Focus on the hard trends, not the things you can’t predict.

Focus on the hard trends, not the things you can’t predict.

By Donny C. Shimamoto

Strategic Technology Decisions

Emerging technologies will disrupt many lower-level accounting jobs, but overall they will be a boon to the accounting profession. To be able to adopt these emerging technologies and ensure that value is gained from their proper use, accountants must begin upskilling now.

MORE: Accountants: Unleash Your Secret Superpower | Ready for Non-CPA CPA Firms? | Accounting Services Aren’t What You Think They Are | Learning from Hurricanes Harvey and Irma | Focus on Cyber Risk, Not Just Security | Making IT Matter to Accountants

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Accountants must develop additional competencies to ensure the success of projects associated with implementing emerging technologies and enable them to be value-added advisors to their organizations and clients.

Look for the Hard Trends

The emerging technologies of big data, artificial intelligence and blockchain have all been said to be major disruptors and possibly the end of the need for accountants. At conference after conference, I heard “thought leaders” of the accounting profession using FUD (fear, uncertainty and doubt) around the impact of these emerging technologies to try to motivate accountants to take action and start learning about these emerging technologies or to shift to advisory services lest they be left in the wake of the change that these technologies would bring.

I don’t know about you, but FUD is not a big motivator for me. In fact, it makes me want to obtain more clarity around whatever is being talked about to be able to dispel the FUD. The futurist Daniel Burrus is often quoted in the accounting profession as saying when dealing with the future, that you need to focus on the hard trends (things that you know will remain constant) not the things that you can’t predict (i.e., don’t focus on uncertainties). So when trying to obtain clarity on the FUD, I look for these hard trends.

To help look at the positive around these emerging technologies, I developed a presentation and polled the audiences to see how much of an impact they perceived to the profession from their work. The aggregated polls discussed in this post represent well over 500 responses from accountants practicing in a variety of areas including audit, tax and management accounting.

The Impact of Big Data on Accountants and Auditors

Big data isn’t an emerging technology in and of itself but rather it’s the fact that the data analysis tools that allow us to work with big data (or even “small data”) have become user-friendly enough that you no longer need an IT person to be able to access or analyze the data anymore. The cost of these tools iw also within the reach of many small businesses. For example, Power Pivot is built into Microsoft Excel, and Microsoft PowerBI is free (to acquire data and design analyses) and only $4 per user per month to access published analyses. (It’s also included in many Office 365 subscriptions, so organizations on Office 365 may have zero incremental cost to use it.)

The reason big data will have an impact on accounting is because it will enable us to incorporate non-financial data into our accounting processes and use that data to provide increased insights to support better decision-making in the organizations that we serve. For example:

Depreciation based on actuals. Depreciation is traditionally computed based on the estimated life of an asset in years. This convention was adopted because historically it would have been difficult and costly for us to measure the actual usage of an asset. Well, with sensors being able to be put on many devices – and the Internet of Things enabling that data to be accessed and gathered more easily – we could begin to cost-effectively depreciate assets based on actuals.

Consider the example of depreciating a vehicle. The life of a vehicle is primarily determined by how much it’s driven, not by its age. The odometers in today’s vehicles are now digital and could potentially be read every time the vehicle goes in and out of a company’s garage. Actual depreciation could then be computed using those readings compared to the manufacturer’s estimated life of the car (in miles) or company’s past experience with its vehicles. Automate the gathering of data and the computation, and you could potentially be tracking the depreciation of the vehicle on even a daily basis.

This is not a future possibility; this is already possible using today’s technologies. Imagine a company like FedEx or UPS doing this with their fleet of trucks – they could be depreciating based on actuals today. This concept could be applied to any type of asset that has an estimated life based on usage, and where sensors can provide the digital measurement of actual usage.

Proactive non-financial risk management. Data from devices and sensors can also be used to help quantify non-financial risks – many of which have financial implications. In the fleet of vehicles example, another device that provides a useful stream of data is the GPS in a vehicle. The GPS may be built into the vehicle itself or it could be from a device that is in the vehicle, for example, the mobile phone carried by the driver.

By combining the GPS data with street map data with speed limits, you could determine how often and by how much a driver is speeding. If the driver were to get a ticket while driving the company’s vehicle, or even worse get into an accident while speeding, the company could be liable for the ticket or any ensuing litigation. By monitoring this risky behavior and counseling drivers who demonstrate this behavior, or even by sending a real-time reminder to their mobile device that you noticed that they are driving in an unsafe manner, you could proactively manage this risk.

In the professional services context, we could also look at the number of times that a project’s expected delivery date has been pushed back, or the number of tasks that remain uncompleted as a project’s due date draws near. Both of these could be indicators of a project that is at risk for being delivered late – which could have impacts to cash flow and more importantly client satisfaction.

Detecting fraud using non-financial data. In cases where there are other activities that precede a financial transaction, we can use the non-financial data from those activities to detect transactions that don’t follow the typical activity pattern, which could be an indicator for fraud.

Consider the audit scenario where you’re testing revenue. Traditionally, auditors would just trace a sample of the transactions that compose the total revenue amount to their source invoices. As more and more invoices are delivered electronically, it becomes increasingly easy to create fake invoices. I can just create an invoice in the accounting system, and I can modify a PDF of a purchase order received from a customer easily as well. However, if there is a sales or e-commerce system where activity occurs before the actual invoice is created, data from those systems can provide an expanded audit data trail that I can trace to beyond just the invoice.

For example, if you were auditing Amazon, you could trace the final Amazon invoices back to the customer’s original search for the item(s), whether or not they looked at any of the alternatives suggested, and also whether they also looked at any of the “people who bought this item also bought these other items” suggestions. How many times have you gone to Amazon and searched for what you wanted, immediately found it, put it in your cart and immediately checked out? If you’re like most people, your answer is probably “rarely.” So when auditing Amazon’s invoices, we would expect to see this expanded “shopping” audit trail.

Using the GPS data obtained from drivers described in the previous section, you could also use the GPS coordinates of the stops where they spent an extended amount of time and cross-reference those locations as a delivery or pickup list (for delivery drivers) or customer/prospect locations (for salespeople or service technicians). If there are stops that don’t match that list, you could determine what is at that location and if it’s for example a coffee shop or restaurant, check their timesheet data to see if they recorded a break or lunch. If they hadn’t, you may have just detected timesheet fraud.

Providing evidence for tax compliance and defense. The additional non-financial data could also be gathered and used both for state and local tax (SALT) compliance and defense. Remember that in most SALT situations the burden of proof for a tax position rests on the taxpayer, not the taxing authority. So by gathering the additional data related to product storage, movement, handoffs, and final delivery routes and locations, both the determination of tax implications (e.g., nexus, point of consumption, etc.) and defense of positions taken based on the data become a lot easier to automate.

These examples just scratch the surface of what is possible using the additional data that is available through the Internet of Things and non-financial data from other systems. These data are already available today, and it’s a just a matter of us accountants and auditors finding the time to think through how we could use these data in our accounting and auditing processes.

Accountants and Auditors Only Expect Some Changes from Big Data

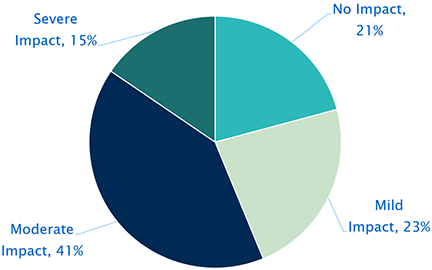

After describing the impacts above to audiences, I polled them to see what impact they perceive from big data within the next three years – meaning essentially by 2021. A majority (approximately 56 percent) see a moderate to severe impact from big data, meaning that they perceive that having access to big data and the potential opportunities that it provides for automation or analytics that impact accounting or auditing functions will cause us to have to significantly redesign the way that we currently do these jobs.

About 1 in 5 respondents said they saw no impact from big data upon their current jobs, and almost a quarter saw just a mild impact. Having seen how much – or in reality, how little – many organizations are leveraging their data for accounting or auditing functions, it surprised me to see that so many people saw no impact or just a mild impact.

However, when I look at the organization and firm sizes, about half of the respondents are coming from small to midsized firms and organizations, so my suspicion is that many of those respondents feel like they would not need to change the way they’re doing their accounting or auditing because it’s “simple enough” to not leverage what’s possible with additional data, or because they may not have felt that there was enough potential benefit from investing in the automations. Another potential reason may be that smaller organizations usually have more manual processes, so they would not have access to the additional data for the automations.

Smaller Firms Can Gain Bigger Benefits

While the above may be reason for smaller organizations to not leverage data-based automations, if you focus on the potential benefits and the fact that simpler operations mean these automations will be easier to design and lower cost to implement, the return on investment may be even greater for smaller organizations. This is especially true given the agility that smaller organizations have, and if the analytics applied provide earlier insights into operational issues that can then be corrected before month-end close, smaller organizations could see significant performance improvements from investing in data analytics and automation projects.

If an accounting firm is specializing in a particular industry, then the use of data-based automations provides an even bigger potential benefit as they can utilize those automations across multiple clients. Auditors specializing in a particular industry can also utilize the data for benchmarking and other analytics across the aggregated data. This could provide a huge competitive advantage in terms of the types of services and insights auditors could provide to clients, especially if their competitors are just providing “traditional” services.

One Response to “What Big Data Means to Small Firms”

Lesley Orr

Terrific article. Thank you for sharing your valuable insights.