For the wealthy, the IRS says it’s out-gunned.

By CPA Trendlines

By CPA Trendlines

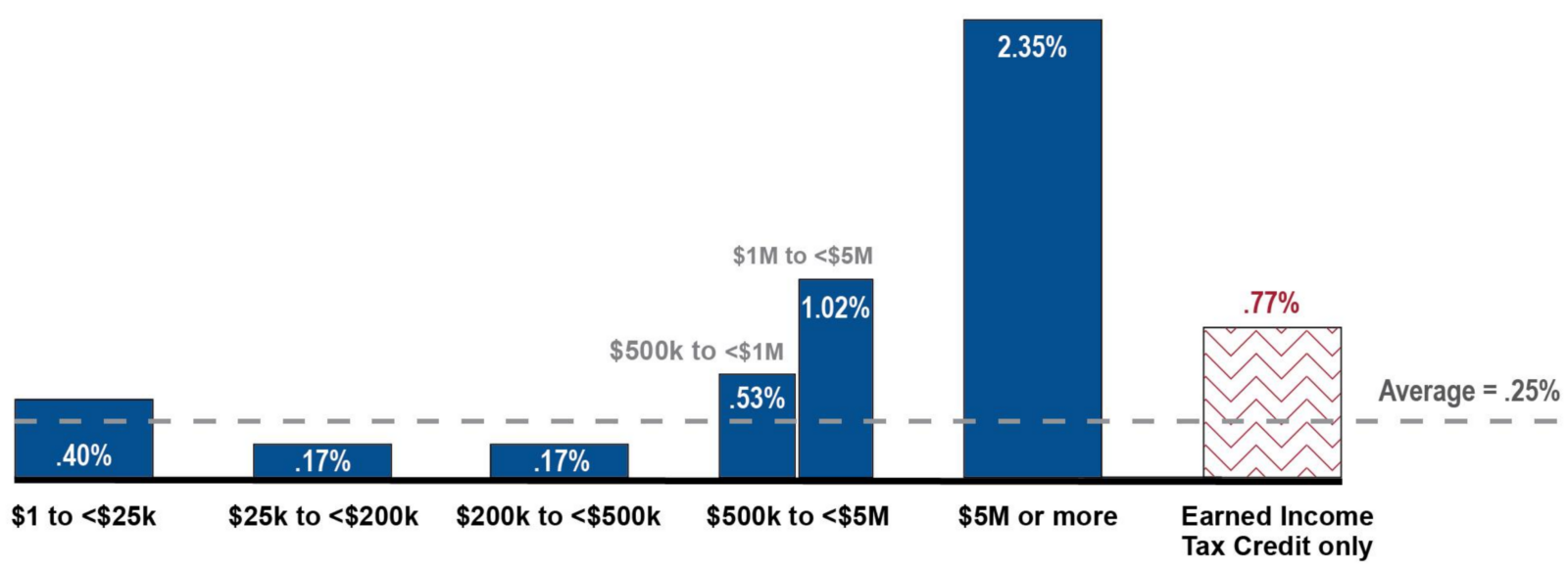

The percentage of taxpayers audited by the IRS has been in precipitous decline since 2010, with the steepest decline in – surprise, surprise! – the highest income bracket, according to a new study.

HOISTED from COMMENTS: “It is not the auditors who are to blame. It is the IRS processes that the auditors are following.”

The odds of a taxpayer being audited are astonishingly low, an average of just 0.25% in 2019, way down from 0.9% in 2010.

MORE on TAX: Six Quick Solutions for IRS Backlogs | Accountants Agree: The Top Five Ways to Fix the IRS | IRS Tops List of Busy Season Problems | Thinking Commercial Real Estate? Think Fast. | New Small Firm Cost Seg Opportunities | What Gig Workers Want | Accountants Agree: The Top Five Ways to Fix the IRS | Tax Season ’22: Working Harder for Every Dollar | IRS Tops List of Busy Season Problems

Exclusively for PRO Members. Log in here or upgrade to PRO today.

Audit rates for brackets between $25,000 and $500,000 are well below average, just 0.17%.

TO READ THE FULL ARTICLE