Our Journey Growing from $500,000 to $5 Million in 10 years – By Changing the Way People Think about Accounting

By Jody Grunden, CPA

The step-by-step blueprint for going virtual in these tough and tumultuous times.

- Practice-proven handbook for building a fully remote workforce delivering high-value CFO services.

- True-life case-study of the firm that actually did it by the people who are making it happen.

- With step-by-step practice aids, checklists, tech guides, illustrated examples, personnel policies, scripts, letters, processes, and procedures.

$375.00 – $395.00

Our Journey Growing from $500,000 to $5 Million in 10 years – By Changing the Way People Think about Accounting

By Jody Grunden, CPA

The step-by-step blueprint for going virtual in these tough and tumultuous times.- Practice-proven handbook for building a fully remote workforce delivering high-value CFO services.

- True-life case-study of the firm that actually did it by the people who are making it happen.

- With step-by-step practice aids, checklists, tech guides, illustrated examples, personnel policies, scripts, letters, processes, and procedures.

TO READ THE FULL ARTICLE

Continue reading your article with a CPA Trendlines Pro membership.

Start benefitting today with the PDF eBook instant download.

Order today, and get the Bonus Appendices with:

- A Recommended Reading List for further study

- The Tech Stack Checklist, and

- The Virtual CFO Client Onboarding Checklist

- Sample engagement letter

The PDF eBook is printable and searchable, with live links to continuously updated reference materials and new developments at the firm as it refines and implements new processes and procedures.

The traditional bound softcover print version is 212 pages, 6×9 inches, contains all the Bonus Appendices and the links to continuously updated reference materials and new developments at the firm as it refines and implements new processes and procedures. (Possible delays due to pandemic-related disruptions.)

Order the Print and eBook Bundle and get the best of each.

How We Pivoted from Accounting to Forecasting

By Jody Grunden, CPA

See Grunden’s latest articles at CPA Trendlines

When I started out in public accounting, I quickly realized that it wasn’t for me.

I was spending up to 80 hours a week away from my brand-new family, and that doesn’t even count the time I spent commuting. It was miserable.

I decided to leave public accounting for the corporate world, where I worked for three years. Three boring years.

By 2002, I thought there had to be a better way.

Scrapping Traditional Accounting

I started Summit CPA in 2002 with the goal of changing the way people think about accounting.

- I wanted to change the way we worked with clients and the value we were offering them as accountants.

- I wanted to offer a better working environment for accountants than the traditional, boring roles that were out there at the time.

- And I wanted to change the way the industry viewed us.

One of the first things I did was hire Adam Hale who became my partner and Summit CPA’s Chief Operating Officer. Adam was able to help take all of the ideas rolling around in my head and put them into place. We chose to name the business Summit CPA Group, rather than Grunden & Hale because we always wanted the firm to be bigger than the two of us.

We wanted to do more for businesses than simply help them file their tax returns and provide them with historical financials that nobody understood. We started out by meeting with clients on a monthly basis to go over their financial statements and try to put everything into layman’s terms. We wanted to help them understand the financial side of their business on a deeper level.

“We quickly came to realize that whenever we started talking about the past, clients’ eyes would gloss over. Clients don’t care about the past. They want to know about the future.”

So, in 2004 we started to implement forecasting into our service. We would teach our clients how to read their financial statements and understand how their actions on a monthly basis were impacting their future.

Dynamic Forecasting: Happy Clients

With dynamic forecasting, we’re not just talking about the income side of things – net profit, gross profit, etc.—we’re also talking about the cash and debt position.

- How much cash is the company going to have in two months, six months, twelve months?

- When are we going to have to rely on the line of credit?

- When can we pay off debt early?

We create a plan and then monitor our situation monthly against the plan, changing assumptions on a regular basis. That’s why we call it a dynamic forecast.

We found that our clients were really intrigued by this. Instead of, “Ugh, I’ve got to go meet with my accountant for two boring hours,” it became, “I’m going to meet with my accountant, and we’re going to talk about strategy and the future of my company!” At that point, we were only meeting with our clients monthly, and they actually wanted to meet with us more often.

We started meeting with them for an hour every week to go over cash flow, forecasting, and overall business strategy.

No Stress-Filled Busy Seasons!

One of the biggest benefits for us was that when the end of the year came, it took a lot less time for us to do our clients’ taxes because we’d already been on top of things and handling their questions throughout the year.

One of the biggest benefits for us was that when the end of the year came, it took a lot less time for us to do our clients’ taxes because we’d already been on top of things and handling their questions throughout the year.

This provided a natural solution for the crazy busy season most accountants endure. And, personally, this was great for me because I was a hockey coach at the time. With hockey season happening at the same time as tax season, I selfishly wanted to be able to work a reasonable schedule year-round. Changing the way we worked with clients made this possible.

Keep in mind, in 2002 the internet didn’t really exist yet, at least not like it does today. From 2002 to 2007, we were providing these services by going out to the client, which meant all of our clients were local. We would show up at their office, or they would come to ours, and there was a lot of inefficiency with this model. Commuting and losing time due to forgotten appointments or last-minute changes created constant challenges. Long term, this limitation was not going to allow us to grow in scale.

We knew that if we really wanted to grow our business, it had to become bigger than Adam and me.

No In-Person Meetings!

With the advances in technology at the time, we were able to shift from in-person meetings to video conferencing.

With the advances in technology at the time, we were able to shift from in-person meetings to video conferencing.

The shift to remote work allowed us to expand our client base in at least six ways:

- Saving on drive time opened up our schedules,

- Enabling us to take on more clients. And,

- Expanding beyond our limited geographical location.

- Training new Virtual CFOs became easier and much more cost-effective.

- Turning clients over to them once they were up to speed on everything.

- Start bringing on new clients — nothing outrageous at first. But to us, the growth was significant.

Going All-In on Internet Advertising.

When it came to advertising, we tried everything. We hired a direct marketing firm to do cold calls, we sent out email blasts, direct mailers, etc. Advertising for CPA firms at that time had been primarily restricted to the Yellow Pages and the local area.

We made a big decision in 2007 to stop putting money into that kind of advertising and instead shift to internet-based advertising.

Everybody Told Us We Were Crazy!

And they were partially right. I think you have to be a little crazy to run your own business. Despite what people thought at the time, I created a website and came up with the term “Virtual CFO” to describe the services we were providing. We were determined to grow beyond our local area, and in order to do this, we needed to think bigger when it came to marketing.

And they were partially right. I think you have to be a little crazy to run your own business. Despite what people thought at the time, I created a website and came up with the term “Virtual CFO” to describe the services we were providing. We were determined to grow beyond our local area, and in order to do this, we needed to think bigger when it came to marketing.

It took four years before we picked up our first client, but eventually, we got our first call in 2011 from a company in Rhode Island called Lullabot (a website design firm that specializes in Drupal).

They found us online and contacted us by email. I reached out to them, and they asked if we could provide our services to them remotely. We said absolutely! That’s how Lullabot became our first truly Virtual CFO client, where we couldn’t actually drive to their location for a weekly meeting. Lullabot loved the service so much that they started referring us to their friends! We ended up with a client from Texas, and then one in New York City, and our business just kept expanding.

“We went from two to four new clients a year, to two to four new clients a month.”

The biggest success of all was that as we were growing, we were truly helping the companies we were serving to grow as well.

What’s Next? Going Global.

What started back in 2002 with just Adam Hale and I has now grown to a team of 40-plus individuals working remotely across the United States (and, hopefully soon, across the world), providing services to hundreds of companies.

We went from a general focus to providing Virtual CFO services to finding our niche within a specific industry—digital services agencies.

We added 401(k) audits to our service offerings and again went from general audit to benefit plan audit to limited scope 401(k) audit.

We are growing at lightning speed, consistently adding about eight new employees per year. It’s been a really fun ride!

We’ve accomplished what we originally set out to do—offering more valuable services as accountants, and creating a sustainable, family-friendly work environment for accountants. We look forward to continuing our mission of changing the way people think about accounting!

So Join Us!

The purpose of this book is to share what we’ve learned along the way in our journey to becoming a virtual accounting firm offering Virtual CFO services and 401(k) audits. Advances in technology are disrupting the accounting industry—in a good way.

The purpose of this book is to share what we’ve learned along the way in our journey to becoming a virtual accounting firm offering Virtual CFO services and 401(k) audits. Advances in technology are disrupting the accounting industry—in a good way.

We’re telling our story not to gloat or brag, but to give you insight from our side after having already done this. We hope that knowing all of this is possible will alleviate any fears that you have and open the doors for you to take a similar journey.

Traditional accounting firms will need to accept these changes and prepare for how they will affect the way they do business, or they are going to get left in the dust.

Maybe we can help you envision and become the firm of the future, and together we will change the way people think about accounting!

How We Became a Distributed Company

“Accountants Love Change!”… said nobody, ever.

Imagine how my office of 18 people, mostly accountants, reacted when I suggested that we close down our brick-and-mortar office and start working as a distributed company. The accounting industry was changing and we needed to change as a company in order to stay ahead in the industry. They didn’t buy it.

Here are some of the excuses they gave me:

Here are some of the excuses they gave me:

- “We won’t be able to.”

- “We can’t meet with people face-to-face.”

- “I’ll be distracted at home because my kids are around.”

- “I don’t have an office.”

- “My internet at home isn’t good ”

You name it, I heard it. So, I caved.

So, I decided to focus on the building we were already in, making the office a really cool, space we could grow into as a company nearly double our size at the time.

The renovations were going to take six weeks. I had to tear down the walls and there was going to be construction everywhere — how else could we get a 250-gallon fish tank inside? So, I asked everyone to appease me and work from home for just that short period of time so we could complete the project. Then we’d all be back in our fresh, new offices.

Guess what happened after six weeks? When it came time for those 18 people to return to the office, 12 asked if they could continue to work from home.

“Turns out, they really liked working from home, once they got used to it.”

What their hesitancy really came down to was a fear of change or a fear of the unknown. But our temporary time out of the office helped give us a new perspective on our ability to work remotely.

How our perspective on remote work changed:

-

Collaborating Remotely:

We found out we were able to collaborate when working remotely just as much as, if not more than, we were when we were in the office together by using tools like Sococo and Slack.

-

Remote Meetings:

We were able to conduct face-to-face meetings using video conferencing tools such as GoToMeeting, Sococo, and Zoom.

-

Working at Home with Kids:

The employees with kids realized the kids could still go to daycare or they could bring someone into the home to babysit while they were

-

Home Office Space:

Those without office space in their homes were able to come up with creative solutions. We realized one of the main keys to being productive when working from home is to have a door so you can close yourself off and focus on your work.

-

Internet Speed:

Employees with concerns about internet speed were able to contact their internet companies and upgrade their service or change to another ISP in order to meet the minimum upload/download speed requirements for running the video conferencing tools and Cloud-based work.

After all of those renovations, $100,000 – and a 250-gallon fish tank – only six people were left in the office.

After all of those renovations, $100,000 – and a 250-gallon fish tank – only six people were left in the office.

Now we’re down to just four, and we’ve grown to about 40 people, distributed all over the country. We are now going global with our team, adding members outside of the United States.

If we had stayed confined to our brick-and-mortar space, we would have outgrown it by now, and I believe we would have had to make some tough business decisions that could have significantly affected our ability to grow.

Now It’s in Our DNA

I wanted to share this story with you upfront because being distributed is a major part of our DNA.

We are a distributed accounting firm. This makes us very unique in our industry. And our willingness to embrace advancements in technology has transformed our client base from a limited local area to a nationwide one. Running a distributed accounting firm comes down to three key areas: people, technology, and process. I’ve structured this book to cover each of these three areas in detail. Let’s dive in!

Table of Contents

With Step-by-Step Practice Aids, Checklists, Tech Guides, Illustrated Examples, Personnel Policies, Scripts, Letters, Processes, and Procedures.

As Told by the People Who Are Actually Making It Happen

PART 1 – PEOPLE

Chapter 1: Core Values & Remote Work Culture

-

- 126 Core Values Every Organization Should Consider

- We Settled on Six:

- Humor

- Empowerment

- Adaptability

- Collaboration

- Curiosity

- Candor

Chapter 2: Using DiSC Styles to Work Together Effectively as a Remote Team

-

- The Four Behavioral Styles Every Firm Needs

Chapter 3: Developing a Leadership Team

-

- The Biggest Mistake a Leader Can Make

Chapter 4: Accountability vs. Organizational Chart

-

- When the Old-Fashioned “Org” Chart Goes Wrong

Chapter 5: Running Effective Leadership Team Meetings

-

- The Three-Letter Formula that Assures Success

Chapter 6: Build Trust Through Transparency

-

- Why You Must Share Your Financials with All Employees

Chapter 7: The Hidden Cost of Running a Distributed Company

-

- No, Just Because You’re Paying Less Rent, Doesn’t Mean You’re Pocketing More Profit

Chapter 8: Thinking Outside the (Geographical) Box and Hiring Remotely

-

- The Secret to Getting 700 Great Resumes for One Job Opening

- Determining a Candidate’s True Potential: 10 Sample Interview Questions

- The Four Success Traits That Have Nothing To Do with Accounting

Chapter 9: Employee Retention – Keeping the Right People on the Bus

-

- What’s Your Team Saying about Your Firm?

- And Why Are You Afraid to Ask?

Chapter 10: Traditional Benefits for Remote Employees

-

- Why You Can’t Build a Great Firm with Only Independent Contractors

Chapter 11: Creative Perks for Remote Employees

-

- How an Extra $325 a Month Pays Off in Productivity and Profit

- And Don’t Forget Birthdays, Anniversaries and Holidays

- Why You Need This Extra Channel in #Slack

PART 2 – TECHNOLOGY

Chapter 12: Innovation – Becoming the Firm of the Future

-

- No! To Billable Hours.

- Yes! To Flat-Rate Pricing

- Why Clients Love It and We Do Too

-

- No Half-Measures: Go 100% Remote, or Go Home

- Burn the Books. Smash the Pencils.

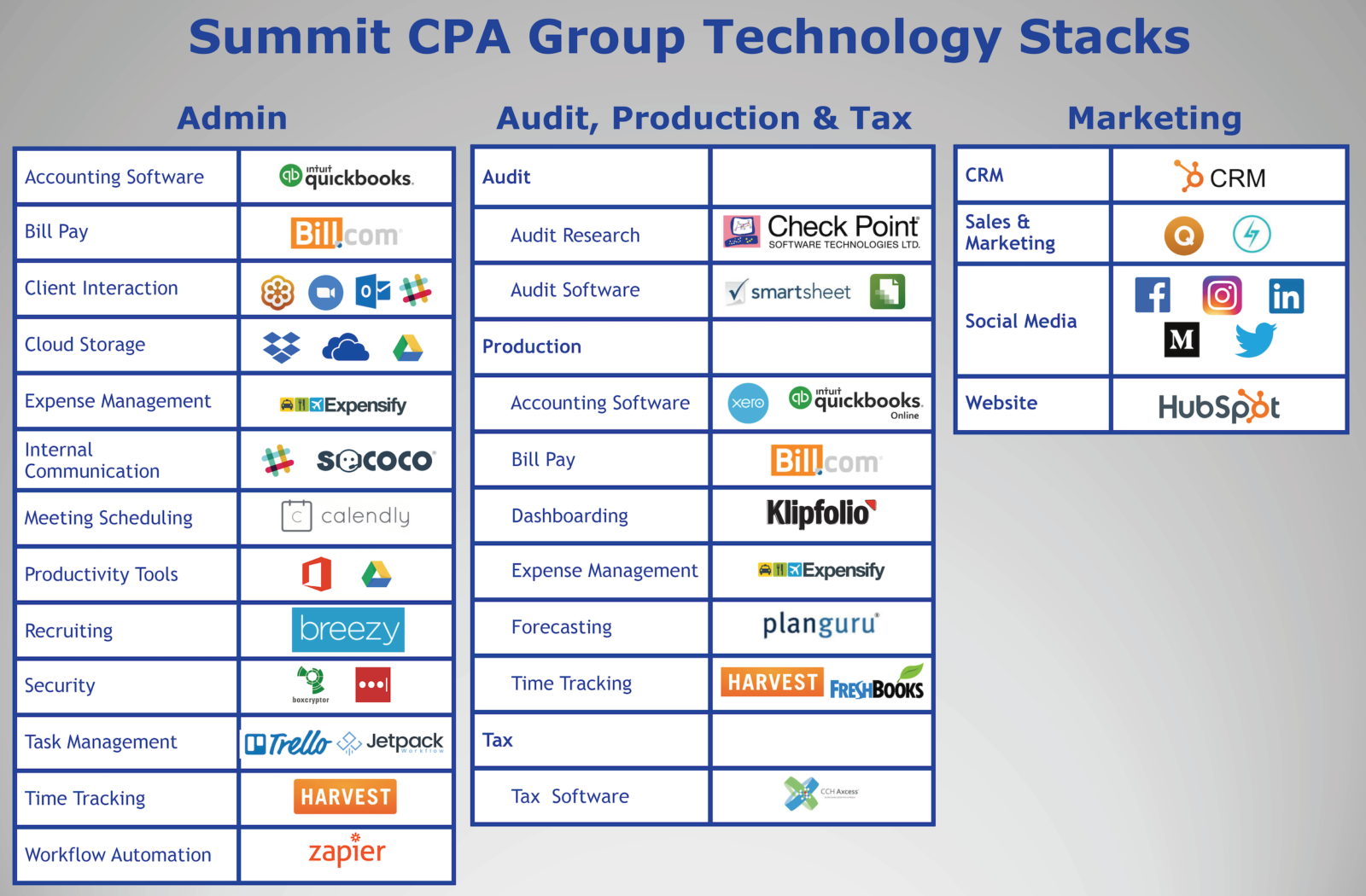

Chapter 14: Standardizing Your Tech Stack

-

- The Three Primary Tech Stacks

Chapter 15: Tools for Communication, Collaboration & Productivity

-

- The Essentials:

-

-

- Accounting Software

- Audit and Audit Research

- Bill Pay

- Client Interaction

- Cloud Storage

- Dashboarding

- Expense Management

- Forecasting

- Internal Communication

- Meeting Scheduling

- Recruiting

- Security

- Task Management

- Tax

- Time Tracking

- Workflow Automation

-

Chapter 16: Evaluating the Effectiveness of New Tools

-

- Five Questions to Ask When Considering New Tools

Chapter 17: Evaluating the Effectiveness of Existing Tools

-

- The Game-Changers that Deliver Competitive Advantage

- Why You Don’t Measure ROI in Dollars and Cents

Chapter 18: How Security Differs in a Distributed Company

-

- Encryption

- Smartphone WiFi

- Personal VPNs

- Password Management

Chapter 19: Security Threats & Tech Solutions

Chapter 13: Our Approach to Technology

-

- When the FBI Comes Knocking at Your Door (Yes, It Happened.)

- Why the Cloud Is Safer than Your File Cabinet

- Embracing Two-Factor Authentication

- Go Phishing. See Who Takes the Bait.

Chapter 20: Automation & the Future of Accounting

-

- The Robots Are Already Here (That’s How Sneaky They Are)

- Automate, Automate, Automate

- How Bots Are Saving Us $200,000 a Year

PART 3 – PROCESS

1. Internal Process

Chapter 21: Why & How We Develop Process

-

- Why Checklists Will Never Die

Chapter 22: Using Workflow Management Software to Increase Efficiency

-

- Standardize 80% of Your Activities. Clean Up on the Other 20%

- Document Everything

- Leverage Video

Chapter 23: Evaluating Workflow Management Software

-

- Why Fast and Easy Implementation is Neither

- The Three Elements to Look for in a Workflow App

- How to Test It with a Team

- The Online Answer Machine You Never Thought to Use for Choosing Professional Software

- Why Creating Your Own User Manual Is So Much Better than the Vendor’s

Chapter 24: Onboarding a New Employee

-

- “See How the Soup Is Made”

- Turning the New Accountant into the New Virtual CFO

- Transitioning Clients to New Staffers

- When It’s Sink or Swim, You Need the Life Jackets

Chapter 25: Evaluating the Effectiveness of Your Accounting Team

-

- Employee Satisfaction: The Question No One Asks, But the Answers Speak Volumes

- Client Satisfaction: Where to Look for the First Signs of Trouble

- Profitability: How to Spot Efficiency Problems Early

2. External Process

Chapter 26: The Services We Provide

-

- Virtual CFO

- Level 1: Virtual CFO (full-service)

- Level 2: Controller

- Level 3: Transactional

- Accounting and Tax

- 401(k) Audits

- CPA Firm Augmentation

- Virtual CFO

Chapter 27: The Virtual CFO Process

-

- Everything Starts with Onboarding!

- The six- to eight-week process that begins right away

- The Onboarding Specialist Role:

- Setting the onboarding timeline and client expectations

- Gathering client information (passwords, tax returns, )

- Doing the heavy lifting during onboarding

- Cleaning up the client’s accounting software

- Creating the forecasting model and KPIs

- Participate in the client’s weekly leadership meetings

- Follow up with a report

- Monthly invoicing meetings

- Monthly forecasting meetings

- Weekly bill pay meetings with two- to six-week cash flow projections

- Plus: Always available anytime during the month for questions, calls, and impromptu meetings

Chapter 28: Five Ways to Bill Clients

-

- Hourly Billing: The better you get, the less you make. Does that make sense to anyone?

- Flat-Fee Billing: Know your costs.

- Retainer-Based Billing: The method used by our digital ad agency clients, and they hate it.

- Value-Based Billing: Why 30% is the magic number.

- Subscription-Based Billing: Get paid weekly

Chapter 29: Our Virtual CFO Approach

The Four Most Important Financial Metrics for Growing Your Business:

1) Money in the Bank

-

-

- Why 40% is fundamental

-

2) Production Metrics

-

-

- Utilization Rate

- Average Bill Rate

- Effective Rate

- Effective Cost

-

3) Financial Metrics

-

-

- Admin Expenses

- Production Expenses

- Marketing Expenses

- Facility Expenses

-

4) Pipeline

-

-

- Comparing contract to capacity

- Celebrate? Or Calibrate?

-

Chapter 30: The 401(k) Audit Process

-

- Getting Paid Always Comes First

- The Six-Step Work Plan

- The Six Requisite Documents

- Preparation and Testing

- Variance Questions and Answers

- Deliver Draft Report and Get Final Payment

- Final Report

- The Marvel of Mini-Deadlines

Chapter 31: Onboarding a New Client

-

- Virtual CFO Onboarding

- You never get a second chance to make a first impression

- Eight weeks to prove you’re worth the money

- What to do when clients want instant results

- 401(k) Audit Onboarding

- Fine-tuned systems and plenty of templates

- Virtual CFO Onboarding

Chapter 32: Open Communication with Clients

-

- The three steps to better client relations

3. Marketing and Sales Process

Chapter 33: Marketing Is About Thought Leadership

-

- It’s different at a virtual firm

- How to tap into the talent, experience, and passion in your firm

- The riches in niches

- Chapter 34 Virtual CFO Sales & Conversion

Chapter 34: Virtual CFO Sales and Conversion

-

- The Six-Step Process to Close the Deal in 14 Days

- Five Questions to Determine if the Prospect Would Be a Good Client

- How Our Online Pricing Calculator Makes the Sale

- Four Essential Components of a Follow-Up Email

- The Right Software for Proposals, SOWs, and Engagement Letters

- Five Best Practice Tips for Sales and Conversion

Chapter 35: 401(k) Audit Sales & Conversion

-

- The Three Ways New Clients Find Us

- Setting Expectations for Doing the Audit Remotely

Closing Thoughts

-

- Going Virtual Is Not Much of a Choice Anymore

- You’ll Find Opportunities Without Borders

- Hire the Best Talent – Anywhere

- Land the Right Clients – Everywhere

- Pick a Specialty, Establish Your Expertise, and the Let the Business Come to You

- Run Your Business Like a Boss, and Leave the BIllings to Others

BONUS APPENDICES & REFERENCE MATERIAL

(including links to real-time checklist updates from the firm)

- Recommended Reading List

- The Summit CPA Tech Stack Checklist

- The Summit CPA Virtual CFO Client Onboarding Checklist

- Sample engagement letter

The Tools of the Trade:

More than Two Dozen Tech Apps and Systems Reviewed and Explained

About the Author

Jody Grunden is the Co-Founder and CEO of Summit CPA Group, with more than 20 years of both public and corporate accounting experience. He is a member of both the American Institute of Certified Public Accountants (AICPA) and the Indiana CPA Society.

Jody strongly believes that a well-run company will excel in both good and bad economies. His firm was a recent recipient of the Indiana CPA Society’s Innovation Award – an award given to a firm that embodies forward-thinking activities designed to address future issues and needs.

Both Jody and partner Adam Hale have been recognized nationally by the AICPA for the implementation of innovative ideas. Because of its success, the firm has experienced significant growth over the past five years. Year after year, Inc. 5000 has recognized Summit CPA Group as one of the fastest-growing private companies in the nation.

Jody graduated from Indiana University’s Kelley School of Business.

About Summit CPA Group

Founded in 2002, Summit CPA Group offers flat-fee Virtual CFO services helping clients maximize profits, minimize taxes, and increase cash flow for creative service professionals all over North America.

Founded in 2002, Summit CPA Group offers flat-fee Virtual CFO services helping clients maximize profits, minimize taxes, and increase cash flow for creative service professionals all over North America.

Unlike many others in the business of accounting who focus on historical financial statements and tax returns, Summit CPA Group operates under a profit-focused model, using dynamic forecasting models and key performance indicators with their clients to help them transcend their focus from simply “being in the black” to longer-term financial health and wealth.

Building on their foundation, Summit CPA Group started another line of business in 2010 – 401K Audits. Since then, the audit team has grown to be recognized as one of the top 1% of all firms performing that type of audit based on the number of audits completed.

With the mission statement, “Changing the way people think about accounting,” the next big step for the Summit CPA Group will be helping make this level of service a norm rather than an exception within the accounting industry.

Summit CPA Group merged its practice with Anders Minkler Huber & Helm LLP of St. Louis in 2022, as reported by CPA Trendlines.

Building the Virtual CFO Firm in the Cloud

$375.00 – $395.00

You may also like…

-

Sale!

SEIZE THE FUTURE

SEIZE THE FUTURE Accountaneur: The Entrepreneurial Accountant

Mind-blowing insights into today's emerging opportunities

$149.97 – $169.94 Learn More -

Sale!

IMAGINE a NEW FUTURE

IMAGINE a NEW FUTURE The Radical CPA

New Rules for the Future-Ready Firm

$129.97 – $149.97 Learn More

By Jody Padar, CPA, MST

Author of the NEW From Success to Significance: The Radical CPA Guide