You’re more than what you think you are.

You’re more than what you think you are.

By Jody Padar

The Radical CPA

To me, to be the most trusted business advisor is to be a small business advisor. That’s what my customers see.

My firm serves small businesses from the ground up to $10 million. Yes, we look at their numbers, but practically speaking one gains a lot when you’re in their financial underwear drawer. Most of our conversations are around their questions. It’s a natural extension of the work we already do – financials, taxes, payroll, cash flow and forecasting.

MORE: Center Your Firm Around Your Client | Commit to Change | Your Client Base Is Global | Ready for Change, So Now What?

Exclusively for PRO Members. Log in here or upgrade to PRO today.

These people are not asking complex tax questions. They’re asking about IT, human resources, general licensing, and for help with some decision-making. We’re small business consultants.

Edi Osborne, chief executive of Mentor Plus, always says that we practice random acts of consulting. I know I’m guilty. My issue becomes “Are we training our teams to deliver that information as well, and not just stay with the firm owners?” Does the same level of experience exist among everyone? Do we have a way to teach that skill? And if so, how do you teach and train it? How do you measure that to make sure it’s the same so you can grow your firm?

It is very difficult to get your team members acting as that advisor.

It takes the same level of technical skill to be a payroll expert vs. a payroll advisor. Yet, the perception of value is perceived extremely different by the customer. Partners can no longer be the only advisors. Entire teams need to have advisory communication skill sets. Talk about a disruption!

Adjust Your Perspective, It’s Not Reality!

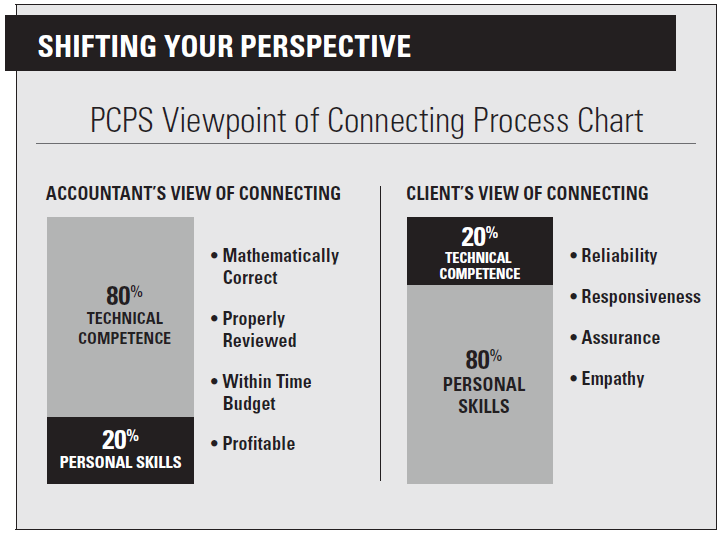

If you look at what we perceive as important with connecting with our customers versus what our customers perceive, they’re two totally different things.

As CPAs, we think that 80 percent technical thinking is important and 20 percent personal skills are important. But for the customer it’s reverse: only 20 percent technical skills are important, while 80 percent vote for personal skills.

The Problem with Efficiency

There are too many firm owners who harp on the importance of efficiency but forget that customers still need to be served uniquely. As efficient as you need to be, you still need to be effective.

I highly recommend the book, “Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers” by Alexander Osterwalder and Yves Pigneur. It will help you rethink your business model, identify your key partners and hone in on your value proposition. I would highly encourage you to go through this process. It will make you think about your customers’ pain points and what they have to gain from engaging with your firm. It will help you to understand how they think and feel in response to what they see and hear from your firm. It will also help you understand their behaviors. By understanding your customers’ needs you can better serve them.

Why Customers Leave

Customers leave because they’re not getting what they want. They need a tax return. Customers really don’t need a tax return, but they are forced to buy it. How are you going to reposition your services so that people get what they want to buy, which is not a tax return, and not what we have been selling them?

This is where we have to rethink our processes and rethink their experience with our firm. We have to do everything we can to help them get there. We have to help them understand and grow their business, not just tell them how much money they spent, and “Oh, by the way, here is your e-file signature page.”

The Market Is Moving Toward the Radicals

CCH published a white paper titled, “Charting a Course for the Future: A Report on Firm Preparedness” that defines the trends that will have the most significant impact on accounting firms and their customers over the next five years. The survey also notes how well prepared accountants are to take advantage of these trends. By putting the “very prepared” firm under the magnifying glass, the report examines what makes firm owners confident about the future.

The most important takeaway is that firms that feel more prepared for the future report that they are more productive and more profitable today. For example, those running the “very prepared” firms say that they are able to put cash in the bank quicker. From initial engagement to invoice is 14 days. Could you imagine if value pricing entered this equation and you received payment up front?

One Response to “How to Be a Small Business Advisor”

small business cpa services Marlboro, NJ

Wonderful information, thanks a lot for sharing this kind of content with us. Your blog gives the best and the most interesting information on the warning signs that tell you need an expert today.