t going to be finished before September or October anyway? And then, suddenly wake up in the middle of the night with the horrifying realization that you left out a client – and, oh those penalties! Or they walk in, in May and tell you they created a partnership or corporation – and, oh, forgot to mention it.

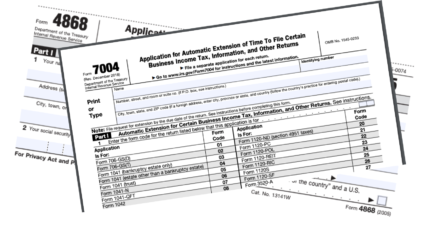

That’s what we are proposing to change. To have the IRS make those March 15 (7004) and April 15 (4868 and 7004) extensions automatic and paperless. Believe it or not, with your feedback, we can make this happen. Why? Because it’s not just your time being wasted, IRS wastes a lot of time on this, too.

It’s actually been done before. Doug Thorburn, EA, and the California Society of Enrolled Agents almost accomplished before. The program, in the mists of time, was called the APEX program – Automatic Paperless Extensions. The IRS and the State of California were very interested – and almost went through with it.

At the last minute, the IRS backed out of the full program – but gave us a compromise. California implemented the program. Today, the California extension is paperless. You only file it if you will have a balance due. (However, if you don’t file the California extension, and pay the balance due, the penalties are eye-popping.)

The IRS’s compromise? They did three main things:

- They made the April 15 extensions automatic – you didn’t have to explain why you needed it anymore – but you did need to file it.

- They eliminated the second extension in August – and made the Form 4868 a six-month extension, instead of four months.

- They eliminated the need to sign the form.

It didn’t happen overnight – but that’s our status right now.

As you can see, the IRS made progress on this issue in the past. Now they are ready for the next step. Doug Thorburn, EA broached the idea again this month.

And… Right now, IRS Stakeholder Liaison has expressed an interest in taking this idea up the food chain, into the IRS Issue Management Resolution System (IMRS).

The IRS needs your feedback to see if tax professionals want to eliminate the extensions altogether. Whatever happens, it won’t happen overnight. It could take two or three years to come about – or maybe sooner. But we can get this started.

Understand, if this happens, that means extending the filing season to Sept. 15 or Oct. 15. Please think about the positive and negative impact this will have on your tax practices, personal lives, and client relationships. And how much extra (billable) time will be spent nagging clients to get you information. And how this later filing deadline will impact how late in the year you learn what your clients did in the year before.

Keep these things in mind:

- One, you can still set your own rules for clients.

- Two, most clients want to get it done and over with.

- Three, there are two pieces of meat:

- If they owe getting it done means they know what they owe and ‘can’ avoid penalties by paying;

- If they are due a refund, many want the refund sooner rather than later.

Please fill out our survey and give us your feedback – good or bad. We’d like your honest input – because, really, YOU can change tax policy.

Historical Notes: First year for 6 months was 2005 (https://www.irs.gov/pub/irs-prior/f4868–2005.pdf). First year with no signature,1996 (https://www.irs.gov/pub/irs-prior/f4868–1996.pdf)

One Response to “Wanna Change the Tax World?”

Susan Ashe

If a business is having to do an extension year after year there’s a problem…. incompetent monthly accountant/bookkeeper or the CPA / Tax preparer. I shake my head every single year when every set of financials are done and uploaded to the tax preparer by Jan 15th bar none and the CPA still files an extension.