A sign of things to come?

Contenders and Defenders: Hazel and a new generation of AI tax and legal tools are challenging the old.

Contenders and Defenders: Hazel and a new generation of AI tax and legal tools are challenging the old.

By CPA Trendlines

A major sell-off in brokerage and wealth management stocks followed the launch of a new AI-powered tax-planning tool by the financial technology platform Altruist.

Investors reacted sharply to the launch of Hazel AI, a feature within Altruist’s platform that automates complex tax strategies — a service traditionally handled by human advisors and high-fee wealth management firms.

Altruist, a tech-forward custodian for independent advisors, says that its Hazel AI platform can now automate document analysis by scanning 1040s, pay stubs, and account statements to draft personalized tax strategies in minutes; Reduce manual entry by removing the “mentally draining” labor typically associated with tax season; and challenge advisory fees.

Jason Wenk, CEO of Altruist, says the tool makes “average advice a lot harder to justify,” directly threatening the fee-based models of traditional firms.

Side-by-side comparison (law vs. accounting vs. financial advisory)

Dimension |

Law (law firms / legal services) |

Accounting & tax (CPA firms / tax practices) |

Financial advisory (RIAs / broker-dealers / advisors) |

Adoption rates (recent, cited) |

Cross-profession benchmark from a large professional-services sample: 46% of professionals report their organization invested in new AI-powered technologies in the past 12 months, and 30% say they regularly use AI-powered tools for drafting/editing or task starters. |

24% say their firm uses public GenAI tools (e.g., ChatGPT) and 13% use tax-specific GenAI tools. Also: 10% report GenAI is being used organization-wide, with another 40% “planning or considering.” |

43% of U.S. advisors “currently use or plan to use” generative AI for digital marketing (Broadridge survey). |

Tasks being automated first (what AI actually does) |

High-volume “language work”: drafting/rewriting, summarizing, initial research synthesis, matter/document review support; measured impact: legal professionals expect to free up ~240 hours/year (survey-based projection). |

Firms cite GenAI use cases concentrated in: accounting/bookkeeping (84%), tax research (84%), tax return preparation (69%), and tax advisory services (67%) (among those using or planning to use GenAI). |

Early practical use is client-facing and growth ops: marketing content + personalization and related workflow support (per the Broadridge advisor survey focus). |

Revenue model impacts (pressure points + likely shifts) |

Core tension: AI compresses time-on-task, which puts pressure on billable-hour realization for commoditized drafting/research. Firms that “productize” outputs tend to move faster toward fixed-fee / subscription / value-based pricing and push human time upmarket (strategy, negotiation, advocacy). (Time-savings magnitude is the accelerant.) |

Firms themselves are split on pricing effects: 40% believe GenAI may lead to increased billing rates; 56% expect to pass through at least some GenAI cost to customers; meanwhile 92% say clients have provided no direction yet—i.e., pricing is a firm decision, not client-pulled (for now). |

The advisory business is already in a fee-pressure regime; AI increases the “table-stakes” effect for investment implementation, pushing differentiation toward planning and coordination. Industry research on advisor economics shows ongoing fee compression and a tilt toward planning/retainer-based models in some channels. |

AI adoption is measurable across all three sectors, but the first-order automation differs—legal starts with drafting/research, accounting starts with tax research/return prep/bookkeeping, and advisory starts with marketing/personalization—while the revenue-model shock is strongest where pricing is tightly coupled to human time or commoditized workflows. (Sources: Thomson Reuters Institute; CPA.com; Broadridge; Cerulli; KPMG.

The news sparked fears of fee compression and market share loss for legacy giants. Major stocks in the sector saw significant single-day declines as sentiment shifted toward AI-driven competitive threats. In the software sector, stocks like Salesforce and Microsoft fell double digits earlier in February after Anthropic released new “Claude Cowork” agents capable of automating legal and data analysis workflows. In the insurance sector, brokers like Willis Towers Watson and Aon slumped after a ChatGPT-based AI tool for insurance comparisons was released, signaling disruption in the insurance intermediary space.

The launch of Hazel, an AI-powered tax-planning and advisor-workflow platform embedded within Altruist, has intensified investor concern that generative and agentic AI could materially compress fees and margins across human-capital-intensive professional services. While Hazel itself did not singlehandedly “crash” financial stocks, its debut became a catalyst that crystallized broader AI-disruption fears already building across brokerage, advisory, tax, legal, and software sectors.

The Specialized AI Threat: K1x, Blue J, and April

The launch of Hazel AI is being viewed as a direct challenge to the “moat” traditionally held by human advisors and CPAs. However, analysts note that the disruption is not coming from a single platform but from a “stack” of specialized AI tools carving up the traditional tax workflow.

Among the most significant of these is K1x, an AI platform that has gained rapid traction among the “Big 25” accounting firms. While Altruist focuses on general portfolio planning, K1x targets the most labor-intensive bottleneck in high-net-worth tax: extracting and validating data from thousands of diverse Schedule K-1s and K-3s.

Other key specialized competitors include:

-

Blue J: A legal-research specialist who uses factor-based machine learning to predict judicial outcomes and IRS rulings with verifiable citations.

-

April (getapril): An “embedded” tax engine that allows banks and fintechs to offer tax filing directly within their mobile apps, bypassing traditional preparers for standard 1040 clients.

-

Kintsugi: An “agentic” tool that autonomously monitors sales tax nexus and handles state registrations without human intervention.

The “Software-mageddon” Valuation Crisis

The current volatility follows a broader trend labeled as “software-mageddon” by some market participants. Last week, software giants like Intuit saw their shares trade near a 52-week low of $411.11 after Anthropic released AI models that demonstrated the ability to automate complex financial and legal workflows.

“The market is moving from seeing AI as a productivity booster to seeing it as a fee-killer,” said Sarah Miller, a senior fintech analyst. “If a $60-a-month AI tool can do the planning that used to justify a 1% AUM fee, the math for traditional firms ceases to function.”

The Mid-Sized Firm Pivot

For mid-sized firms, the integration of these tools has begun to alter staffing models. Early data from 2026 suggests that firms using a dual-AI stack—pairing Hazel AI for client-facing planning with K1x for K-1 document processing—have reported a 60% reduction in the need for seasonal data-entry staff.

By shifting professional time away from manual data wrangling and toward high-level advisory, these firms are maintaining margins amid market-wide fee compression.

The Defensive Response

Legacy providers are attempting to reclaim ground through aggressive human-centric pivots. Intuit is launching nearly 600 “Expert Office” locations to pair digital filing with human oversight, while Thomson Reuters is leaning on its proprietary legal archives through the CoCounsel platform.

However, the Feb. 10 market close suggests that Wall Street is increasingly skeptical of these moats. The focus for firm owners must now be on value-based pricing and the high-level strategy that continues to require human accountability.

A Day in February

Company |

Closing Price |

% Change |

Why It Fell |

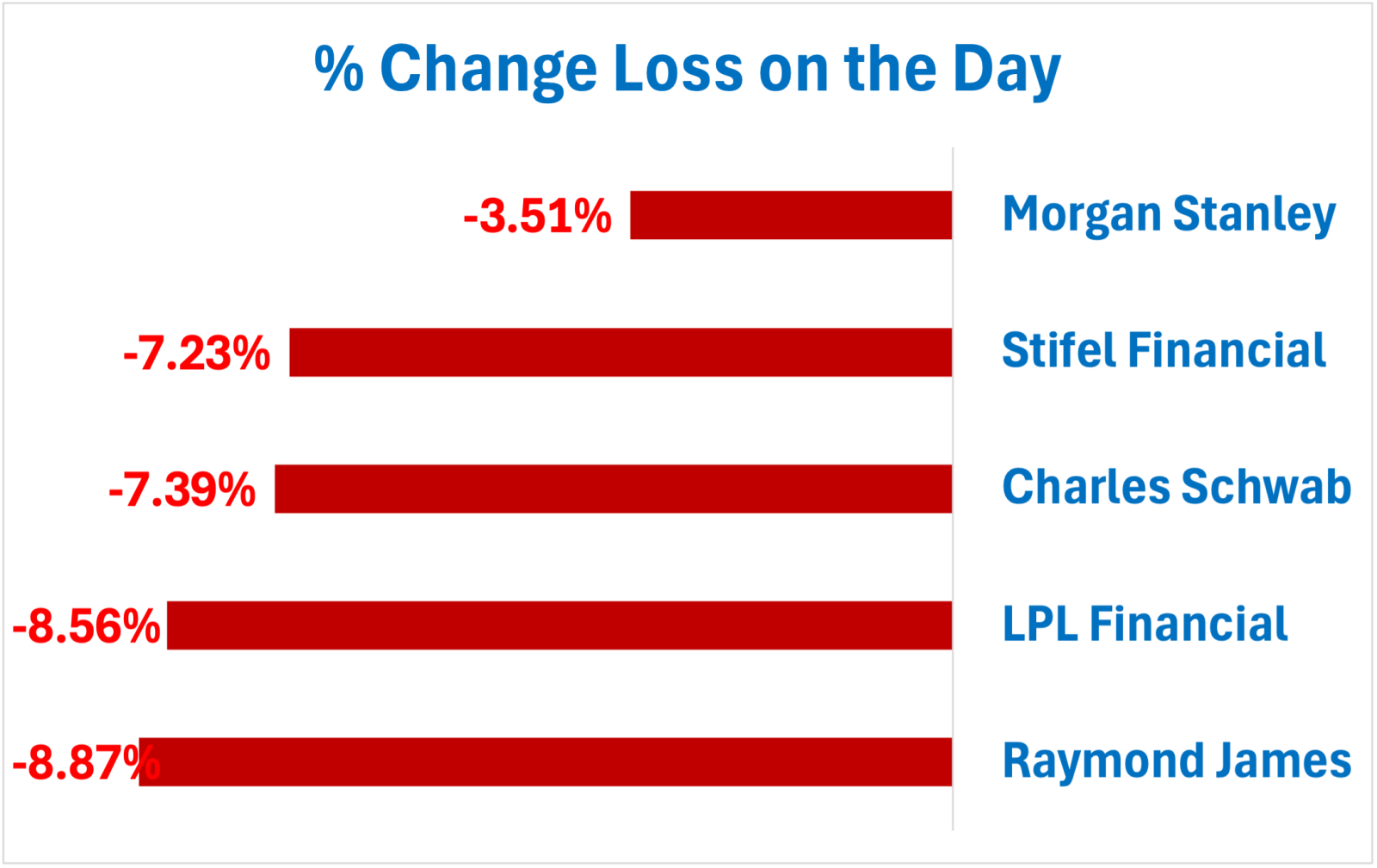

| Raymond James | $158.40 | -8.87% |

Seen as vulnerable to disruption in traditional advisory models.

|

| LPL Financial | $359.58 | -8.56% |

Investors feared a loss of market share to tech-enabled competitors.

|

| Charles Schwab | $99.29 | -7.39% |

Anxiety over the impact on its massive retail brokerage business.

|

| Stifel Financial | $104.15 | -7.23% |

Caught in the sector-wide “AI-driven rout.”

|

| Morgan Stanley | $118.42 | -3.51% |

Less affected due to its scale and high-net-worth client stability.

|

Altruist’s Hazel platform is positioned as an AI-native system that ingests client tax returns (including Forms 1040), pay stubs, and account statements, applies tax logic, and generates personalized tax-planning strategies in minutes. This description aligns with Altruist’s own product positioning and third-party reporting.

In early February 2026, multiple publicly traded brokerage and wealth-management firms experienced sharp single-day declines following widespread coverage of Hazel’s new tax-planning capabilities. Schwab, LPL Financial, and Raymond James each fell in the high single to low double digits intraday, in some cases closing down comparable amounts on the day, according to market reports, as investors reassessed the durability of traditional advisory fee models amid AI-driven automation.

CEO Wenk has publicly framed Hazel as addressing one of the advisors’ most time-consuming pain points. He has described tax planning as “one of the most powerful ways advisors can improve outcomes, but also slow and mentally draining,” and has said Hazel “expands what a single advisor can handle” while making “average advice a lot harder to justify.” This language closely matches external coverage and public commentary.

“Hazel is a game changer for advisors. She’s designed to take on the work that weighs most on them… By unifying all of these core functions in one platform, she’s making it easier for advisors to do what they got into this business to do in the first place—help people,” says Wenk.

Accounting & Tax Software Sector Reaction

Survey research shows that AI adoption is already widespread across professional services, though initial use cases differ.

Across professional services, including legal:

- About 46% of professionals report that their organizations invested in new AI-powered technologies in the past 12 months.

- Roughly 30% say they regularly use AI tools for drafting, editing, or task initiation.

- Legal professionals estimate AI could free up nearly 240 hours per year—about five hours per week—by automating routine research, drafting, and document review tasks.

- Approximately 72% of legal professionals describe AI as a transformative force.

(Thomson Reuters Institute, Future of Professionals 2025)

Accounting and tax firms:

- Roughly 28% of tax professionals report using open, public GenAI tools such as ChatGPT for personal use.

- Fewer than 10% currently use tax-specific proprietary GenAI tools, though about 44% plan to adopt tax-specific tools within the next several years.

- About 10% of firms report GenAI use organization-wide, with another 40% planning or actively considering adoption.

- Among firms using or planning to use GenAI, cited use cases include accounting/bookkeeping (84%), tax research (84%), tax return preparation (69%), and tax advisory services (67%).

(Thomson Reuters Institute; CPA.com)

Financial advisors and RIAs:

- About 43% of U.S. advisors say they currently use or plan to use generative AI for digital marketing and related client-facing activities.

(Broadridge survey)

The immediate impact of AI differs by profession, but the economic pressure point is similar: AI compresses time-on-task.

Legal services: AI adoption has initially focused on high-volume language work, such as drafting, summarization, research synthesis, and document review. As time requirements fall, pressure mounts on billable-hour realization for commoditized work, accelerating shifts toward fixed-fee, subscription, and value-based pricing models.

Accounting and tax: GenAI adoption is concentrated in research, return preparation, bookkeeping, and advisory workflows. Surveyed firms are divided on pricing impacts: about 40% believe GenAI may eventually support higher billing rates, while roughly 56% expect to pass through at least some AI-related costs to clients. Notably, about 92% say clients have not yet dictated pricing expectations, leaving firms to determine how productivity gains translate into fees.

Financial advisory: Advisory businesses were already operating under fee-compression pressure. AI-driven automation of planning and tax-alpha workflows raises the baseline expectation for service quality, pushing differentiation toward holistic planning, coordination, and relationship management rather than implementation alone.

Key points on Intuit:

- Price weakness is tied to both sector rotation and AI-driven growth concerns.

- Sell-off not isolated to Hazel AI; broader reevaluation of SaaS/software multiples weighed on shares.

- Analyst positioning remained constructive, with many analysts still rating shares a Buy despite volatility, partly due to Intuit’s entrenched accounting/tax software ecosystem and roadmap for AI-enhanced features.

Key points on Thomson Reuters:

Thomson Reuters (TRI) Thomson Reuters, a major provider of professional tax, accounting, legal, and compliance software (including platforms like ONESOURCE for tax and transfer pricing), showed relative resilience compared with pure-software peers during the early February market downturn. Latest stock data show TRI trading modestly positive in early February, around $89 with general stability, in contrast to the sharp declines seen in broker/dealer equities.

Thomson Reuters’ reaction was supported by firm financial results reported on Feb. 5, 2026, showing continued organic growth across its Legal, Tax & Accounting and Audit segments, and a clear strategy to invest in AI capabilities that augment, rather than replace, professional workflows.

CEO Steve Hasker emphasized scaling “agentic capabilities” to deliver speed and clarity for customers, underscoring confidence in AI as a differentiator rather than a threat to its subscription/licensed software base.

Across accounting and tax software names, the sequence of events around the February mini-crash suggests two contrasting investor reactions:

- Pure software/infrastructure names (e.g., Intuit) experienced valuation repricing as broader AI disruption fears intensified — particularly where revenue is tied to tax preparation and advisory tasks that could be automated.

- Content + workflow-oriented platforms (e.g., Thomson Reuters) exhibited relative defensive characteristics, as investors valued stable subscription cash flows and the company’s strategic integration of AI into deeply embedded professional tools.

This dichotomy illustrates how the market is differentiating AI risk vs. AI enablement among software and data vendors serving the accounting and tax ecosystem.

How AI Is Impacting Professional Services (Lawyers, Online Legal Platforms)

The same kinds of AI-driven disruption that rattled brokerages and wealth managers with Hazel AI are also reshaping professional services such as legal practice and online legal platforms, with significant implications for lawyers, paralegals, and consumers alike.AI in Legal WorkflowsAI tools are increasingly embedded in day-to-day legal practice, automating tasks that traditionally accounted for substantial time and cost.

According to surveys and industry research, AI is driving productivity gains across routine legal tasks such as document review, research, contract analysis, and summarization. Major legal professionals report that AI could save lawyers nearly 240 hours per year by handling repetitive work, such as legal research and drafting basic briefs, allowing human lawyers to focus on higher-value judgment and strategy. 72% of legal professionals see AI as a transformative force, and more than half of firms are already seeing a return on AI investments.

AI is now used to:

- Automate document review and legal research, dramatically reducing the manual effort required to sift through case law and contracts.

- Draft routine memos, contracts, and summaries, accelerating turnaround times and lowering overhead costs for practices large and small.

- Flag legal risk and compliance issues through machine learning models trained on vast legal corpora.

Investor reaction suggests a growing distinction between AI risk and AI enablement.

Pure software and infrastructure vendors, including tax-exposed names such as Intuit and H&R Block, particularly those tied to automating tasks historically performed by professionals, have faced valuation pressure amid AI-driven uncertainty. Intuit, for example, saw shares fall sharply in early 2026—nearly 30% year-to-date in some reports and roughly 45% below prior highs—as investors weighed slower growth forecasts and the possibility that AI could erode the value of traditional tax-preparation and small-business software. Despite this, many analysts maintained Buy ratings, citing Intuit’s ecosystem strength and ongoing integration of AI into QuickBooks and Credit Karma.

By contrast, content-plus-workflow platforms have been viewed more defensively. Thomson Reuters reported solid Q4 and full-year 2025 results in early February 2026, with continued organic growth across its Legal, Tax & Accounting, and Audit segments. Management emphasized scaling “agentic capabilities” to deliver speed and clarity for professional users. Investor commentary has framed Thomson Reuters as an AI enabler deeply embedded in professional workflows, rather than a vendor at risk of disintermediation.

The pressures evident in tax and advisory mirror those reshaping legal services. AI tools now automate document review, legal research, contract analysis, and routine drafting. Industry research suggests that 40–50% of legal tasks are technically automatable today, with some studies indicating even higher rates for paralegal workflows.

Legal platforms such as Westlaw Precision AI, Lexis+ AI, Harvey, and Casetext CoCounsel, including platforms embedded in the Thomson Reuters and LexisNexis ecosystems, illustrate how proprietary content combined with AI agents can augment professional judgment rather than replace it outright. Online legal providers, including LegalZoom and Rocket Lawyer, are integrating AI to expand access and personalization, challenging traditional attorneys on cost and speed while raising new governance and ethics questions.

Across law, accounting, tax, and advisory services, AI is forcing firms to confront the same strategic question: where does human judgment remain uniquely valuable once routine analysis and drafting approach zero marginal cost? Investors appear to be repricing firms based on how convincingly they answer that question.

Rather than a single app “crashing” stocks, Hazel has become a symbol of a broader shift. AI is no longer viewed solely as a productivity enhancer; it is increasingly treated as a structural force capable of reshaping pricing models, margins, and competitive advantage across professional services.

Not a Crash — a Repricing

Hazel has become a symbol of a larger transition.

The volatility following its launch reflects not a single-product shock, but a repricing of human-capital-dependent business models across professional services. AI is no longer viewed solely as a productivity tool. It is increasingly treated as a structural force capable of reshaping pricing models, seaffing structures, competitive moats, and margin durability.

The question for firm leaders is no longer whether AI will be adopted. It is whether their pricing model can survive it.