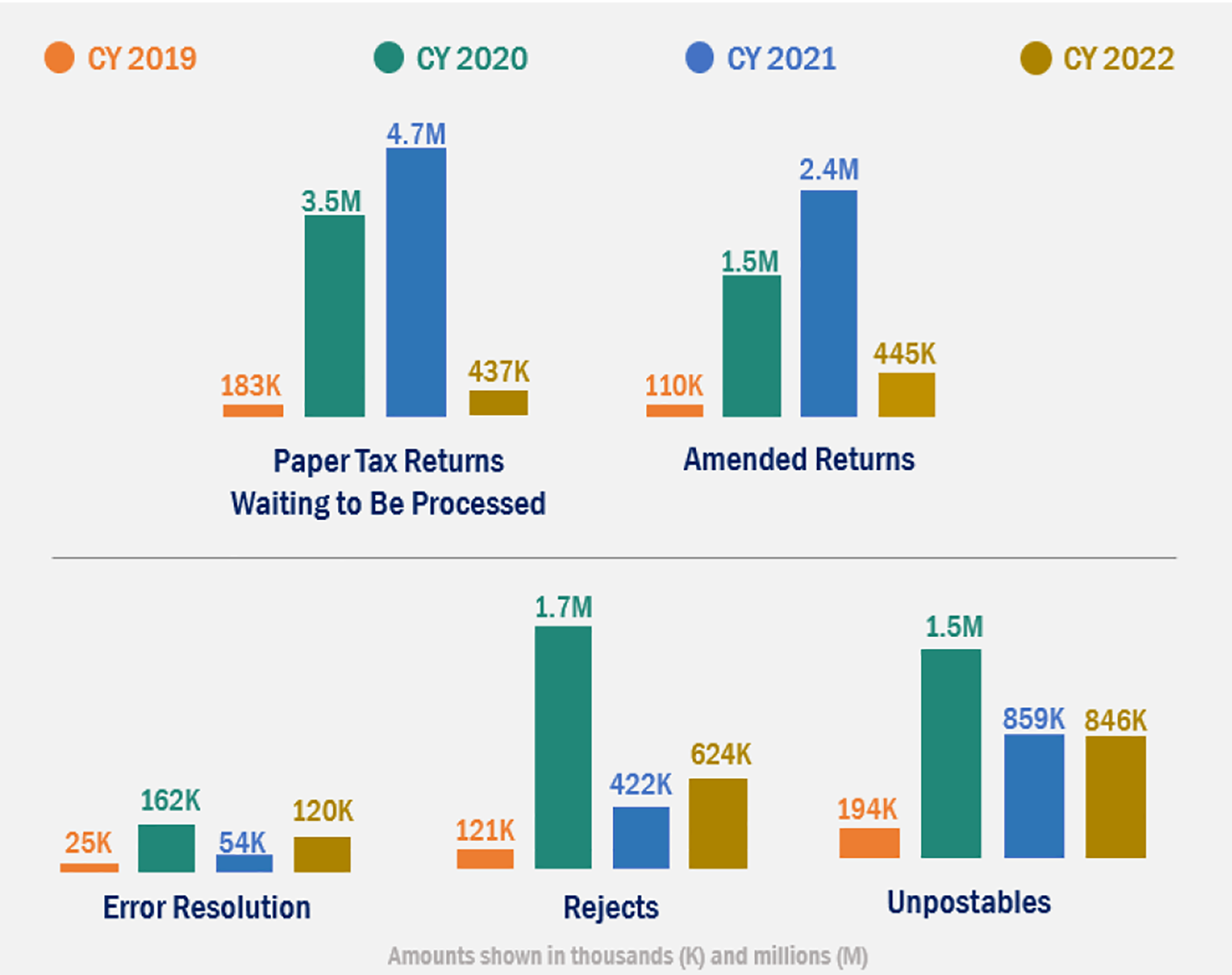

IRS Still Falling Short on Service

It doesn’t seem to know which problems most need solving.

By CPA Trendlines Research

The Internal Revenue Service wants to do a better job. It really does. It got an infusion of funds (though it seems some might get taken back), and it’s got a Strategic Operating Plan with objectives for improving the taxpayer experience and modernizing operations.

MORE: Must the IRS Be a Dark Hole? | 10 Tips to the IRS for Beefing Up Staff | Eight Ways the IRS Can Speed Up Processing Tax Returns | IRS Plays Whac-A-Mole with the Phones | Ten IRS Problems That Need Solutions | Treasury IG Sees Progress at IRS | With Fresh Funding, IRS Shows Service Improvements

Exclusively for PRO Members. Log in here or upgrade to PRO today.

And it’s made a lot of progress. But it’s still got wide open spaces to accommodate improvement.

READ MORE →