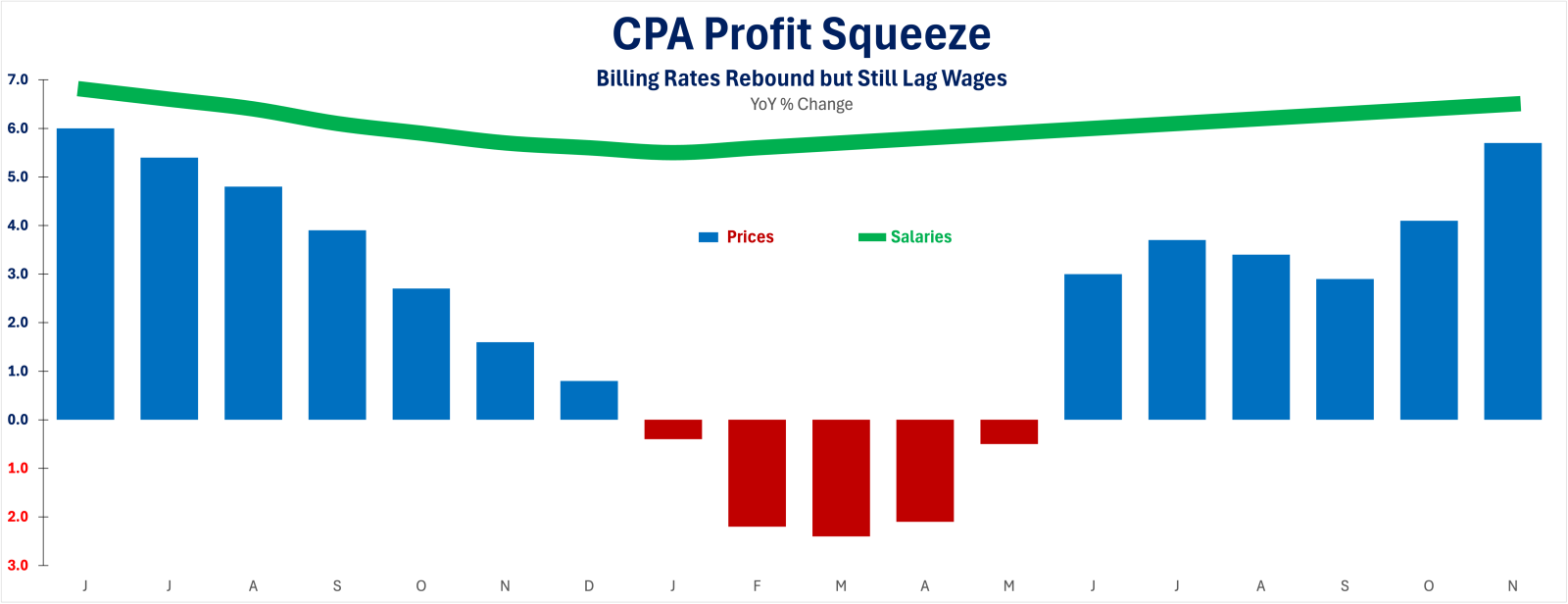

The IRS in 2026: Quiet Backlogs, Harder Fixes, and Late Guidance

Less capacity, more obligation.

Less capacity, more obligation.

By CPA Trendlines Research

Identity theft is becoming one of the biggest time drains for tax professionals this filing season, and the IRS may be less equipped than ever to handle it.

JOIN THE BUSY SEASON SURVEY. GET THE RESULTS

MORE BUSY SEASON BAROMETER | MORE OUTLOOK 2026

According to the IRS Advisory Council—the body representing tax professionals—identity-theft refund cases now take nearly two years to resolve, as staffing cuts and system limits slow IRS response.

But identity theft is only one of a long list of problems that can only get worse this year. Tax professionals are bracing for prolonged client disputes and frustrating follow-ups with an understaffed, ill-equipped IRS.