Study finds that more than half don’t WANT to grow.

By CPA Trendlines Research

Tax preparers are pulling down some respectable bucks, and many are expanding their services to find more clients and handle more complex work, according to the 2023 Tax Professional Fee Study produced by the National Association of Tax Professionals.

MORE: With Fresh Funding, IRS Shows Service Improvements | How Tax Practitioners Became Cybersecurity Risks | Top Tax Vendors Caught Red-Handed Selling Private Taxpayer Data

Exclusively for PRO Members. Log in here or upgrade to PRO today.

The study finds that a vast majority report raising their fees regularly. A solid 49 percent increases fees yearly and another 28 percent every two years. The most recent increases were 6 to 10 percent for 40 percent of respondents, though 34 percent limited themselves to 1 to 5 percent raises. Nine percent jacked up fees by more than 16 percent.

The main concern over increasing fees was fear of upsetting existing clients, and 11 percent didn’t have a comfortable way to explain an increase. At the same time, the main reason for increases, reported by 37 percent, was to stop giving away so much free work.

The main concern over increasing fees was fear of upsetting existing clients, and 11 percent didn’t have a comfortable way to explain an increase. At the same time, the main reason for increases, reported by 37 percent, was to stop giving away so much free work.

Experience Counts

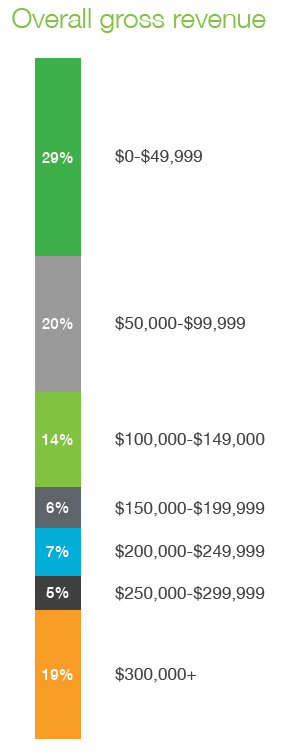

Half of responding tax preparers make over $100,000 in gross revenue, with 38 percent making over $150,000. A sizable 19 percent gross that is twice that or more.

Half of responding tax preparers make over $100,000 in gross revenue, with 38 percent making over $150,000. A sizable 19 percent gross that is twice that or more.

Experience may account for a lot of the bigger numbers. Sixty-seven percent of the respondents have been in the business for 21 years or more, with 91 percent either an owner or partner of a private practice. Forty-five percent work solo.

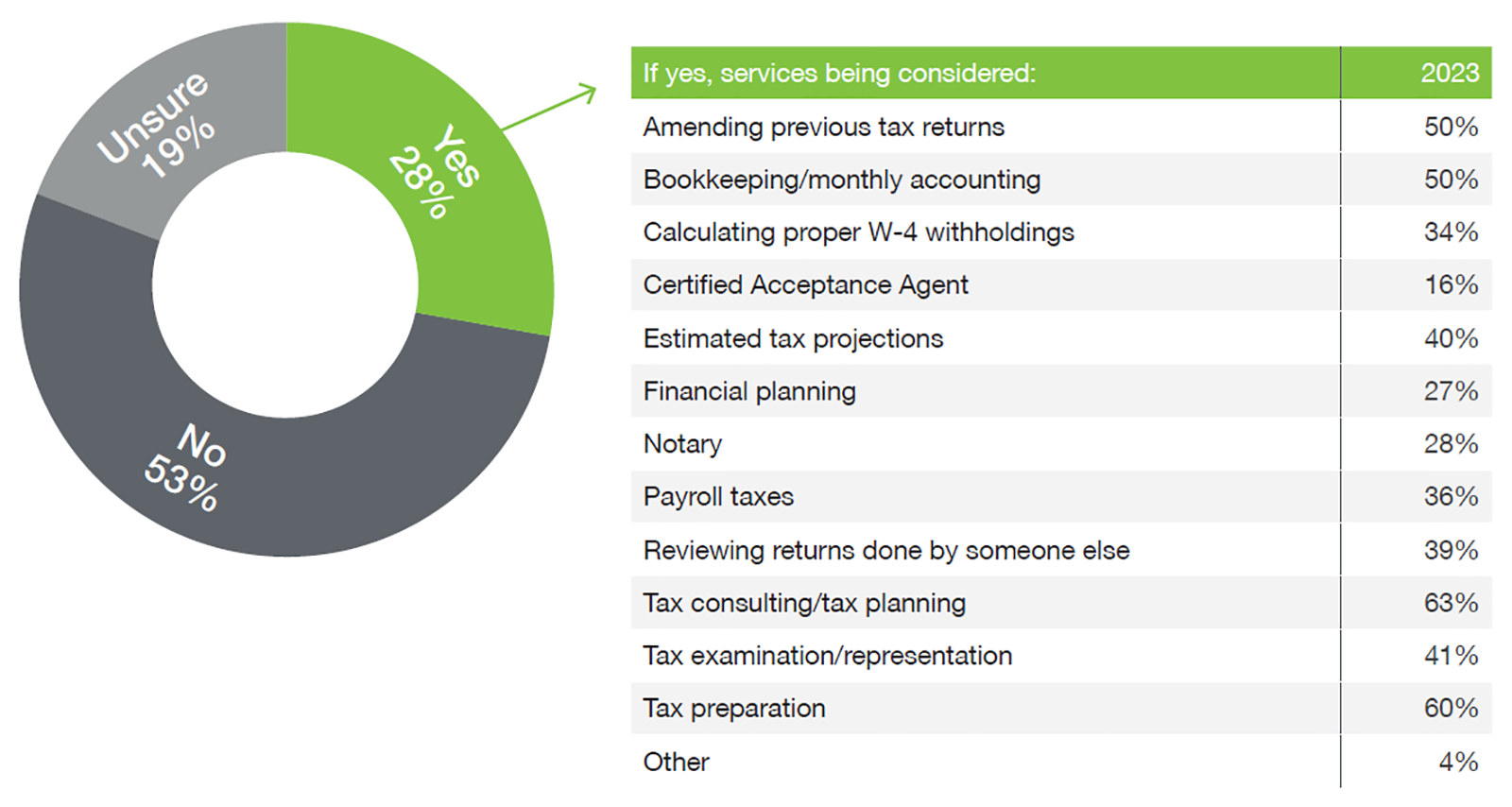

More than half of tax pros offer other services, though 43 percent find 81 to 100 percent of their income strictly from tax preparation. Overall, on average, tax pros earn 70 percent of their gross revenue from tax preparation, plus another 12 percent for bookkeeping and monthly accounting. Only 5 percent of revenue comes from tax planning and projections.

Over Half are Growing; More Than Half Don’t Want To

Over half say their practice is growing, and only 16 percent are downsizing. A vast majority of those actively pursuing growth – 77 percent – are trying to do more returns, but an ambitious 43 percent are expanding into tax consulting. A more traditional 39 percent see opportunity in bookkeeping.

More than half – 53 percent – have no intentions of expanding.

Though 51 percent say their preparation of individual returns increased in 2021, and 48 percent saw an increase in 2023, 16 percent report decreases in both years. The main cause of the decrease was the 49 percent who are phasing out of their business. Tax software contributed to 29 percent of the decreases, and FreeFile accounted for 23 percent. Just over a quarter were doing fewer returns because they were doing more complex returns.

The money may be in more complex returns and business returns. Last year, 45 percent prepared more business returns, and only 14 percent prepared fewer. Among those preparing fewer, 52 percent are phasing out of their business, and 50 percent saw clients’ businesses closing.

Pricing the 1040

Half of tax preparers price a 1040 preparation according to a minimum fee plus cost based on complexity. Thirty-five percent use set fees for each form and schedule. Only 6 percent charge strictly by the hour.

Half of tax preparers price a 1040 preparation according to a minimum fee plus cost based on complexity. Thirty-five percent use set fees for each form and schedule. Only 6 percent charge strictly by the hour.

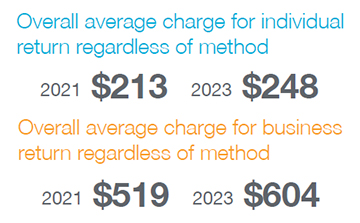

The average charge for a 1040, regardless of method: In 2021, $213. In 2023, $248.

Charging by the hour yielded substantially less. For Schedules 1-3 of a 1040, $155 per hour in 2021, $179 in 2023. But the average varied by community size, ranging from just $117 per hour in communities of under 10,000 to almost double that in communities of over 50,000.

The average per-hour charge was about the same for business returns, but the ultimate yield, for all billing methods, was more than twice that of 1040 preparation. In 2021, the average charge was $519. In 2023, it soared to $604. Sixty percent charge a minimum fee plus cost for complexity.

Six percent of work went unbilled, most of it for the usual reasons: friends, family and free advice.

4 Responses to “Tax Pros Are Expanding and Earning More”

tax planning for business owners Marlboro, NJ

One of the best posts I have ever come across. Not only did I learn a lot of hidden things. Keep uploading and encouraging us.

JD Scott & Co

Taxes are a significant expense for most individuals and businesses, and having a well-thought-out tax strategy can make a substantial difference in achieving financial success.

CPA Trendlines Research

Glad you asked.

The survey was conducted by the National Association of Tax Professionals (natptaxtax.com). CPA Trendlines Research considers the NATP a reliable source with a history of providing well-founded information and a stable and loyal membership base. It’s worth a look to become a member.

According to the report of the findings:

“The survey was administered electronically to a 50% stratified random sample of NATP’s membership population and 8,999 nonmembers. A total of 1,037 members and nonmembers completed the survey for an overall response rate of 5%. A total of 840 members completed the survey for a member response rate of 8%.”

CPA Trendlines Research assesses that the study represents a broad cross-section of the professional tax preparation sector.

But, of course, your mileage may vary.

They did not provide geographic details.

Tom Sienicki

How Many professionals participated in the survey? Any geographic differences?