But big challenges loom.

By CPA Trendlines Research

No question about it: the 2023 tax season was a banner year. Generally speaking, revenues were up, profits were up, no quarantines and the IRS didn’t pop any surprises in the middle of it.

MORE: SURVEY: Accountants Economic Outlook Brightens | Tax Pros Are Expanding and Earning More | Research: Accounting Pros Cautiously Optimistic about Generative AI

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Yes, it was also a tough year, with staff shortages increasing the workload on practitioners, but it was that extra work, unburdened with payroll costs, that led to higher profits.

So what’s up for next year?

According to early results from the CPA Trendlines Emerging Issues, Opportunities and Trends survey, we could be seeing a turbulent season – not a bad season but one tossed around by the winds of change.

Join the Survey. Get the Results.

Click here to launch the 10-minute survey.

What’s in the Wind?

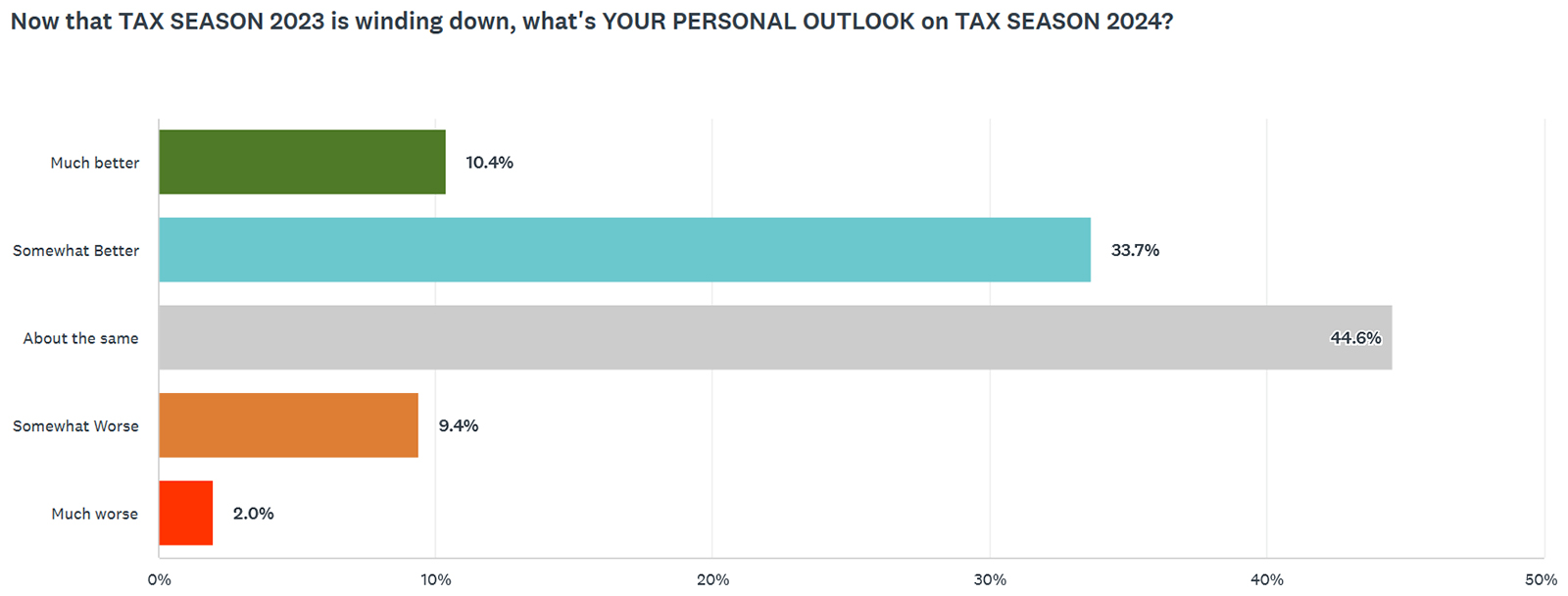

Responses to the survey are still coming in – and it’s not too late to toss in your two cents – but so far, practitioners are telling us that they expect a pretty good season coming up. Just over 10 percent tell us say it will be much better than 2023, and another 35 percent say it will be at least somewhat better. With 45 percent figuring it will be about the same, only 8 percent think it will be worse.

They’re seeing a better season – better than this year’s good season! – for several reasons.

- AI may – may – ease operations.

- Most firms are outsourcing more work.

- Almost half see opportunities in advisory services.

- Almost 70 percent are trying to work with better, higher-value clients.

- More than a third expect overall fees to increase by about 10 percent.

- More than a third will increase billing rates by about 10 percent.

- A fifth expect a 10 percent increase in clientele.

- Thirty percent foresee a 10 percent increase in revenue per client.

AI: The Big Unknown

While 29 percent see artificial intelligence having a positive impact on their practice, 67 percent say it’s too soon to tell.

Despite the guarded optimism on AI, comments revealed considerable concern about the impact.

“Not sure” was the most common response.

A worried Canadian had a very negative opinion, predicting that AI will “take away the accounts business,” and John Lawson, at Schechter Dokken Kanter in Minneapolis, says “AI will allow others to commoditize our service.”

From his Wisconsin firm, John Howard says AI will do “nothing for small firms.”

But Darek Koleda, at New Jersey firm Fanty, Koleda & Associates, says AI will “help with the grunt work so accountants can focus on advisory.”

Will the Economy Help?

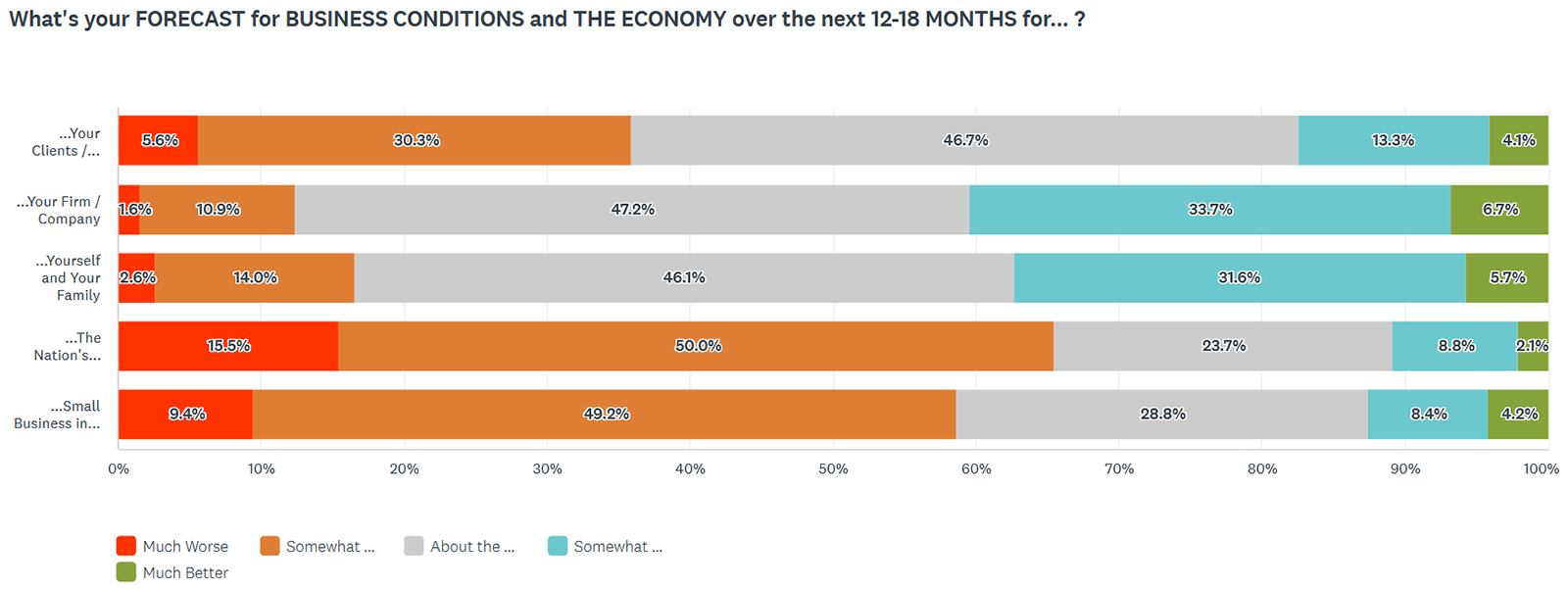

Respondents are rather divided about next year’s business conditions and the national economy. Curiously, they generally think it will get worse for everybody else but not themselves.

- 34 say it will get worse for clients, though most say only “somewhat worse.”

- 63 percent say it will get worse for the national economy.

- 58 percent say it will get worse for small businesses in particular.

And yet …

- 40 percent say it will be better for their own firm, and only 13 percent think it will get worse.

What to Do?

Half of the respondents had advice for small businesses. Here’s a sampling:

- “Don’t take shaky deals. If the customer looks like they will not pay, don’t sell to them. You don’t need bad receivables or inflated sales numbers.”

- “Pay attention to cash flow, reduce borrowing (so as to lower financing costs), establish a cash reserve to weather a rough patch (invest it in fairly liquid but interest-earning vehicle), focus on doing high-quality work.”

- “Hang in there and make sure to save for the rainy season – it’s coming.”