If past recessions are any guide, the profession could lose up to 100,000 jobs.

If past recessions are any guide, the profession could lose up to 100,000 jobs.

Busy Season Barometer:

Bracing for the Coronavirus recession

Join the survey. Get the facts.

By Beth Bellor

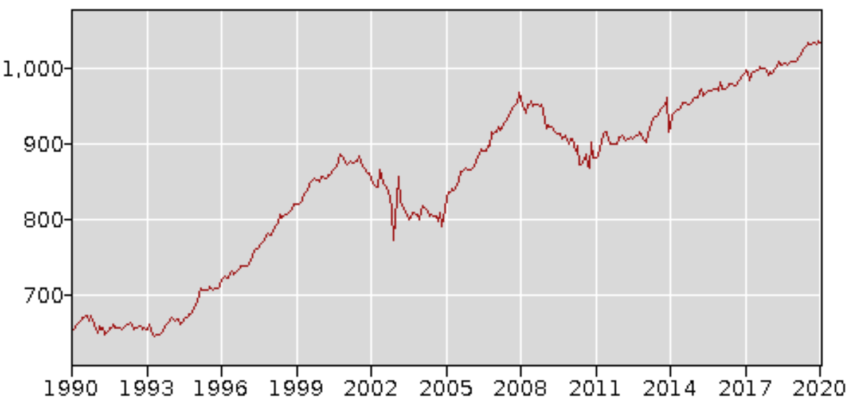

The tax and accounting profession was adding new jobs at a rate of 2.3 percent per year before the Coronavirus outbreak, according to CPA Trendlines Research.

See: All CPA Trendlines Special Coronavirus Crisis Coverage

More Staffing and Hiring Trends: Automation and the Future of Accounting | Getting and Keeping the Best: The Struggle Continues | Headcounts Dip by 3,500 in Tax & Accounting | Creative Perks for Remote Employees | What Staffing Shortage? | Hiring Trends Flash Warning Signs of Slowdown in Tax & Accounting | Salary Survey: Top Skills Getting Top Pay

Exclusively for PRO Members. Log in here or upgrade to PRO today.

But with a new recession looming, CPA Trendlines estimates the profession could lose up to 100,000 jobs and take up to seven years to recover.

The latest data available show more than a million employees in the profession, and growing at about 2,800 new jobs per month. At the same time, wages are hitting record highs.

But with the Coronavirus crisis threatening a new recession, CPA Trendlines conducted a long-term, 30-year analysis, focused on the job losses caused by the dot-com crash of 2001 and the financial meltdown of 2007. From the analysis, CPA Trendlines calculates the profession could shed up to 10 percent of its current workforce, and not fully recover for two to seven years.

In this report, CPA Trendlines highlights:

- Current and long-term hiring trends in each of the bookkeeping, payroll, tax and CPA segments of the industry (all data seasonally adjusted)

- Average hourly wages for key segments

- Typical hours worked per week

- Trends concerning women in the accounting workforce

TO READ THE FULL ARTICLE