Why Tax Pros Are Imposing Standards on Themselves.

By CPA Trendlines Research

As the 2026 filing season begins, the National Association of Tax Professionals is launching a formal credentialing program for taxpayer representation.

MORE Tax, Busy Season, The Next Circular 230

The NATP is stepping into a regulatory void left by years of congressional inaction, leaving more than 500,000 paid preparers operating without national standards, even as IRS and GAO data show higher error rates on paid-prepared returns than on do-it-yourself filings, and Congress is delaying action.

Loving v. IRS

That vacuum traces directly to Loving v. IRS, the 2014 federal court decision that barred the Internal Revenue Service from requiring competency testing or continuing education for unenrolled preparers without explicit authorization from Congress. Since then, the IRS has relied on voluntary programs and narrow enforcement tools, lawmakers have failed to enact a replacement framework, and the paid preparer workforce has continued to grow—leaving professional organizations to fill a gap in federal policy that has remained unresolved for more than a decade.

Until Congress decides whether paid tax preparation is a profession worth regulating, taxpayers are caught between voluntary standards and a federal system that still treats “paid” as something other than “qualified.”

More than a decade after Loving, the regulatory framework governing paid tax preparation remains fragmented. The IRS can identify preparers but cannot require competence. Congress acknowledges the problem but has not acted. Taxpayers continue to assume that paying for preparation buys expertise, even as federal data show that paid-prepared returns are not consistently more accurate—and in some cases are more error-prone—than do-it-yourself filings.

Filing Season Urgency Meets a Regulatory Gap

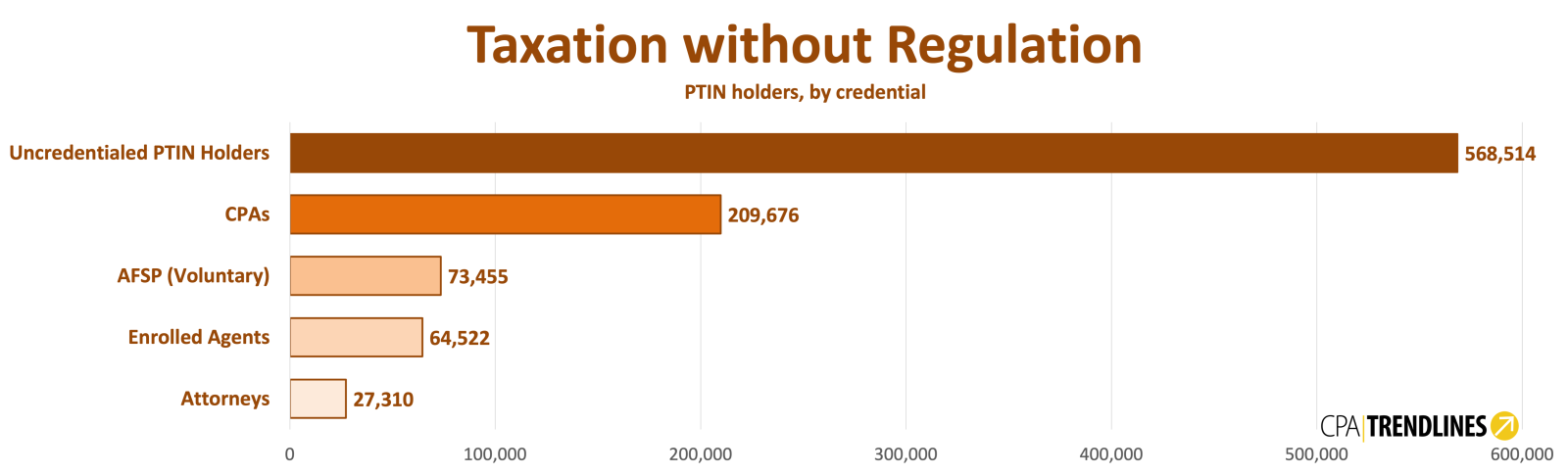

Each filing season, the IRS must depend on a preparer population that now rivals or exceeds the size of many licensed professions. IRS data show roughly 870,000 individuals held active PTINs at the start of the 2026 season. Of those, only about 302,000 are credentialed as certified public accountants, attorneys, or enrolled agents. Another 73,000 participate in the IRS’s Annual Filing Season Program, a voluntary continuing education initiative created after Loving. The remaining roughly 570,000 paid preparers operate without any mandatory federal competency or education standard.

Despite the scale of that workforce, the IRS’s regulatory reach is limited. Circular 230 governs only those who “practice before the IRS,” primarily credentialed professionals and those representing taxpayers in audits or appeals. It does not authorize the agency to impose baseline standards on paid return preparation itself.

As a result, the federal government enters each filing season urging preparers to renew identification numbers and protect taxpayer data, yet it lacks the authority to require proof of technical competence for most of the industry.

What the Data Say About Accuracy

The absence of federal standards would be less controversial if paid preparation reliably produced better outcomes for taxpayers. Federal compliance data suggest otherwise.

In an analysis of IRS National Research Program audit data cited by the Government Accountability Office, returns prepared by paid preparers showed a higher estimated error rate—about 60%—than self-prepared returns, which had an estimated error rate of about 50%. Errors were defined as changes to tax liability or refund amounts identified during IRS examinations.

The findings challenge the widely held assumption that paying for tax preparation automatically results in greater accuracy than preparing a return independently, including with tax software.

The same research found a notable difference in the direction of those errors. Self-prepared taxpayers were more likely to overpay, while paid-prepared returns were more likely to understate tax, exposing taxpayers to later assessments, penalties, and interest when discrepancies were discovered.

The GAO cautioned that the data do not isolate preparer credential status or taxpayer complexity, but the overall pattern has remained central to debates over whether minimum competency standards are warranted for paid preparers.

Industry Reaction: Building Standards Without Congress

Against that backdrop, professional groups say waiting for Congress is no longer realistic.

So the NATP is rolling out a professional credentialing program through its newly created NATP Center for Professional Excellence, marking one of the most significant industry-led responses to the post-Loving regulatory landscape. The NATP will administer NATP credentials and set expectations for competence, ethics, and accountability in tax practice. The first credentials—Accredited Tax Professional in Representation (ATPR) and Advanced Accredited Tax Professional in Representation (AATPR)—are designed for practitioners engaged in or seeking to enter taxpayer representation work. Eligibility includes education, examination, and continuing education requirements.

“These credentials are about more than testing knowledge,” says Scott Artman, CPA, CGMA, chief executive officer of NATP. “They represent a commitment to professional excellence, ethical practice and continuous learning. Through the Center for Professional Excellence, NATP is providing tax professionals with a meaningful way to demonstrate their value and advance their careers.”

NATP says additional credentials will be rolled out later in 2026, including Core and Advanced Individual Tax and Core and Advanced Business Tax tracks.

“Tax professionals face increasing complexity and greater scrutiny,” Artman says. “These programs help professionals differentiate themselves while reinforcing public trust in the profession as a whole.”

Other professional organizations, including the American Institute of CPAs, have long argued that voluntary efforts cannot substitute for statutory authority. The AICPA has repeatedly urged Congress to authorize the IRS to establish minimum standards for paid preparers, warning that oversight gaps undermine taxpayer confidence and create uneven enforcement.

Bipartisan Bills, Little Movement

On Capitol Hill, the policy response remains stalled.

Rep. Steve Cohen, a Tennessee Democrat, has reintroduced the Tax Return Preparer Accountability Act, which would give the Treasury explicit authority to require testing, continuing education, and background checks for paid preparers. Separately, Rep. Jimmy Panetta, a California Democrat, and Rep. Greg Steube, a Florida Republican, introduced the Taxpayer Protection and Preparer Proficiency Act, framing preparer regulation as a consumer-protection measure.

Both bills were referred to the House Ways and Means Committee. Neither has received a hearing. Neither has advanced to markup.

The National Taxpayer Advocate has repeatedly flagged the lack of preparer oversight as a “most serious problem” in annual reports to Congress, noting that a majority of paid-prepared returns are completed by individuals with no professional credentials and no mandatory education requirements.

In the Senate, preparer oversight language has surfaced in broader tax administration discussion drafts circulated by members of the Senate Finance Committee, tying preparer accountability to efforts to reduce improper payments and improve taxpayer experience. Those proposals have yet to emerge as standalone legislation, but they suggest preparer regulation remains on the policy agenda—even if momentum is slow.