Can busy season get any worse? We’re about to find out.

By CPA Trendlines

The year 2021 gave tax preparers and taxpayers one big mutual hope — the hope that such a year never happens again.

MORE for TAX SEASON 2022: Eight Ways to Charm a Client | Prepping for Tax Season: Plug Small Leaks Before They Become Big Floods | Four Issues with ‘Quick’ Tax Questions | UPDATED: Accountants Critical of Competitor Price-Cutting | When to Pick Up the Phone This Tax Season | Get Your Team Ready for Tax Season | Automate Busy Season with Apps You Already Use | These Five Procedures Will Simplify Your Tax Season | 11 Steps to Better Client Tax Instructions | 12 Ways to Squeeze Fun into Tax Season | Six Ways to Get Paid Faster | SURVEY: Worries for Small Business Clients | Busy Season Forecast: More Chaos |

Exclusively for PRO Members. Log in here or upgrade to PRO today.

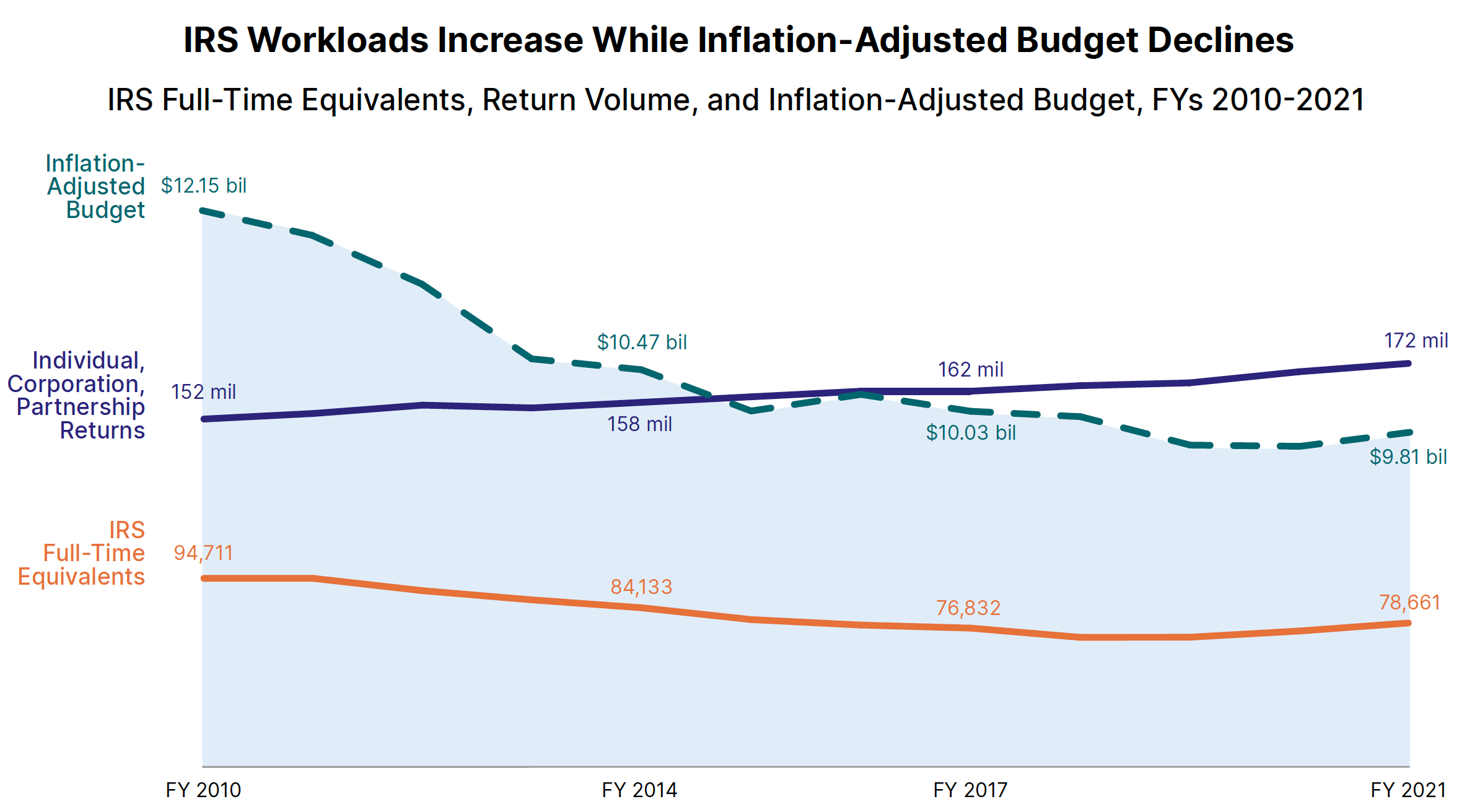

And just in case Congress didn’t get the message, National Tax Advocate Erin M. Collins submitted to that august body an annual report that pulled no punches and spared no explication. The new filing season starting Jan. 24 could bring hitherto unbelievable problems.

The situation, she said, was dire.

TO READ THE FULL ARTICLE