Busy Season 2026: Chaos Looms as DOGE Cuts and OBBBA Changes Collide

Downsizing and backlogs become national policy.

By CPA Trendlines Research

By CPA Trendlines Research

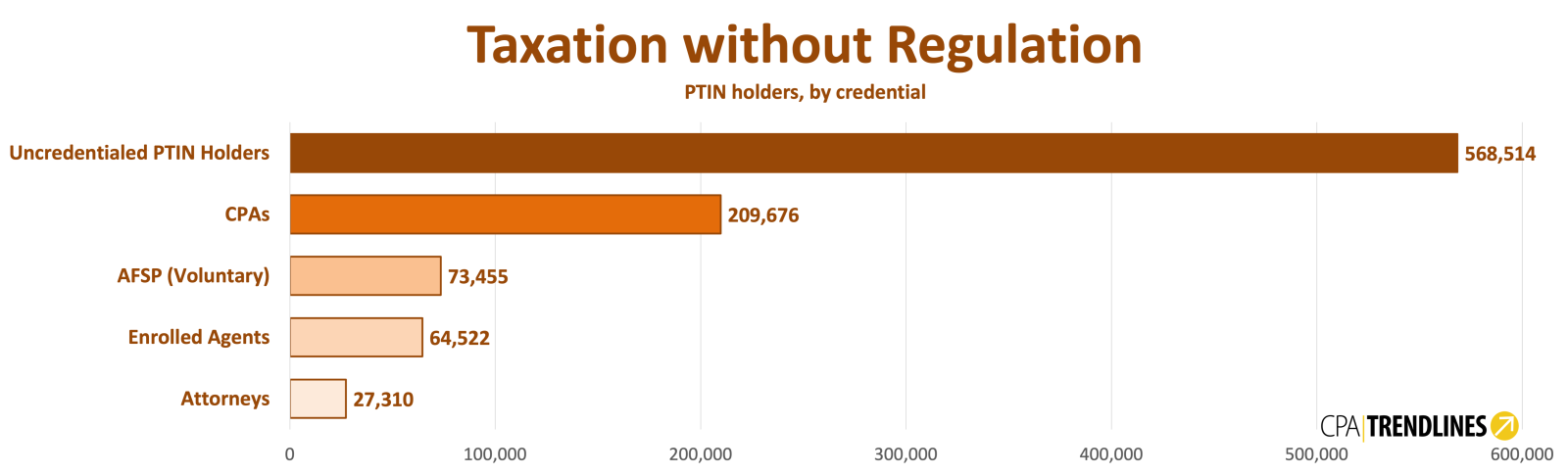

The Internal Revenue Service is heading into the 2026 filing season with fewer employees, more complex tax law changes, and less capacity to resolve problems when returns go wrong — a combination federal watchdogs say will leave tax professionals managing the fallout even as headline service metrics appear stable.

JOIN the Busy Season Barometer daily pulse check for top trends, best practices, and emerging opportunities

MORE Tax, Busy Season, Outlook 2026

National Taxpayer Advocate Erin M. Collins says most taxpayers with straightforward, electronically filed returns should see few disruptions. But she warned that the true test of the filing season will be how the IRS handles the millions of returns that require human intervention — at a time when the agency’s workforce has been cut by more than a quarter.

Less capacity, more obligation.

Less capacity, more obligation.