Revenues and client rosters outpace profit gains as firms battle cost pressures.

By CPA Trendlines

CPA firms heading into the 2026 tax season expect revenue gains driven primarily by higher prices, not by adding clients, even as a majority anticipate another heavy extension season.

JOIN the Busy Season Barometer survey here.

MORE TAX, PRICING, and THE 2026 OUTLOOK

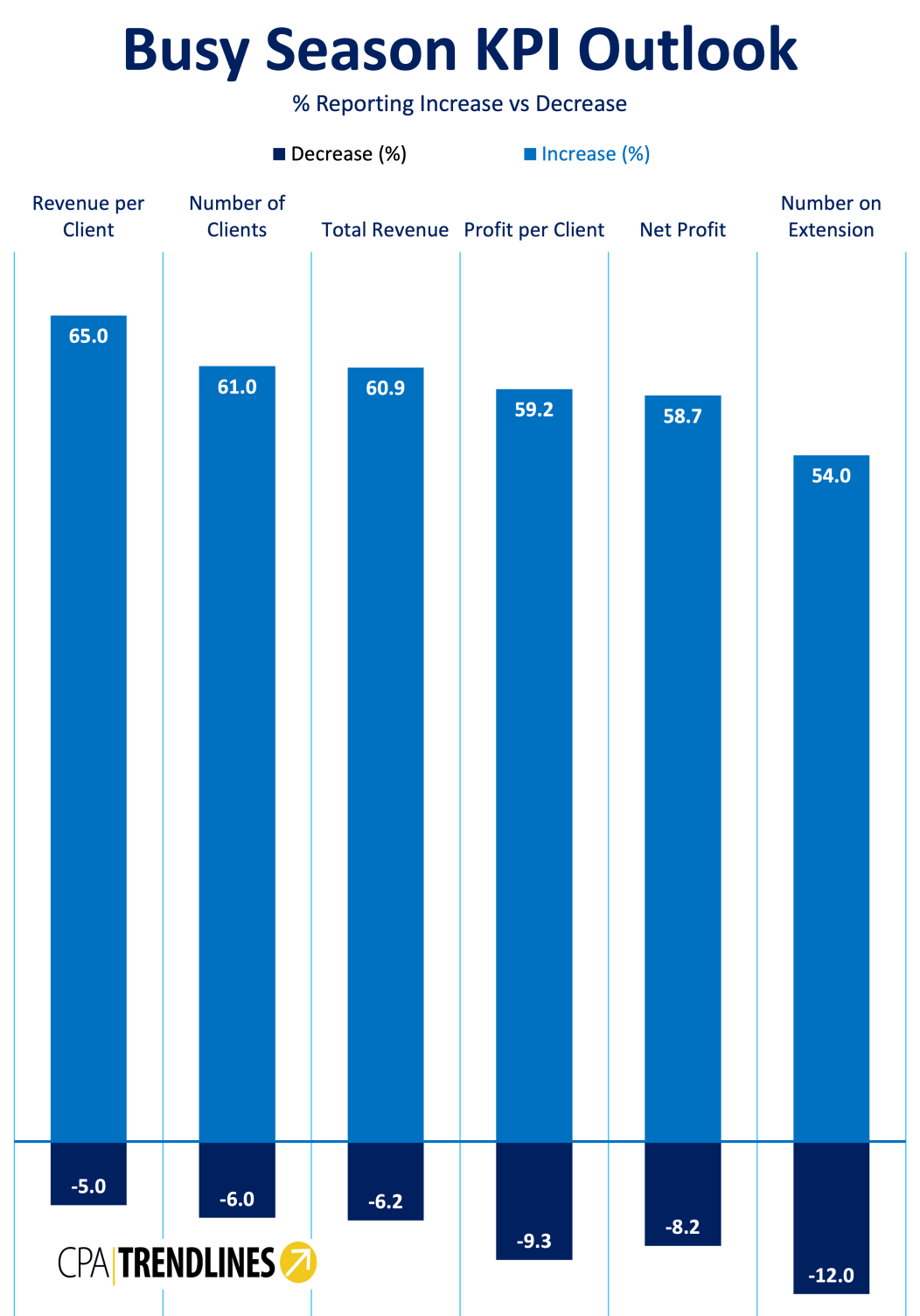

According to the CPA Trendlines Busy Season Barometer, about 6 in 10 firms expect total revenue to increase this year, while roughly one-third expect revenue to hold steady. Profit expectations trail revenue slightly, a pattern that points to continued cost pressure even as clients and would-be clients clamor for more, and more high-end, services

Firms are responding with everything they have: Price increases. Hiring more help. Mergers. Tech upgrades. New automations. And streamlined workflows.

For example, Wendi Hall, director of tax and accounting at DBHW Wealth Partners in South Milwaukee, Wisc., reports, “Our practice management software and document storage software have incorporated new AI technology we are trying to implement.”

“Hopefully,” she adds, “that will reduce staff processing burdens.”

In Cedar Hill, Texas, David L. Dickerson is “merging another firm into ours.” As if that wasn’t enough, he’s also modifying the firm’s engagement letter and client organizer and raising prices.

They’re raising rates in Brunswick, Maine, also. Bob Langworthy, founder and president of Maine Beancounters, is also “rolling out a new document management software.”

Nils Lenz, at B&N Lenz in Zephyrhills, Fla., is keeping it in the family. “I will be giving my daughter more work to do to help considerably with my backlogs.”

But for some, the end of tax season can’t come quickly enough. For example, Dave Kwiecinski in Winthrop, Ill., is both a fitness trainer and, in his words, “a recovering CPA, who is now strongly contemplating full retirement.”

Selectively optimistic

Pricing expectations are stronger than any other metric in the survey. Nearly two-thirds of firms expect revenue per client to rise, outpacing expectations for client growth. By contrast, expectations for the number of clients are positive but more restrained, with about one-third of firms expecting no material change.

Taken together, the results point to a profession that is selectively optimistic: confident in its ability to raise prices and protect margins, but realistic about capacity limits and timing pressures. For many firms, growth in 2026 will depend less on expansion and more on execution.

The gap between revenue and client expectations points to a familiar strategy: firms are counting on higher prices, expanded scope, or a shift toward more complex work, rather than simply adding more clients. Firms expect to make more money without taking on proportionally more clients.

Pricing power shows up clearly — profits less so.

Revenue per client is one of the most decisive metrics in the survey. About two-thirds of firms expect it to rise, with very few anticipating declines. This confirms that pricing increases are not only planned but broadly expected to stick.

Profitability tells a more cautious story. While most firms still expect profit per client and net profit to increase, optimism here is weaker than for revenue. A sizable share of respondents expects profits to remain flat, and a non-trivial minority anticipates declines.

That divergence suggests cost pressure — particularly labor — is absorbing some of the revenue gains firms expect to generate.

Apparently, firms believe they can charge more, but they are less certain that those increases will fully translate into higher profits.

Extensions remain the pressure point

One metric stands apart from the rest: the number of returns on extension. Unlike revenue or pricing, an “increase” here is not a positive signal. Across all three waves, most firms expect the number of extensions to rise, with relatively few anticipating any decline.

This expectation reinforces what firms have been reporting for several years: work spills past traditional deadlines, driven by staffing shortages, client delays, and increasingly complex filings. Even as revenue expectations improve, the extension burden remains unresolved.

Firms expect revenue growth and continued pricing power. Client growth will be selective, not expansive. Profit gains are likely but constrained. And capacity limits — especially reflected in extension volume — remain the industry’s defining challenge.

Busy Season 2026 won’t be a story of firms pulling back, but a story of firms adapting — growing where they can, pricing more confidently, and managing workload as best they can in a tight labor market.

Managed growth

For many firms, growth is no longer tied primarily to taking on more clients. Instead, it is increasingly driven by higher fees, expanded advisory work, and tighter alignment between pricing and complexity. Respondents repeatedly pointed to deliberate pricing resets undertaken over the past two years as a foundation for their confidence entering 2026.

That shift helps explain why overall optimism has remained resilient despite persistent staffing shortages and workflow pressure. Firms that have adjusted pricing appear better positioned to absorb higher costs and capacity constraints without sacrificing margins. Growth, in this context, is being managed rather than chased.

In fact, staffing strain does not appear to dampen expectations. Firms reporting staffing shortages as a top concern were more optimistic about their overall metrics than firms that did not cite staffing pressure. More than six in ten firms facing staffing constraints still expect growth, compared with just over four in ten firms without staffing pressure.

Extensions, extentions, extensions

This counterintuitive pattern suggests staffing shortages are being felt most acutely by firms with strong demand. Rather than signaling distress, staffing strain increasingly reflects success: firms with robust pipelines and pricing power are encountering capacity limits first.

Higher margins, however, do not necessarily translate into easier busy seasons. Improved economics make pressure more survivable, not less intense. Even firms expecting growth acknowledge that long hours, deadline compression, and client readiness issues remain structural features of tax season.

Importantly, firms expecting more extensions are not materially more pessimistic about their overall performance than firms expecting extension volumes to remain flat. That alignment reflects a shift in how extensions are perceived. Rather than a breakdown in process or client management, extensions are getting treated as a normal feature of modern tax practice, particularly for firms handling complex returns and advisory-heavy relationships.

How firms are operationalizing growth

For many firms, expectations of growth are not abstract forecasts, but the result of deliberate operational choices made well before filing season. Accountants are implementing a range of tactical adjustments to align capacity with demand and protect margins amid continued staffing constraints.

One of the most common strategies is stricter client triage. Firms report being more selective about which clients they accept, retain, or disengage, with a sharper focus on complexity, responsiveness, and willingness to pay for timely work. Low-fee, high-friction engagements are increasingly being declined or priced out, freeing capacity for higher-value relationships.

Fee enforcement has also tightened. Firms that reset pricing over the past two years are now more consistent in holding the line, particularly on late or incomplete work. Several respondents noted that clear deadlines, surcharge policies, and upfront engagement terms have become standard tools for managing client behavior rather than last-resort measures.

Workflow redesign is another area of focus. Firms described spreading work more evenly across the calendar, using extensions strategically to manage peaks, and investing in automation to reduce manual bottlenecks. While technology alone has not eliminated busy-season pressure, it has helped firms redirect staff time toward higher-value tasks.

Not easily shocked

Finally, firms are reassessing how gains are reinvested. Rather than simply absorbing higher profits, many are channeling resources into compensation, training, and process improvements aimed at retention and sustainability. These investments reflect a recognition that pricing gains are only durable if matched by operational resilience.

Risks remain. Firms continue to cite IRS dysfunction, regulatory uncertainty, and technology integration challenges as potential disruptors to an already compressed season. Yet concern about these risks does not materially suppress growth expectations, suggesting firms have learned to operate despite them.

Another notable finding is what has not changed. Growth expectations have remained remarkably stable, indicating that firms are no longer recalibrating in response to each new shock. Instead, they appear to be planning around known constraints and focusing on execution.

As filing season opens, the key question is no longer whether growth will occur, but how that growth will be absorbed. Firms that pair pricing discipline with investments in process, staffing, and technology may be better positioned to convert growth into sustainable operations.

Setting Boundaries

Busy Season 2026 may not bring relief. But for firms that have aligned expectations, pricing, and capacity, it may confirm that growth and strain have become inseparable features of modern accounting practice — and that managing both deliberately is now central to long-term success.

For firm leaders, the 2026 outlook means growth is increasingly a choice, not an accident. The firms expecting stronger performance are not counting on external relief or sudden efficiency gains. They are making deliberate decisions about pricing, client mix, and capacity—and living with the trade-offs that follow.

Leadership in this environment is less about chasing incremental revenue and more about setting boundaries. That includes deciding which clients to serve, how firmly to enforce deadlines and pricing policies, and where to reinvest gains. Firms that fail to make those choices explicitly risk having them made by staff burnout, missed deadlines, or declining service quality.

Intentionality matters

The data also suggest that financial improvement alone is not a sufficient measure of success.

Higher margins without parallel investments in people, process, and technology may prove short-lived. Firms that translate pricing power into better workloads, clearer workflows, and more sustainable careers are more likely to retain talent and preserve client relationships over time.

Ultimately, Busy Season 2026 appears set to reward clarity. Firms that enter the season with realistic expectations, disciplined pricing, and an operational plan for absorbing growth are better positioned to navigate the strain ahead.

Relief may remain elusive, but intentional management can turn pressure into a productive force rather than a corrosive one.